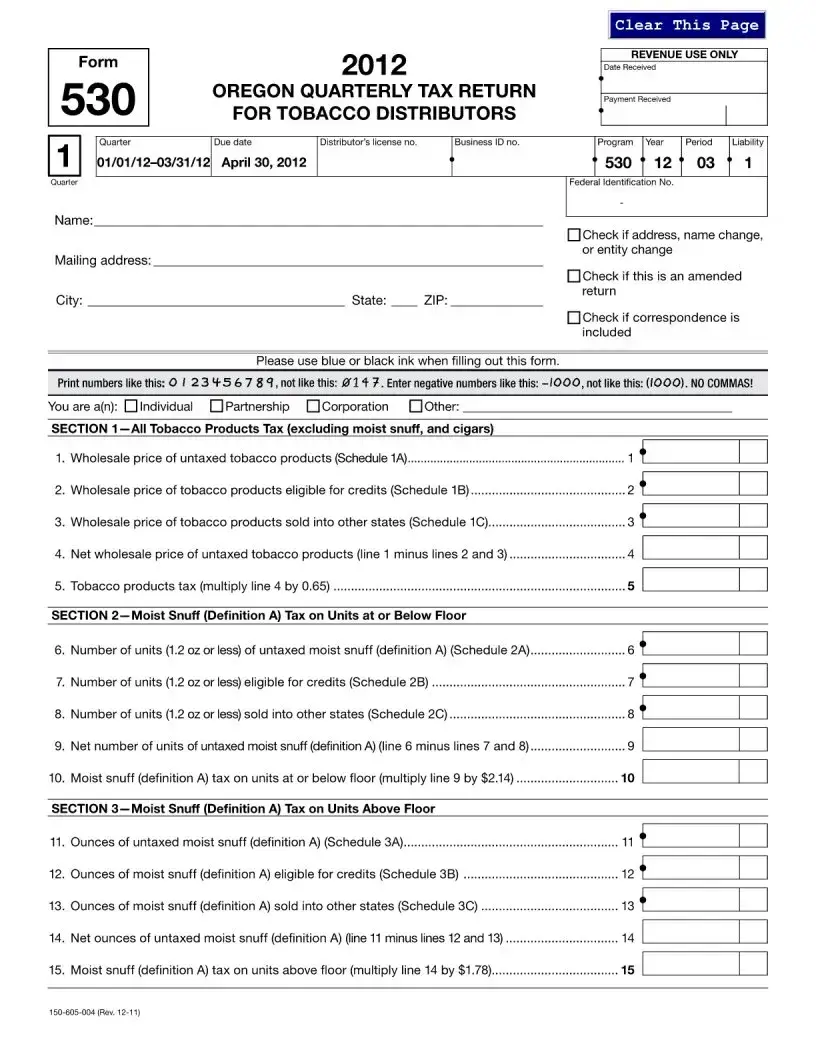

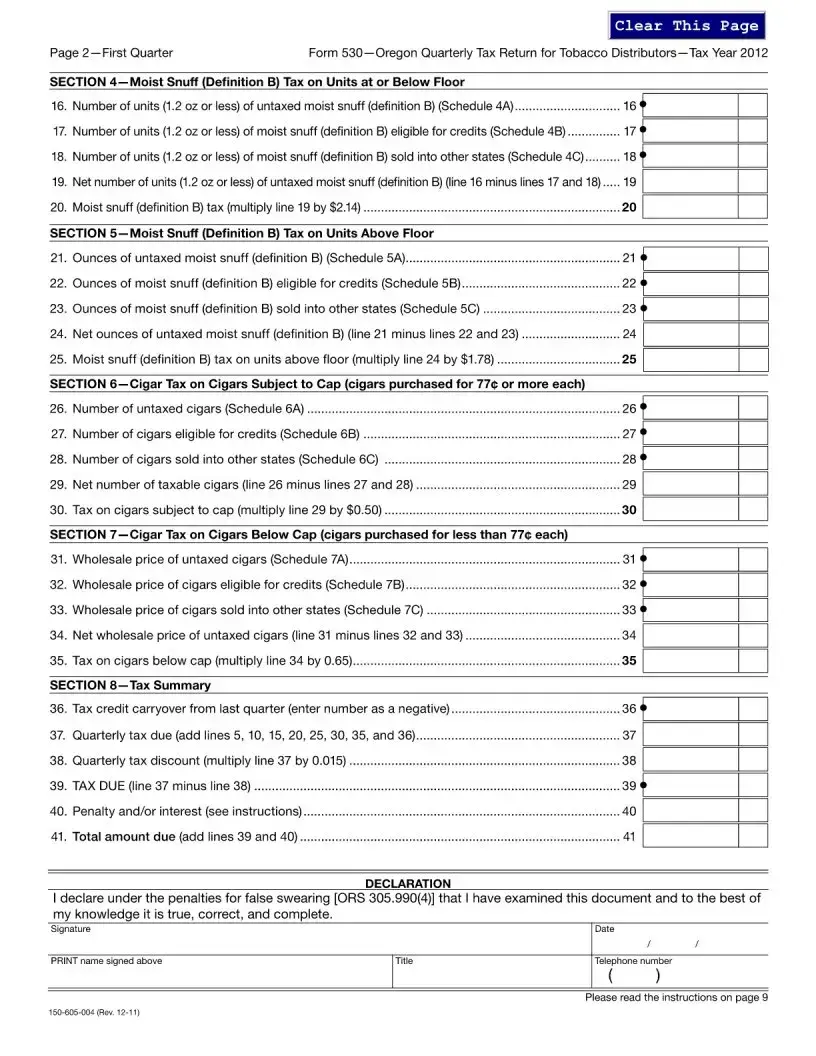

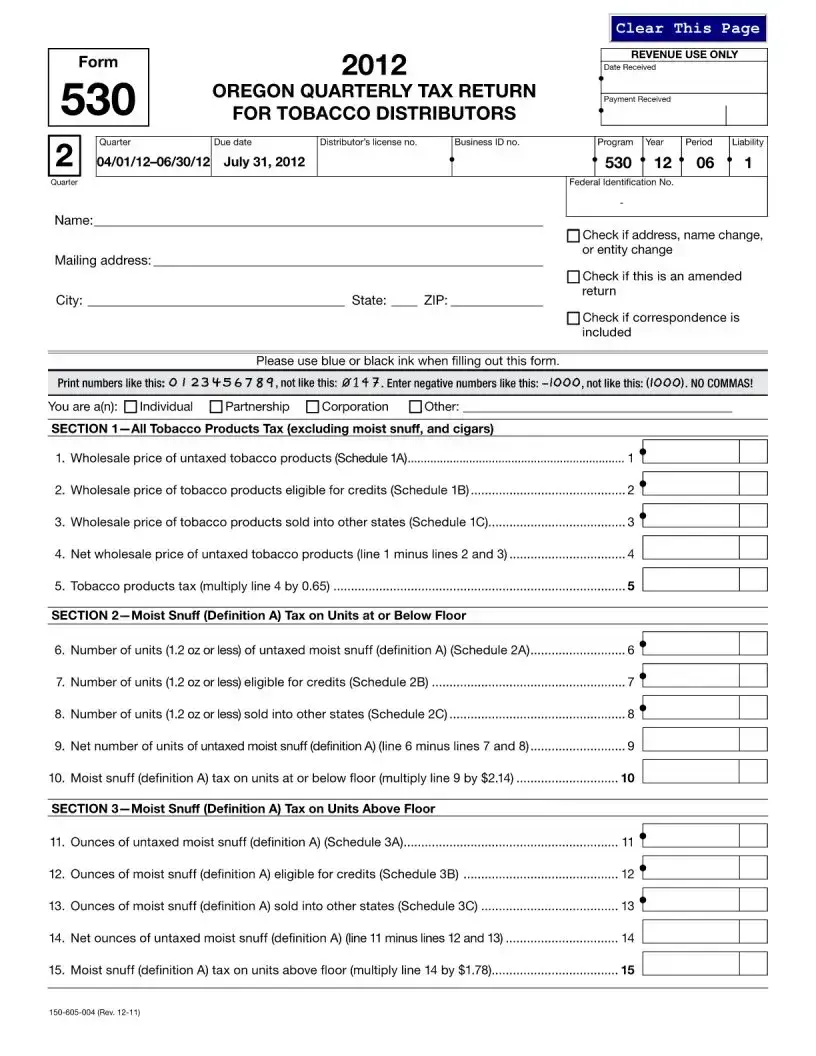

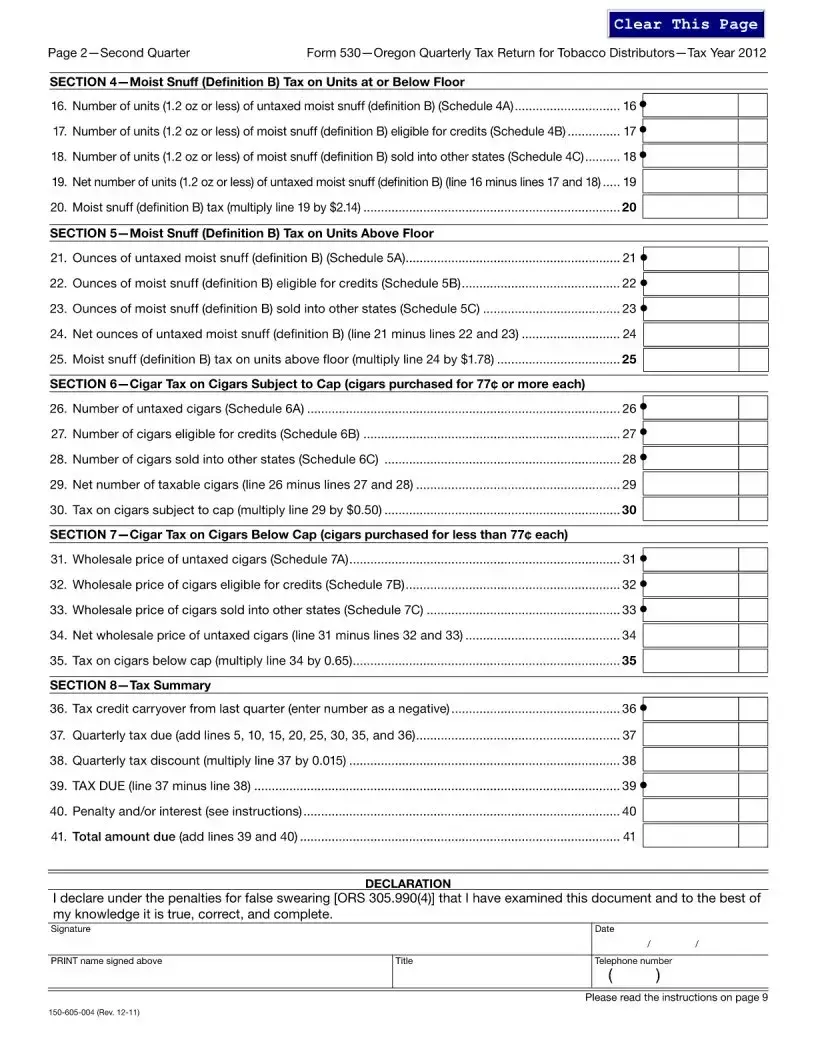

