INSTRUCTIONS

These instructions are for lines not fully explained on the form.

Line 1—Claiming an exception

Exception 1—Farmers and commercial fishermen.

If at least two-thirds (66.7 percent) of your 2005 or 2006 total gross income is from farming or fishing, you don

pay underpayment interest.

Gross income includes items such as wages, interest, and dividends. It also includes gross profit from rentals, royal- ties, businesses, farming, fishing, and the sale of property. When figuring gross profit, subtract only the cost of goods sold. When figuring gross profit on the sale of property, subtract only the adjusted basis or cost.

Farmers. Use the amounts on the following lines of both your 2005 and 2006 federal income tax returns to determine your gross income from farming:

•Federal Schedule F, line 11;

•Federal Schedule E, line 42;

•Federal Form 4797, line 20. (Include only gains from sale of livestock held for drafting, breeding, dairy, or sporting purposes.)

Fishermen. Use the amounts on the following lines of both your 2005 and 2006 federal income tax returns to determine your gross income from fishing:

•Federal Schedule C, line 5;

•Federal Schedule C-EZ, line 1;

•Federal Schedule E, line 42.

Exception 2—Prior year.

You meet this exception if all of the following are true:

•Your net income tax for 2005 was -0- or you were not required to file a return for 2005.

•You were a full-year Oregon resident in 2005.

•Your tax year was a full 12 months.

Your 2005 net income tax is your Oregon income tax after tax credits, including refundable tax credits, but before with- holding, estimated tax payments, or payments made with an extension.

Note: If you were a nonresident or a part-year resident in 2005, you can, you may be

able to use the Safe Harbor Method to figure your required annual payment. See Part A instructions on this page.

Exception 3—Retired or disabled and have a reasonable cause for the underpayment.

You meet this exception if:

•There was reasonable cause for underpaying your esti- mated tax, AND

—You retired at age 62 or older during 2005 or 2006, or

—You became disabled during 2005 or 2006.

Reasonable cause will be decided on a case-by-case basis. The extent of your effort to comply with the law will be considered. Attach a statement explaining the cause to be considered for the exception. Label the statement “Form 10 Attachment” at the top center of the page.

Exception 4—Underpayment due to unusual circumstances.

No interest is due if your underpayment is due to a casualty, disaster, or other unusual circumstance. Unemployment does not qualify as an unusual circumstance. Books and records that are destroyed by fire, flood, or other natural disaster may qualify as an unusual circumstance. Unusual circumstances will be determined on a case-by-case basis. The extent of your effort to comply with the law will be considered. Attach a statement explaining the cause to be considered for the exception. Label the statement “Form 10 Attachment” at the top center of the page.

Exception 5—S corporation shareholders.

Contact the Department of Revenue to see if you meet this exception. See page 8 for numbers to call.

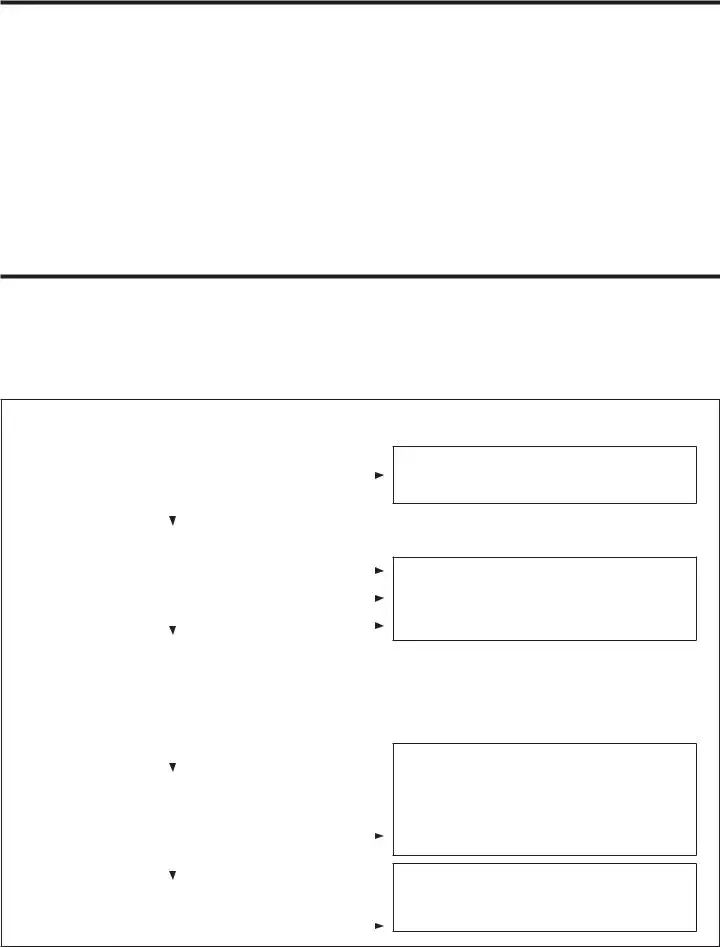

PART A—Figure your required annual payment

Line 2. Fill in your 2006 net income tax amount from Form 40, line 41; Form 40N, line 59; or Form 40P, line 58.

