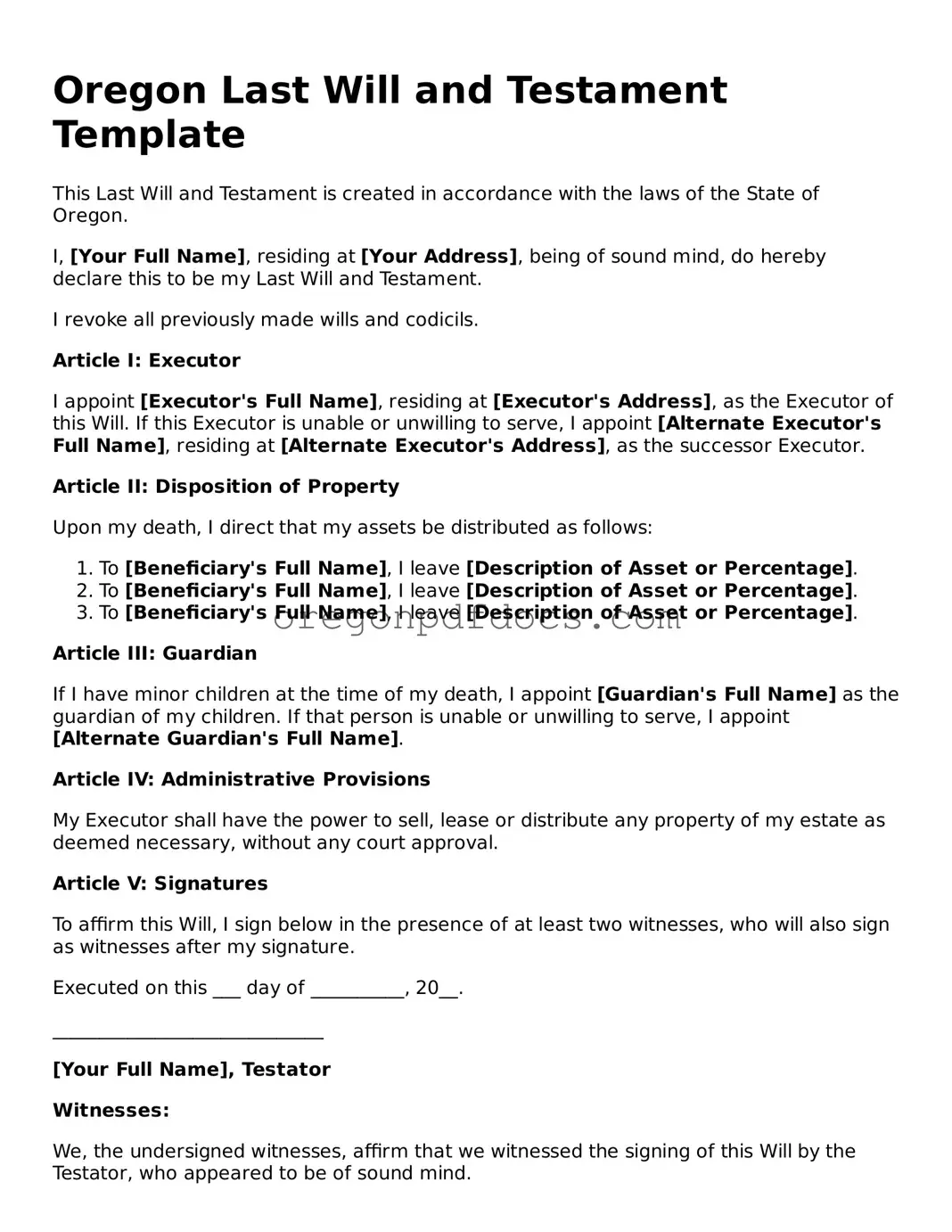

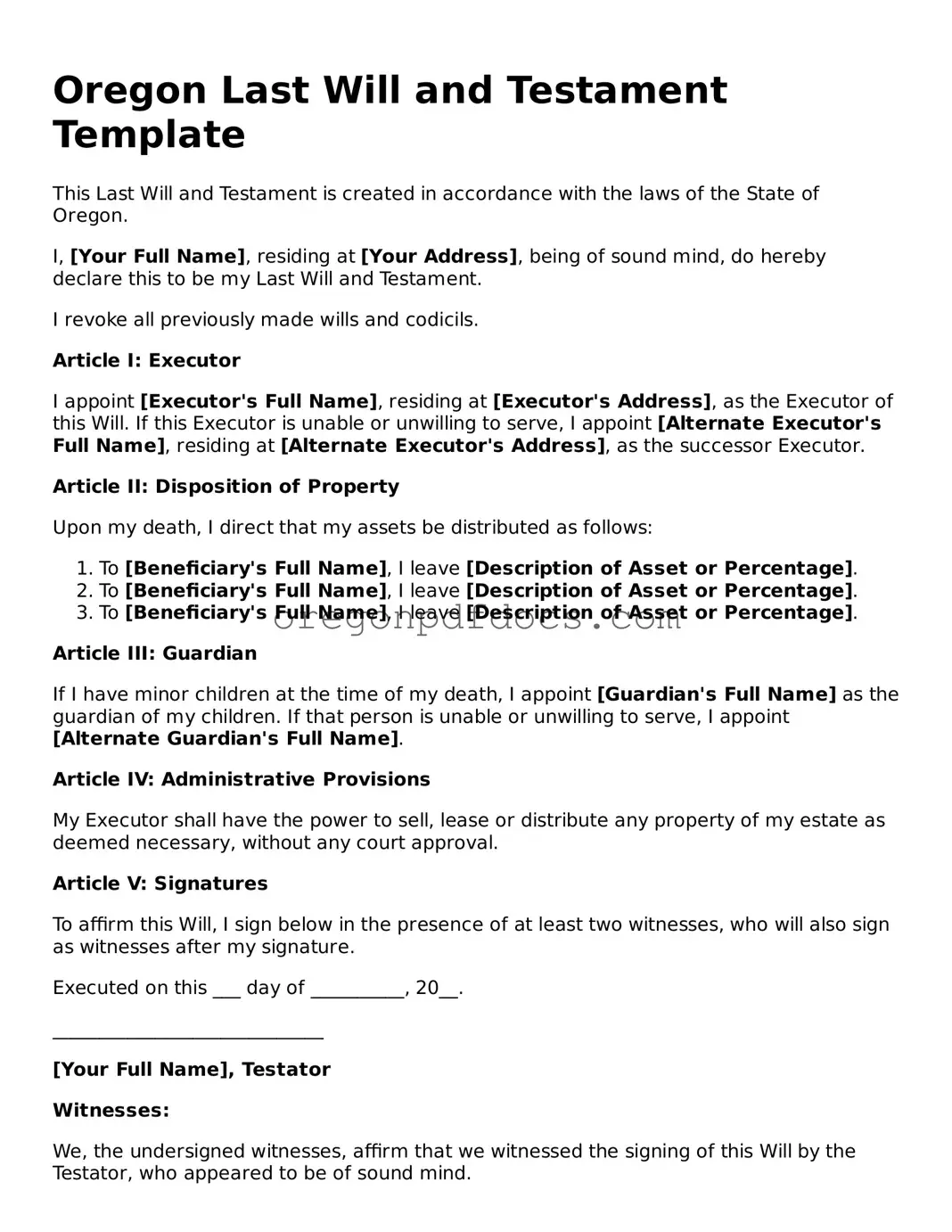

Printable Oregon Last Will and Testament Document

The Oregon Last Will and Testament form is a legal document that allows individuals to outline their wishes regarding the distribution of their assets after their passing. This essential tool ensures that your intentions are honored and can help prevent disputes among heirs. Understanding how to properly complete this form is crucial for anyone looking to secure their legacy.

Ready to take the next step? Fill out the form by clicking the button below.

Make My Document Online

Printable Oregon Last Will and Testament Document

Make My Document Online

Make My Document Online

or

Get Last Will and Testament PDF Form

One more step to finish this form

Finalize your Last Will and Testament online in a few easy steps.