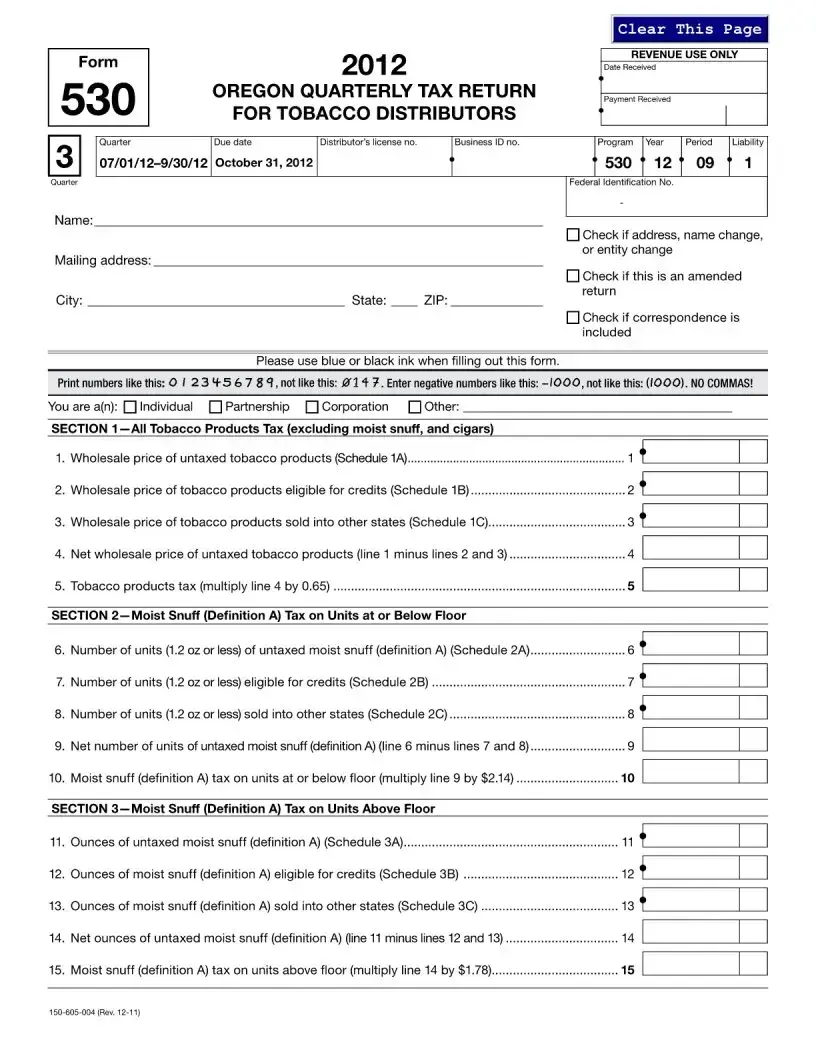

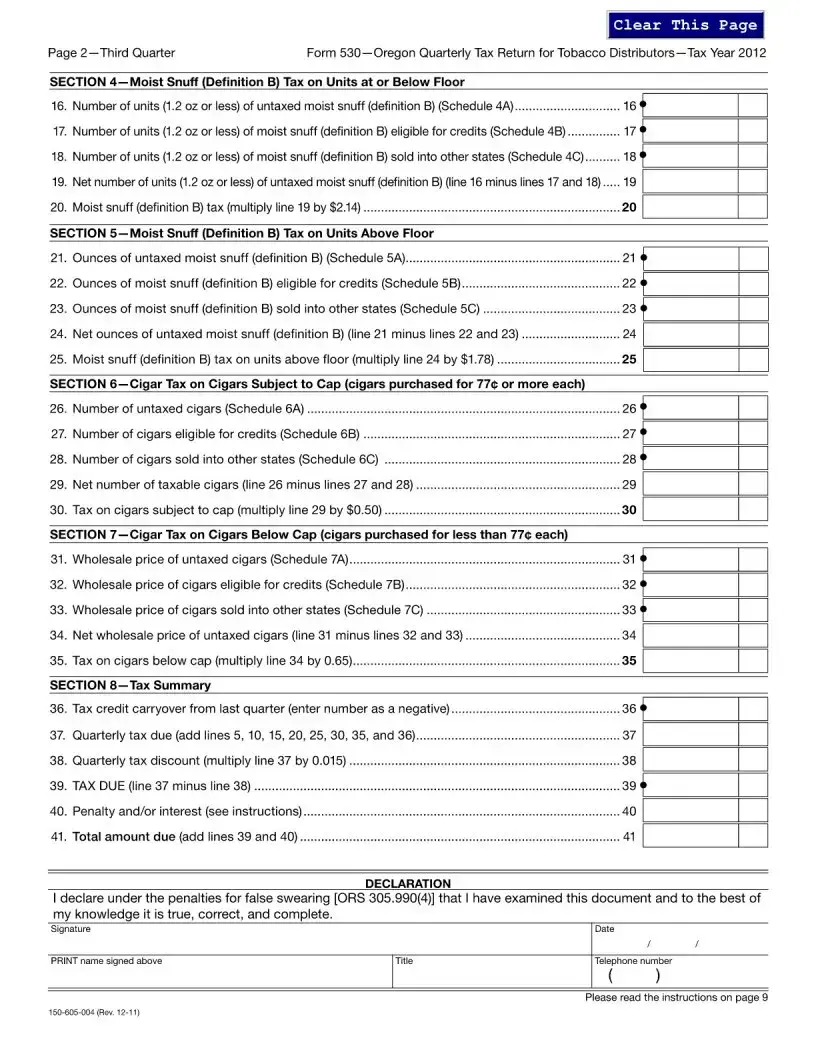

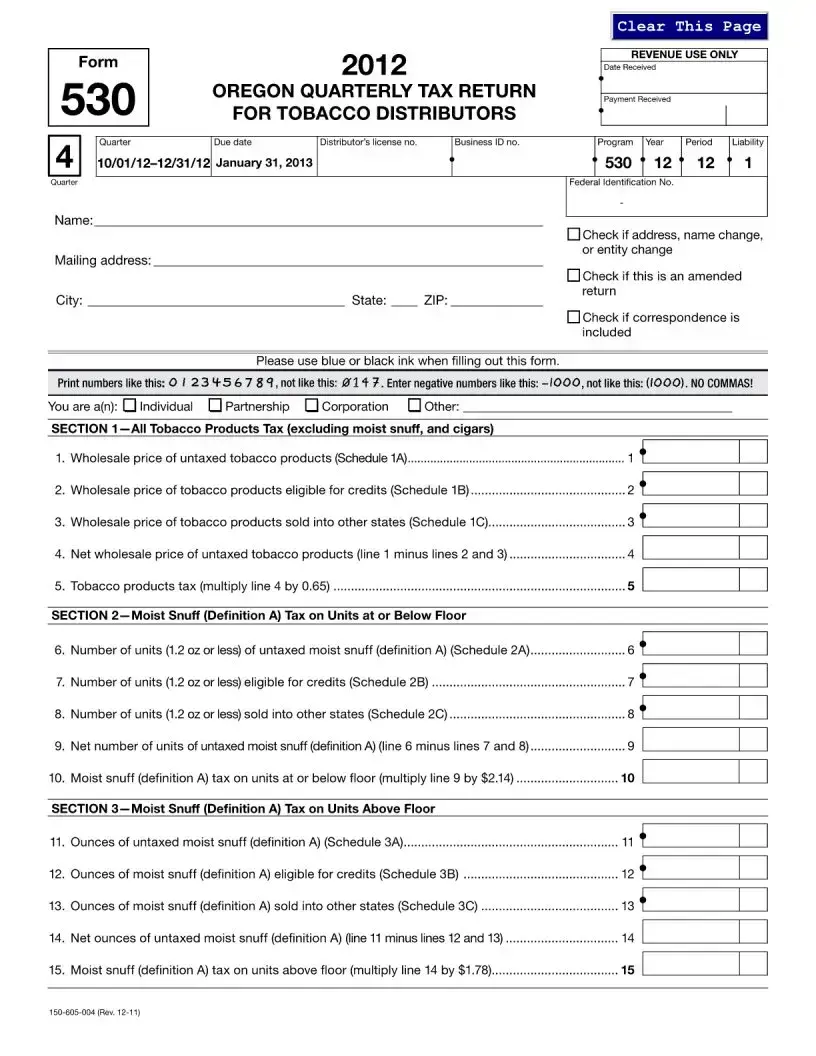

