Free Bin Oregon Form

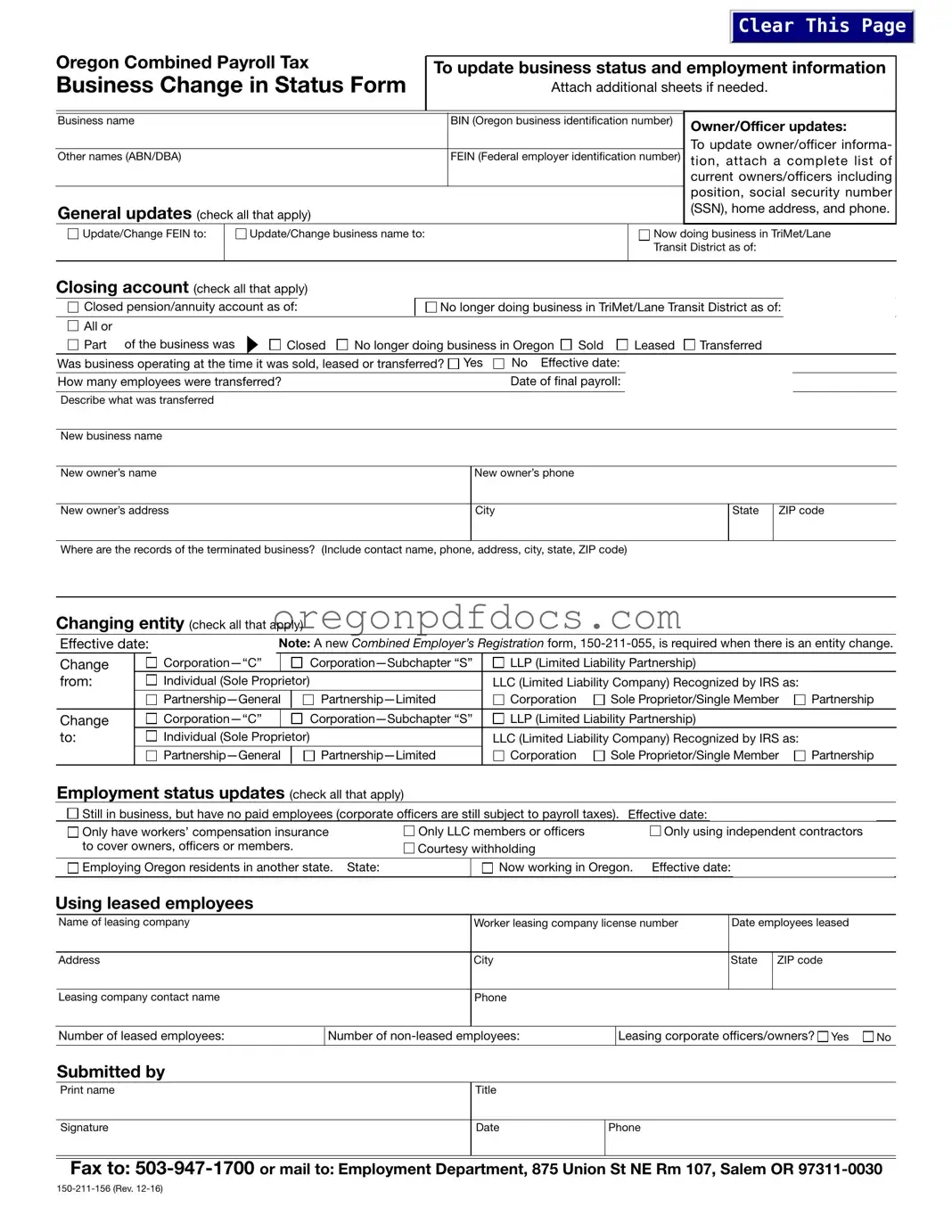

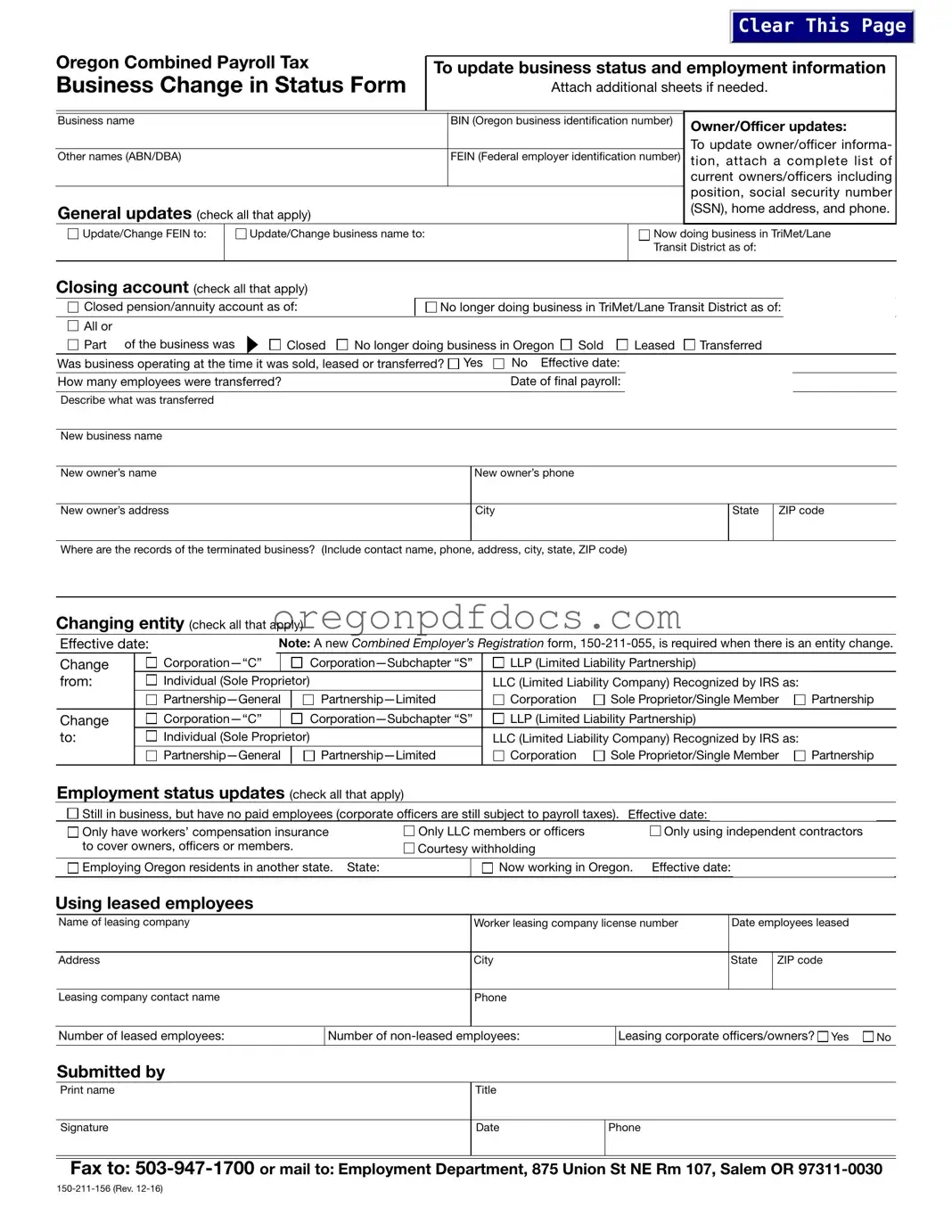

The Bin Oregon form is officially known as the Oregon Combined Payroll Tax Business Change in Status Form. This document is essential for notifying the Employment Department, Department of Revenue, and Department of Consumer and Business Services about changes to a business's status or employment information. Timely submission of this form ensures compliance with state regulations and helps maintain accurate records.

To proceed with filling out the form, please click the button below.

Make My Document Online

Free Bin Oregon Form

Make My Document Online

Make My Document Online

or

Get Bin Oregon PDF Form

One more step to finish this form

Finalize your Bin Oregon online in a few easy steps.

Still in business, but have no paid employees (corporate officers are still subject to payroll taxes). Effective date:

Still in business, but have no paid employees (corporate officers are still subject to payroll taxes). Effective date: