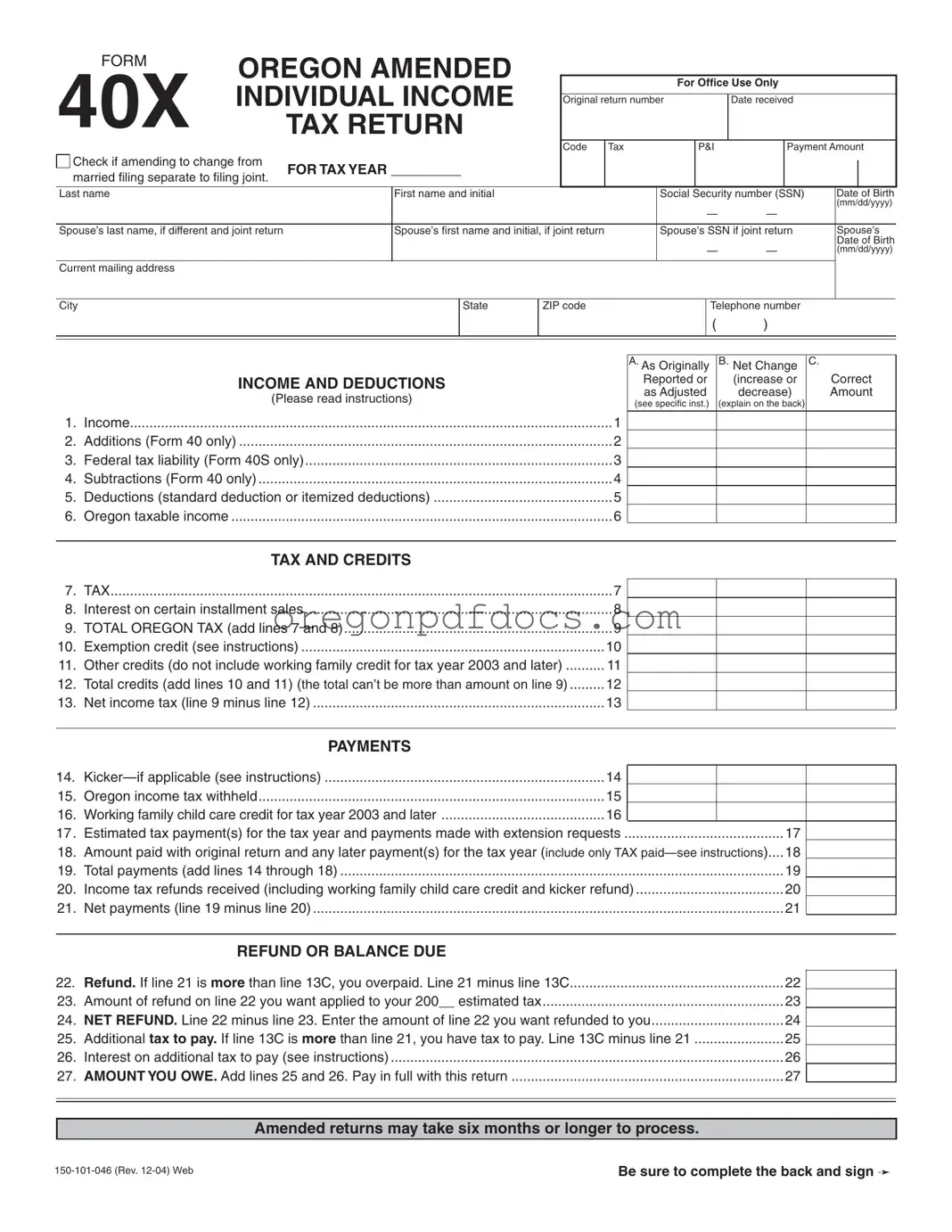

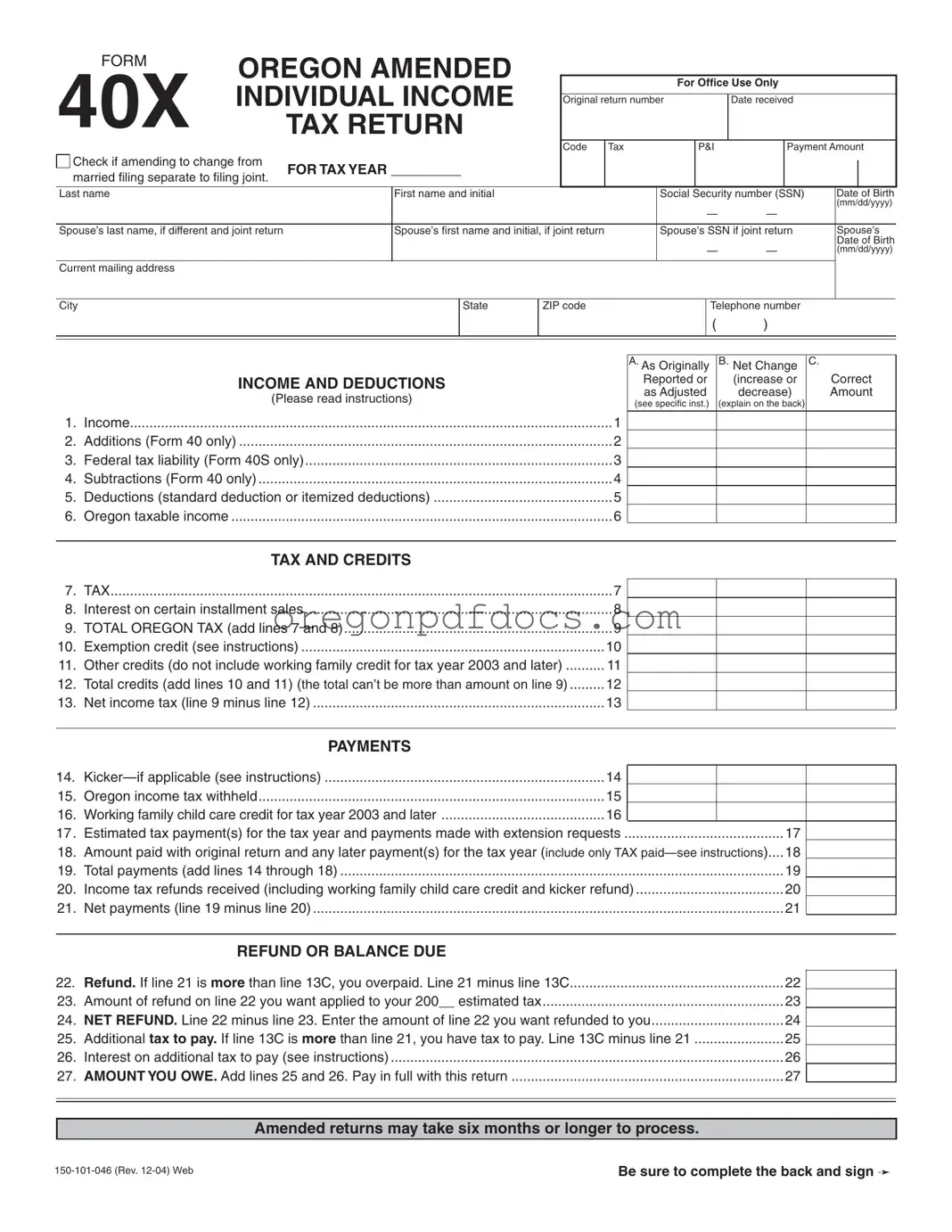

Free 40X Oregon Form

The 40X Oregon form is an amended individual income tax return used to correct or change information on a previously filed Oregon tax return. This form allows taxpayers to adjust their filing status, income, deductions, and tax liabilities as needed. If you need to amend your tax return, consider filling out the 40X form by clicking the button below.

Make My Document Online

Free 40X Oregon Form

Make My Document Online

Make My Document Online

or

Get 40X Oregon PDF Form

One more step to finish this form

Finalize your 40X Oregon online in a few easy steps.