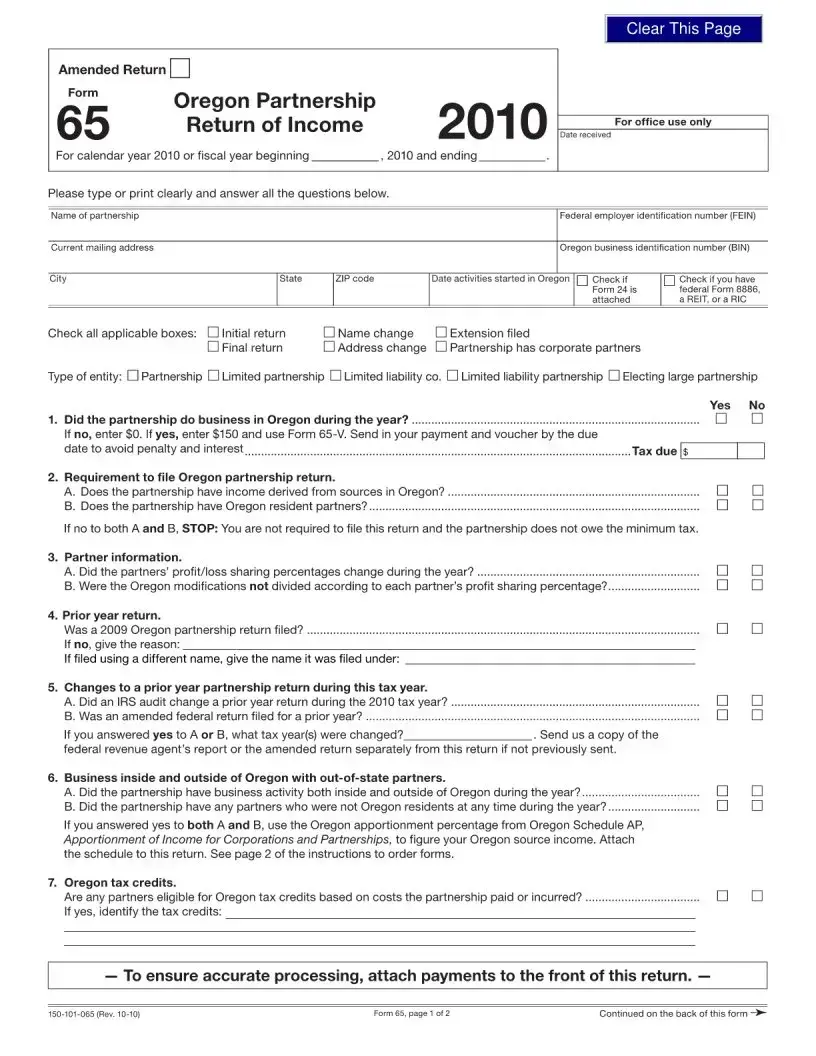

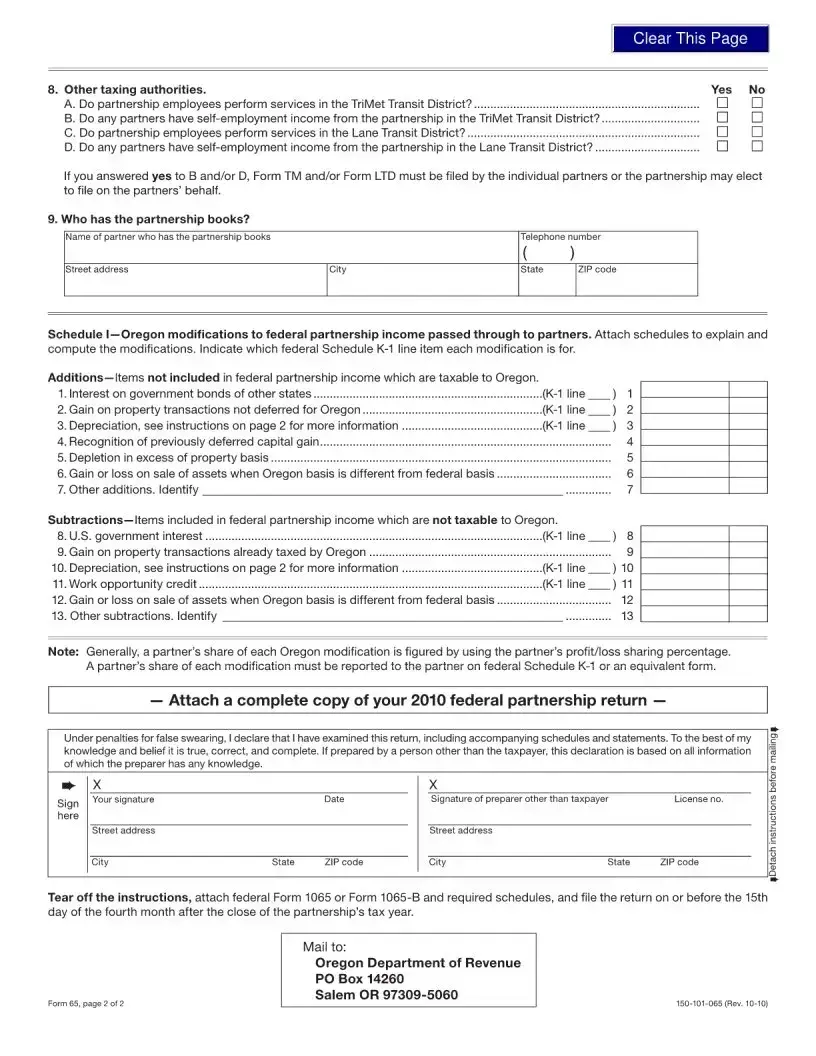

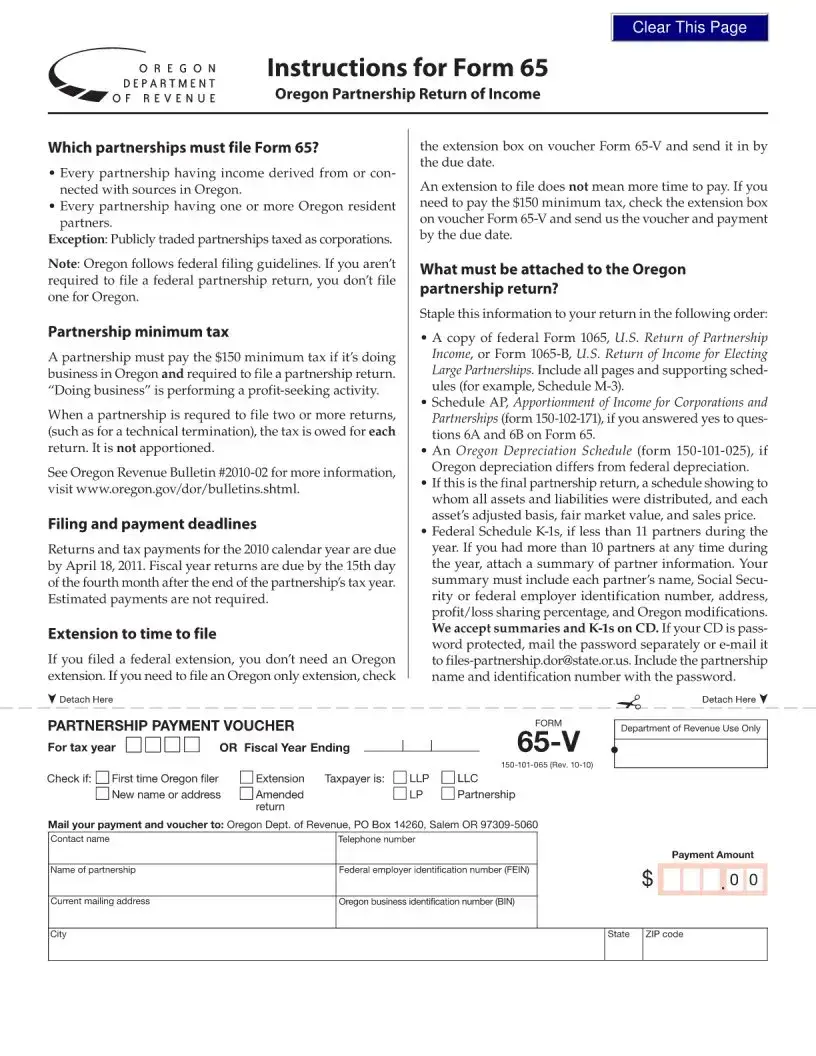

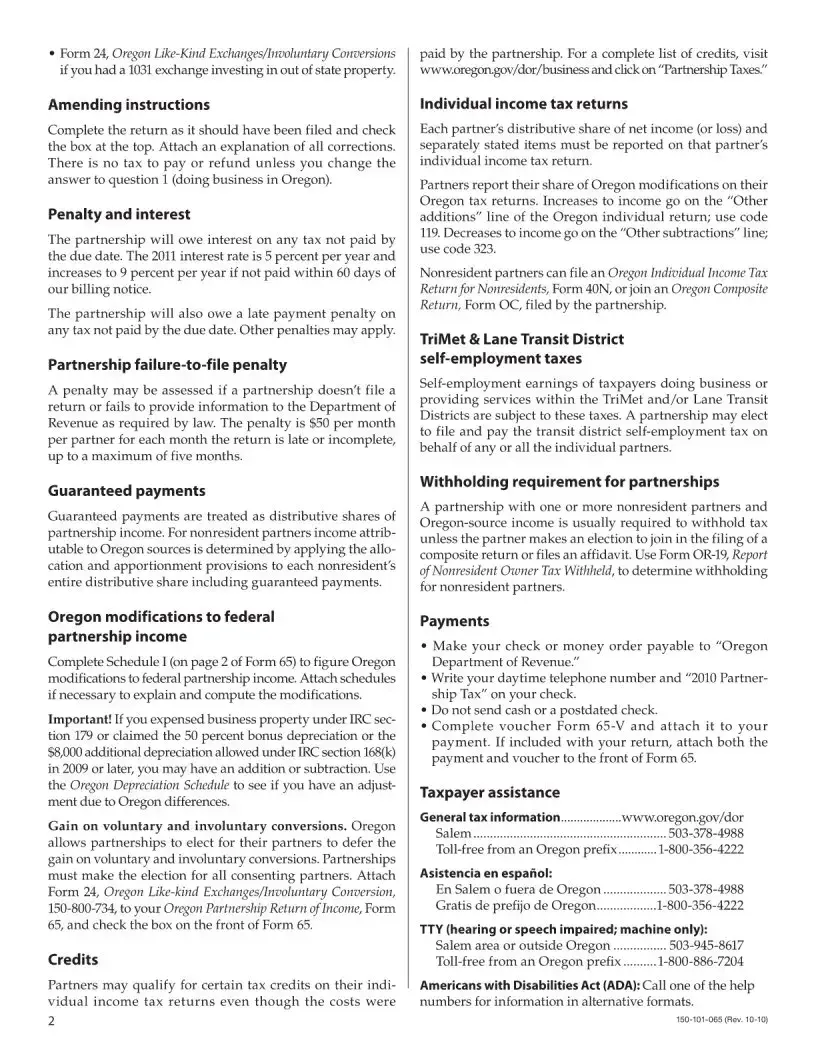

