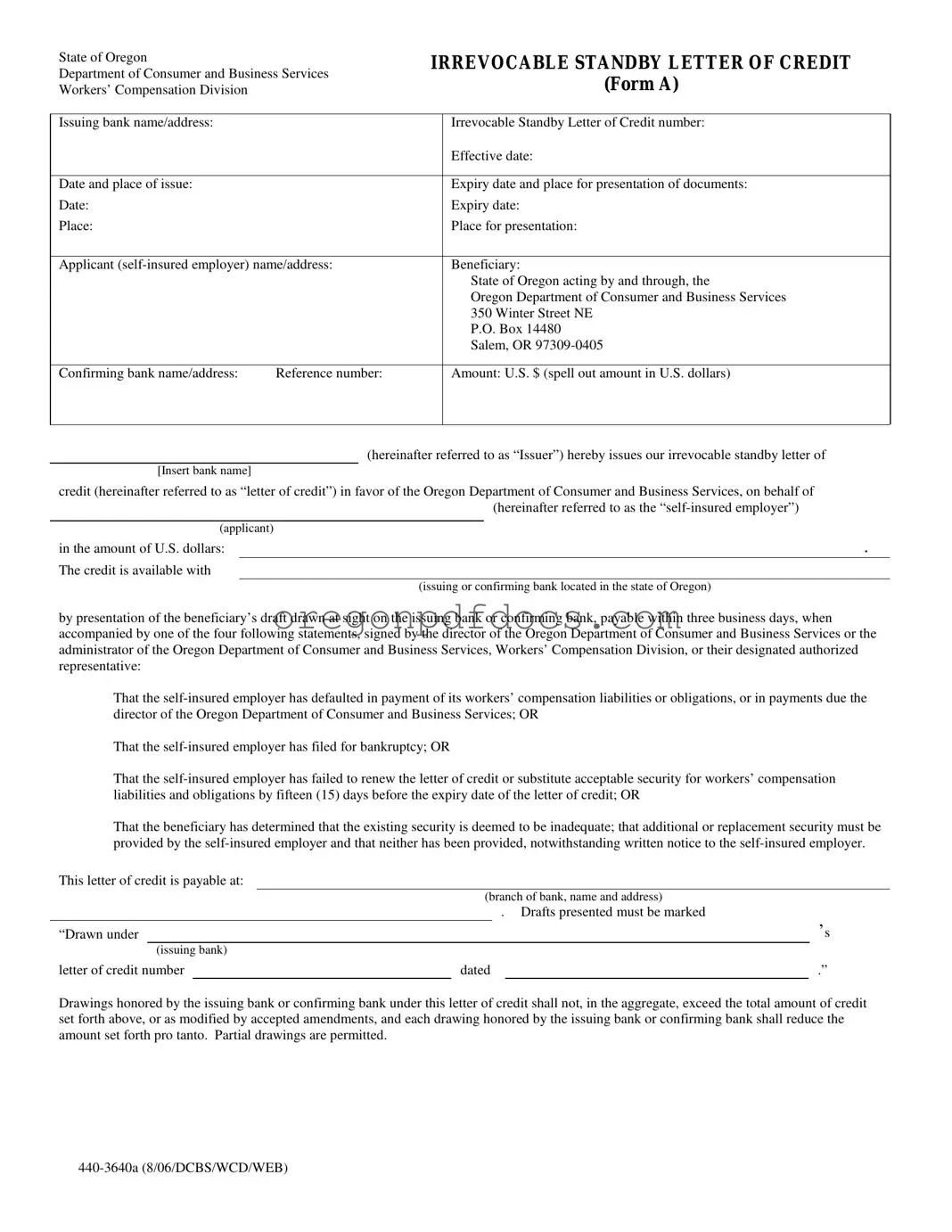

State of Oregon

Department of Consumer and Business Services

Workers’ Compensation Division

IRREVOCABLE STANDBY LETTER OF CREDIT

(Form A)

Issuing bank name/address: |

|

Irrevocable Standby Letter of Credit number: |

|

|

Effective date: |

|

|

|

|

|

Date and place of issue: |

|

Expiry date and place for presentation of documents: |

Date: |

|

Expiry date: |

Place: |

|

Place for presentation: |

|

|

Applicant (self-insured employer) name/address: |

Beneficiary: |

|

|

State of Oregon acting by and through, the |

|

|

Oregon Department of Consumer and Business Services |

|

|

350 Winter Street NE |

|

|

P.O. Box 14480 |

|

|

Salem, OR 97309-0405 |

|

|

|

Confirming bank name/address: |

Reference number: |

Amount: U.S. $ (spell out amount in U.S. dollars) |

|

|

|

(hereinafter referred to as “Issuer”) hereby issues our irrevocable standby letter of