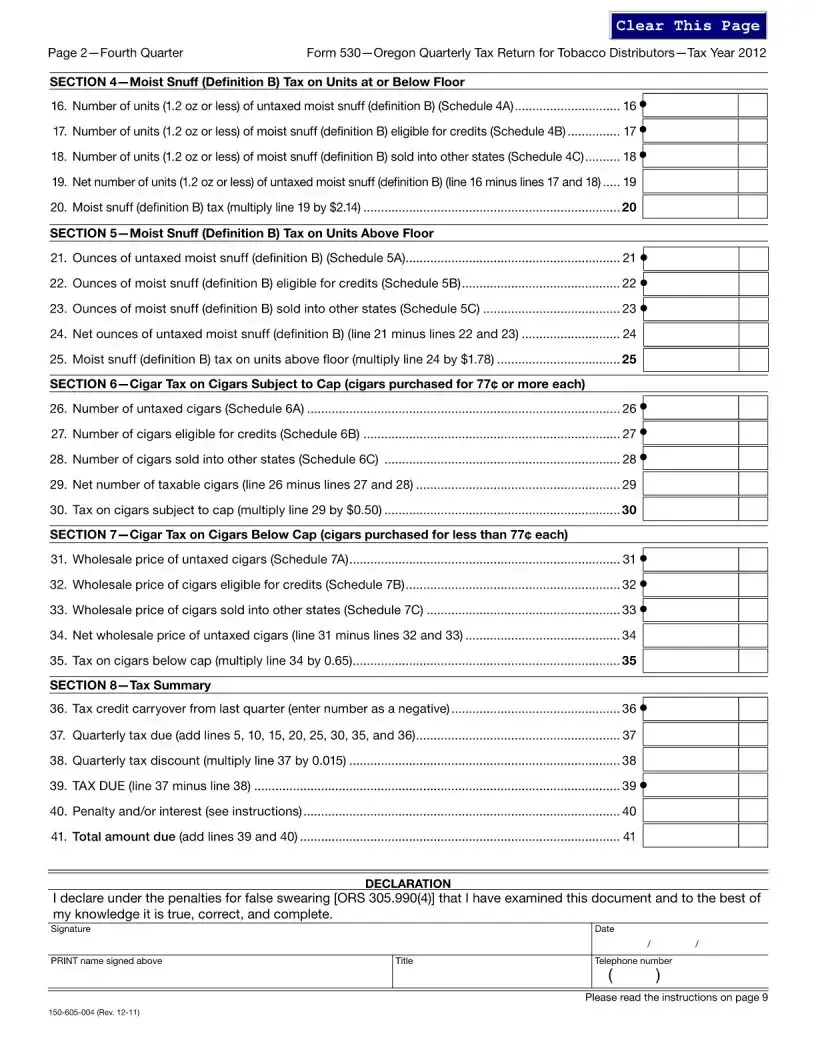

Free 530 Oregon Form

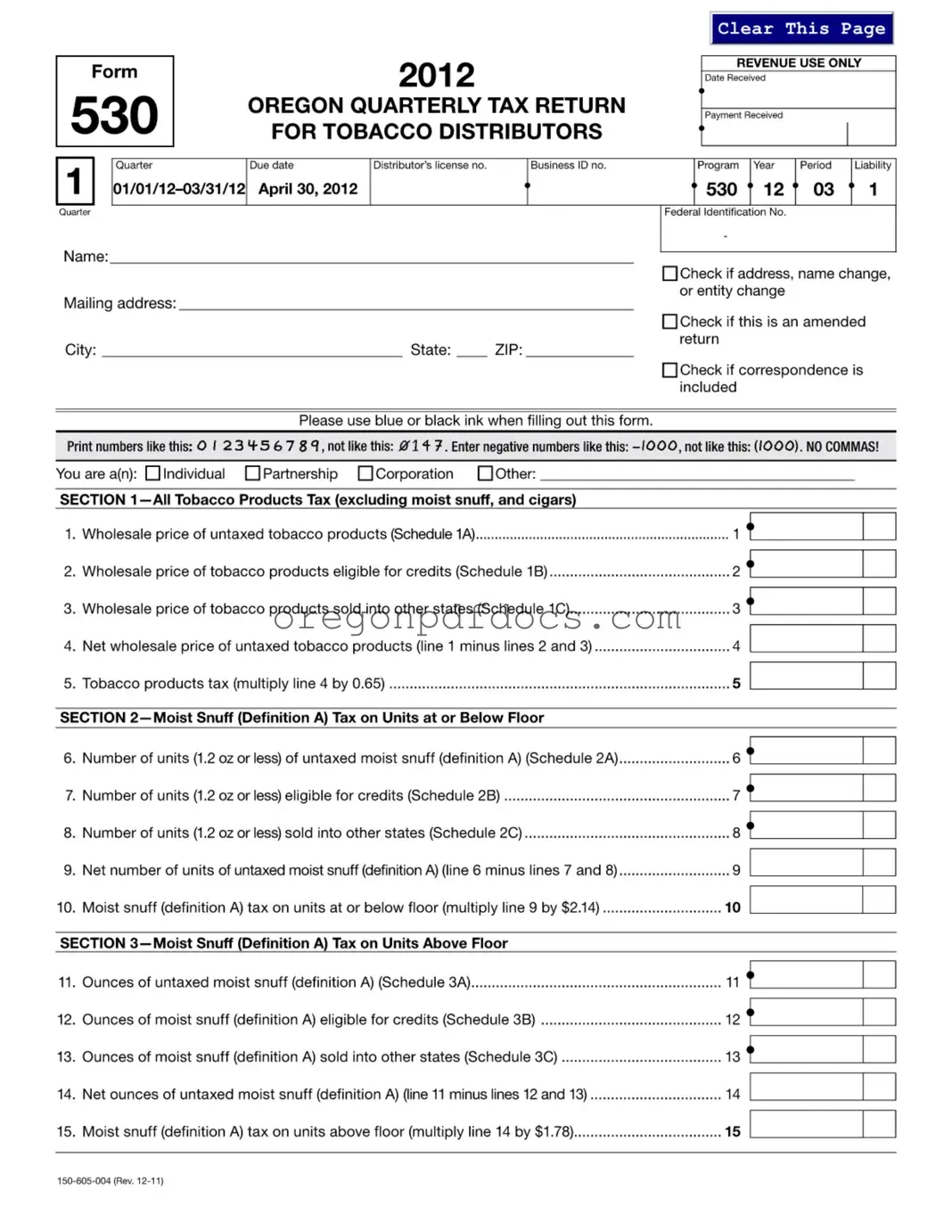

The 530 Oregon form is a quarterly tax return specifically designed for tobacco distributors operating in Oregon. This form is essential for reporting the sales and tax obligations related to various tobacco products, including cigarettes, cigars, and moist snuff. Understanding how to accurately complete this form is crucial for compliance and avoiding potential penalties.

Ready to fill out the 530 Oregon form? Click the button below to get started!

Make My Document Online

Free 530 Oregon Form

Make My Document Online

Make My Document Online

or

Get 530 Oregon PDF Form

One more step to finish this form

Finalize your 530 Oregon online in a few easy steps.