Line 3. Fill in your total 2006 refundable tax credit amounts from Form 40, lines 44–46; Form 40N, lines 62–64; or Form 40P, lines 61–63.

Line 6. Fill in only your Oregon income tax withheld from income. Don’t include any estimated tax payments.

Line 8. Enter your 2005 tax after all credits, Form 40, line 42 minus line 45; or Form 40N or 40P, line 60 minus line 63. If your 2005 tax after credits is less than zero, enter -0-.

If you didneturn for 2005, or your 2005 return was

not timely filed (including extensions), or your 2005 tax year was less than 12 months, don’t complete line 8. Enter the amount from line 5 on line 9. Note: If you were a part-year resident or nonresident in 2005 and you have a tax year of 12 months, you may use the tax shown on your 2005 Form 40N or 40P, line 60 minus line 63.

PART B—Figure your required periodic payment

Line 11. Divide line 9 by four and enter the amount in each column. If you moved into or out of Oregon in 2006, use the column(s) that correspond to the dates you lived in Oregon. Divide the amount on line 9 by the number of periods you were a resident of Oregon. This is your required payment for the period.

OR

If you annualized your income using the Annualized Income Worksheet on the back of Form 10, enter the amounts from line 31 of the worksheet.

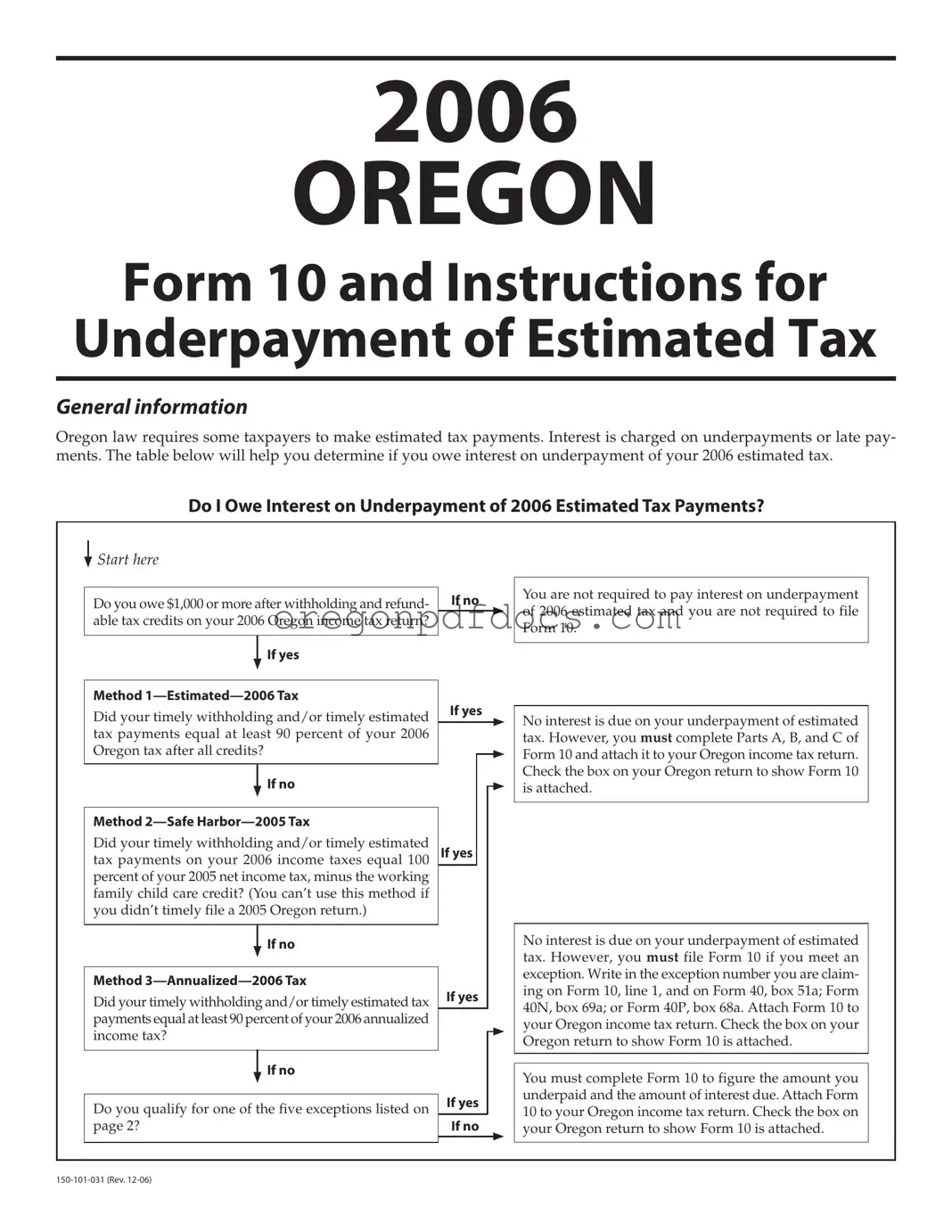

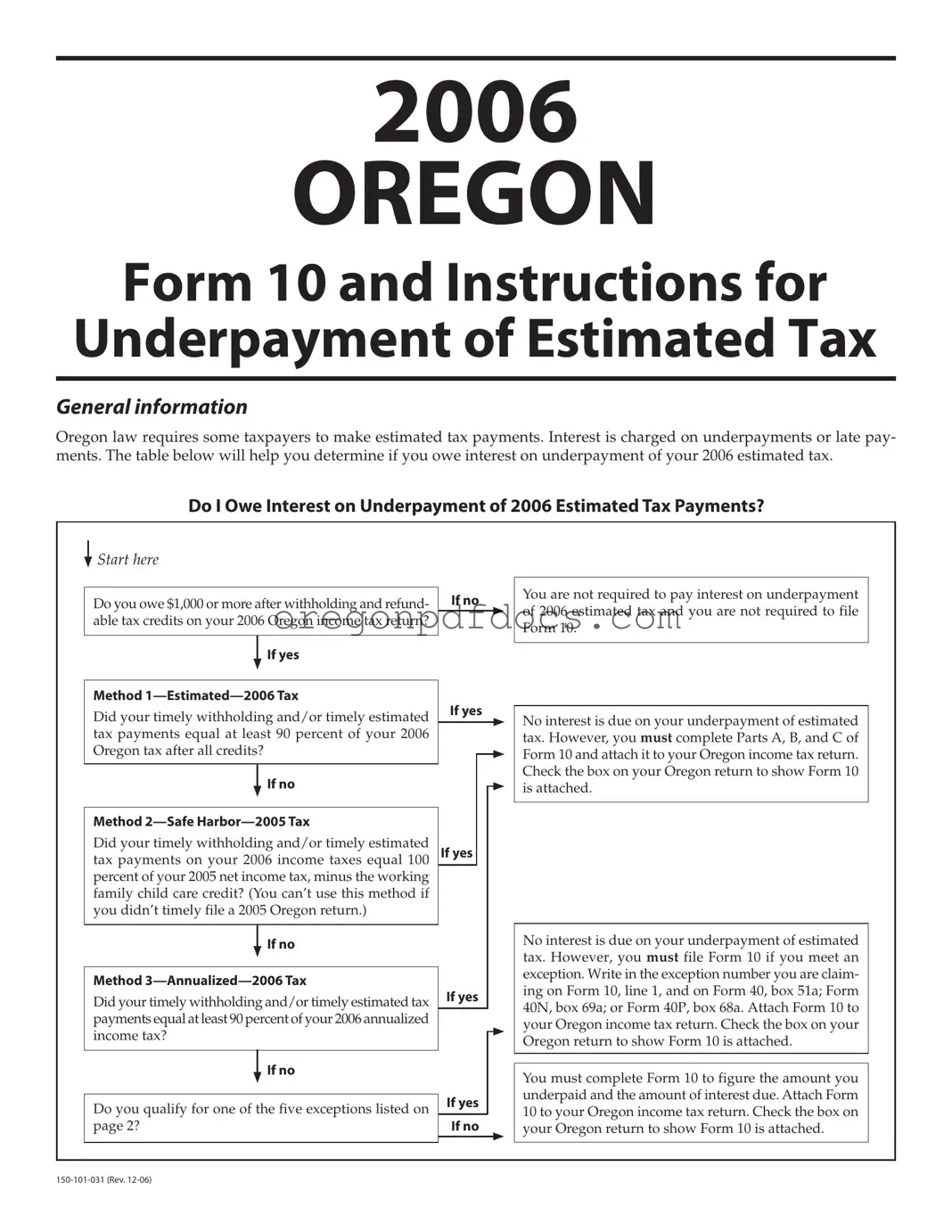

Start here

Start here