[Insert bank name]

credit (hereinafter referred to as “letter of credit”) in favor of the Oregon Department of Consumer and Business Services, on behalf of (hereinafter referred to as the “self-insured employer”)

(applicant) |

|

in the amount of U.S. dollars: |

|

. |

The credit is available with |

|

|

|

(issuing or confirming bank located in the state of Oregon) |

by presentation of the beneficiary’s draft drawn at sight on the issuing bank or confirming bank, payable within three business days, when accompanied by one of the four following statements, signed by the director of the Oregon Department of Consumer and Business Services or the administrator of the Oregon Department of Consumer and Business Services, Workers’ Compensation Division, or their designated authorized representative:

That the self-insured employer has defaulted in payment of its workers’ compensation liabilities or obligations, or in payments due the director of the Oregon Department of Consumer and Business Services; OR

That the self-insured employer has filed for bankruptcy; OR

That the self-insured employer has failed to renew the letter of credit or substitute acceptable security for workers’ compensation liabilities and obligations by fifteen (15) days before the expiry date of the letter of credit; OR

That the beneficiary has determined that the existing security is deemed to be inadequate; that additional or replacement security must be provided by the self-insured employer and that neither has been provided, notwithstanding written notice to the self-insured employer.

This letter of credit is payable at:

|

|

|

(branch of bank, name and address) |

|

|

|

|

|

. Drafts presented must be marked |

|

“Drawn under |

|

|

|

’s |

|

(issuing bank) |

|

|

|

|

letter of credit number |

|

dated |

|

.” |

Drawings honored by the issuing bank or confirming bank under this letter of credit shall not, in the aggregate, exceed the total amount of credit set forth above, or as modified by accepted amendments, and each drawing honored by the issuing bank or confirming bank shall reduce the amount set forth pro tanto. Partial drawings are permitted.

440-3640a (8/06/DCBS/WCD/WEB)

