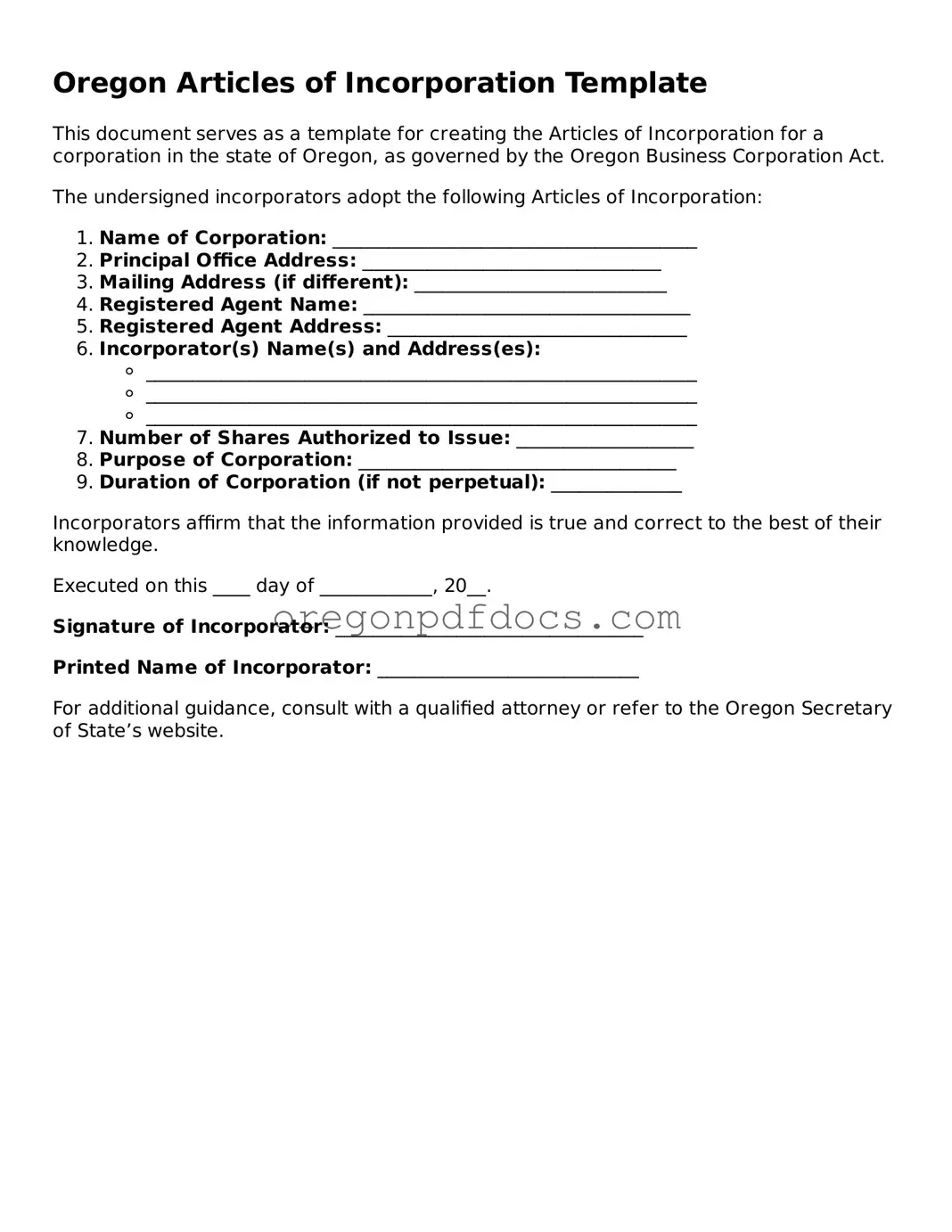

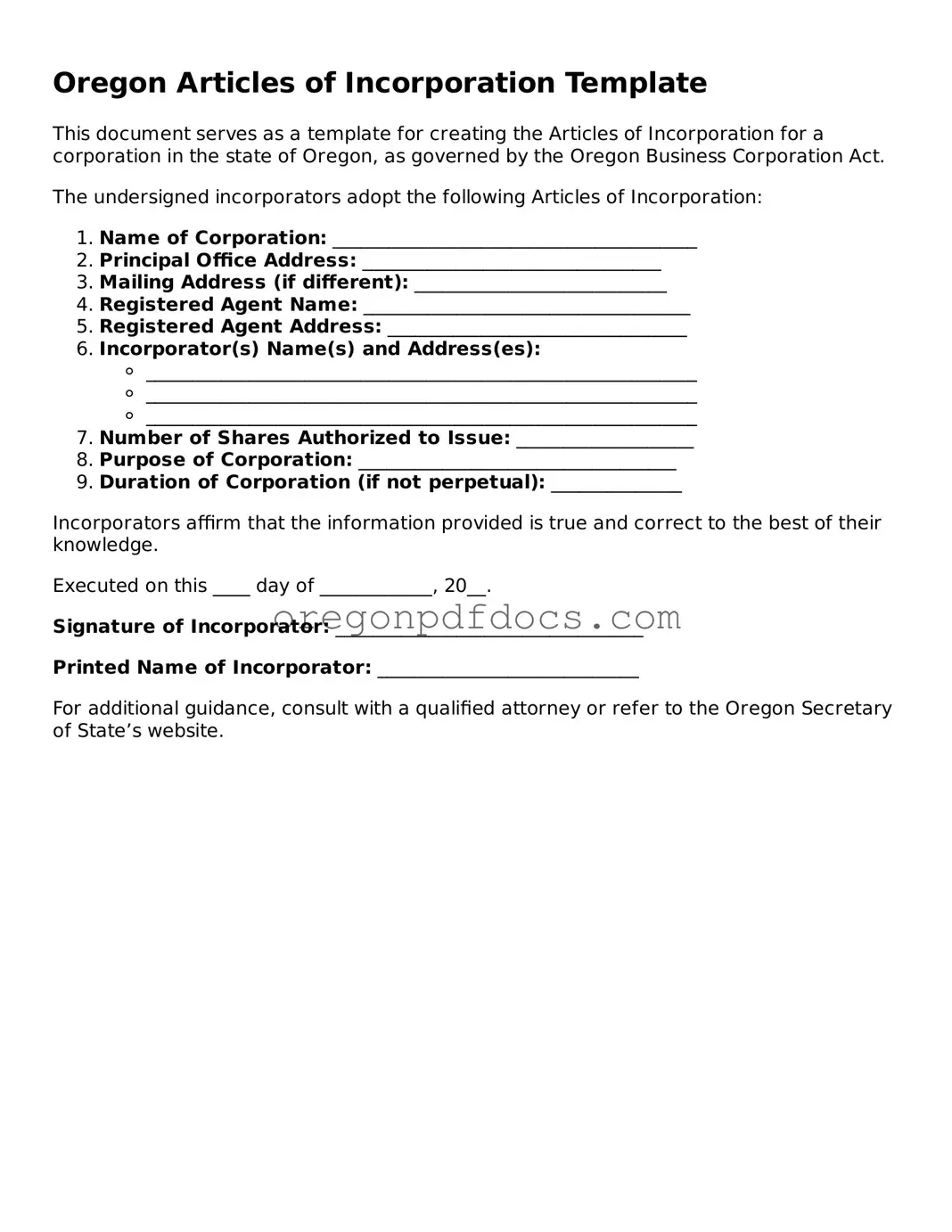

Printable Oregon Articles of Incorporation Document

The Oregon Articles of Incorporation form is a crucial document that officially establishes a corporation in the state of Oregon. This form outlines essential information about your business, including its name, purpose, and structure. Completing this form is a vital step in your journey toward creating a successful corporation, so don’t delay—fill it out by clicking the button below.

Make My Document Online

Printable Oregon Articles of Incorporation Document

Make My Document Online

Make My Document Online

or

Get Articles of Incorporation PDF Form

One more step to finish this form

Finalize your Articles of Incorporation online in a few easy steps.