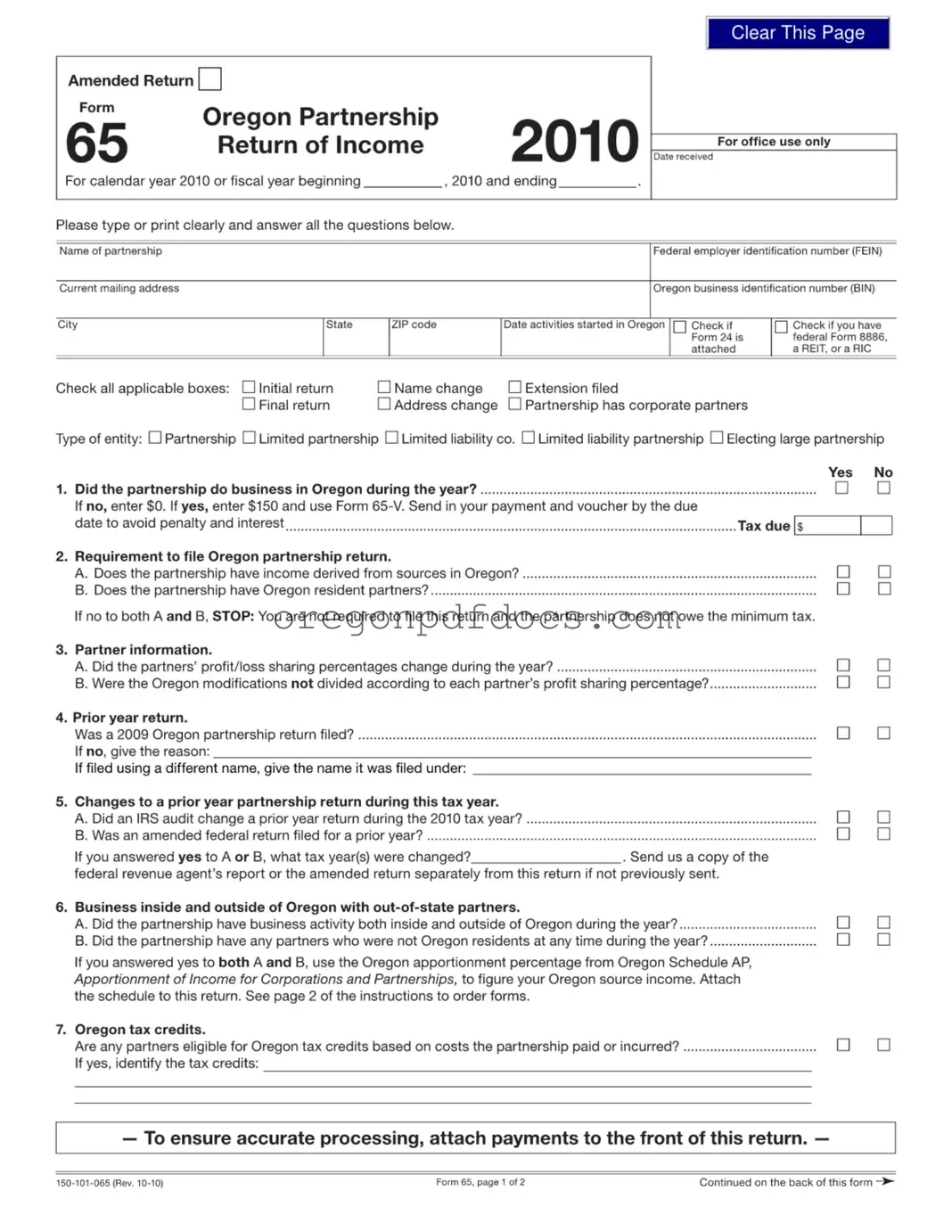

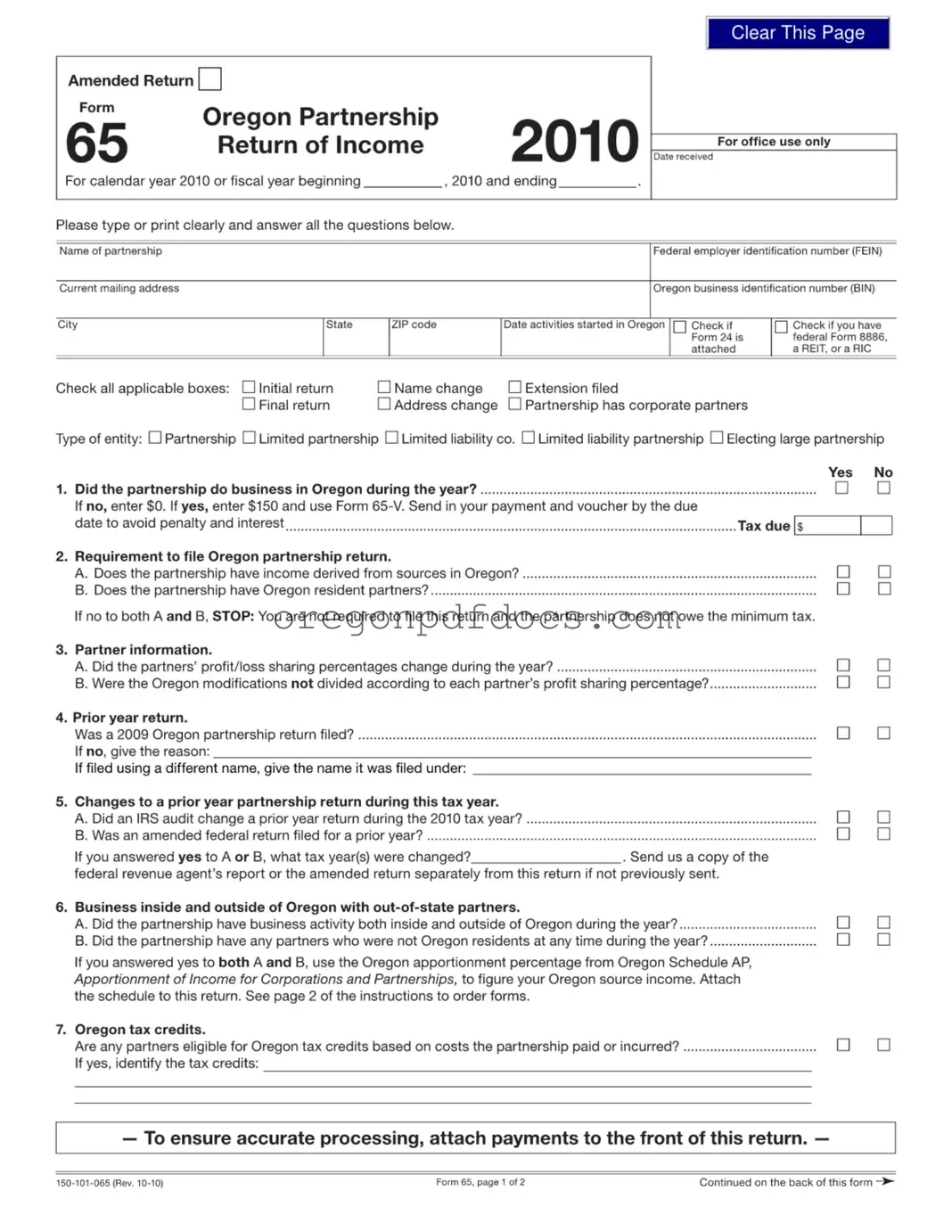

Free 65 Oregon Form

The 65 Oregon Form is the official document used for filing the Oregon Partnership Return of Income. This form is essential for partnerships operating in Oregon, as it ensures compliance with state tax regulations. If you need to fill out this form, click the button below to get started.

Make My Document Online

Free 65 Oregon Form

Make My Document Online

Make My Document Online

or

Get 65 Oregon PDF Form

One more step to finish this form

Finalize your 65 Oregon online in a few easy steps.