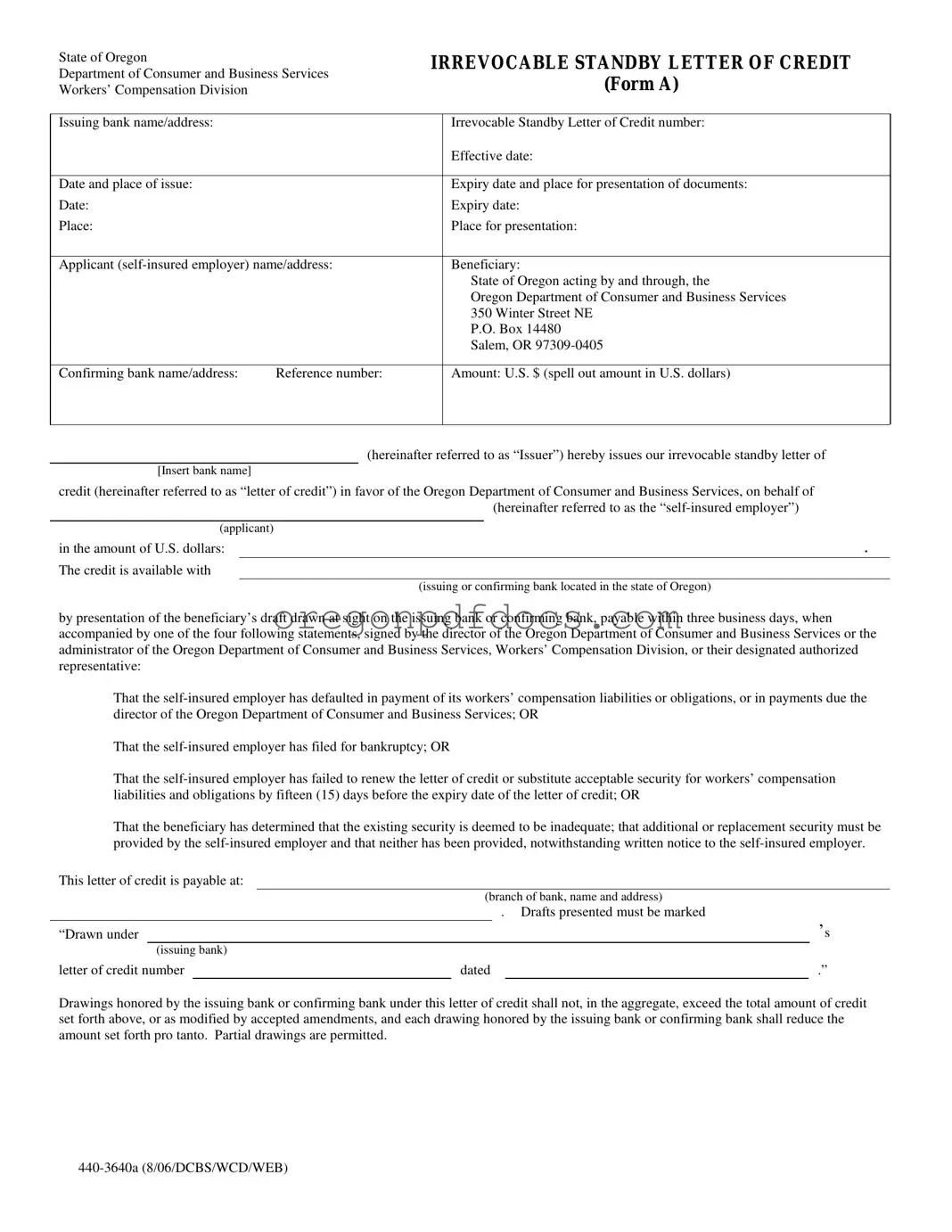

Letter of Credit Number

Page 2

The purpose of this letter of credit is to create a primary obligation on the part of

(issuing bank)

and any confirming bank to the Oregon Department of Consumer and Business Services relating to the self-insured workers’ compensation liabilities and obligations of the self-insured employer

(applicant)

in accordance with Chapter 656 of the Oregon Revised Statutes. Except as stated herein, this letter of credit is not subject to any condition or qualification and is the issuing and any confirming bank’s individual obligation which is in no way contingent upon reimbursement, and shall cover all of the certified self-insured employer’s past, present, existing, and potential liability up to the total amount of credit set forth above for assessments, contributions, or other obligations due from the certified self-insured employer to the Oregon Department of Consumer and Business Services, Workers’ Compensation Division.

This letter of credit will be automatically extended without amendment for one year from the expiry date shown above, or any future expiry date, unless at least 60 days prior to expiry, we notify the beneficiary by registered mail or overnight delivery that we elect not to extend this letter of credit for such additional period. The notification will be addressed to the Administrator, Workers’ Compensation Division, Department of Consumer and Business Services, State of Oregon, 350 Winter Street NE, P.O. Box 14480, Salem, OR 97309-0405.

Payment of any amount under this letter of credit by the issuing or a confirming bank shall be made by wire transfer to the Oregon Department of Consumer and Business Services’ bank account, as instructed in the demand notice signed by the director or the administrator or their designated authorized representative, for deposit to the account of the Oregon Department of Consumer and Business Services for the self-insured employer’s workers’ compensation liabilities and obligations under ORS 656.

If the issuing bank or any confirming bank is closed at the time of the expiry of this letter of credit for any reason that would prevent the delivery of a demand notice during its normal hours of operation, this letter of credit will be automatically extended for a period of 30 days commencing on the next day of operation.

All bank charges for this letter of credit are for the account of the applicant.

Any amendments to this letter of credit must be approved by the beneficiary.

Except so far as otherwise expressly stated, this letter of credit is subject to the International Standby Practices 1998 (ISP 98) International Chamber of Commerce Publication # 590 and to the laws of the state of Oregon. In the event of a conflict between these authorities, the laws of the state of Oregon will control.

We hereby engage with drawers, endorsers, and/or bona fide holder that drafts drawn under and presented in strict conformity with the terms of this credit will be duly honored on presentation to us.

The funds provided by this letter of credit are not construed to be an asset of the self-insured employer. If any legal proceedings are initiated with respect to this letter of credit, it is agreed that such proceedings shall be subject to the courts and law of the state of Oregon.

|

|

|

|

|

|

is requested to add its confirmation to this letter of credit. |

(name of confirming bank or N/A) |

|

|

|

Issuing bank |

|

|

|

Name: |

|

|

Date: |

|

Title: |

|

|

|

|

Signature: |

|

|

|

|

|

|

|

|

|

|

hereby undertakes to honor any drafts presented to it when |

(name of confirming bank or N/A) |

|

|

|

drawn under and in strict conformity with the terms of this credit. |

|

|

|

Confirming bank |

|

|

|

Name: |

|

|

Date: |

|

Title: |

|

|

|

|

Signature: |

|

|

|

|

Accepted by the Oregon Department of Consumer and Business Services |

Name: |

|

|

Date: |

|

Title: |

|

|

|

|

Signature: |

|

|

|

|

440-3640a (8/06/DCBS/WCD/WEB) |

|

|

|