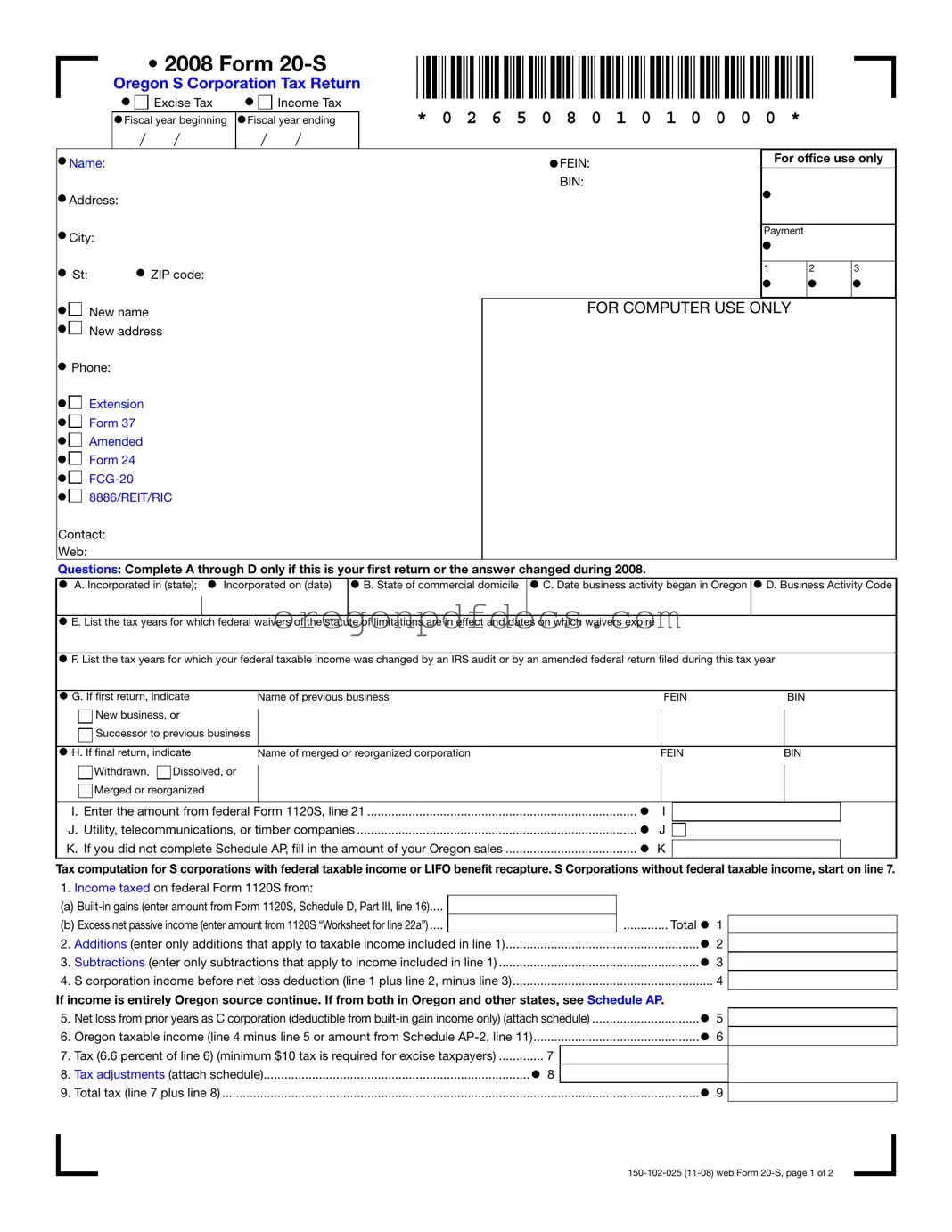

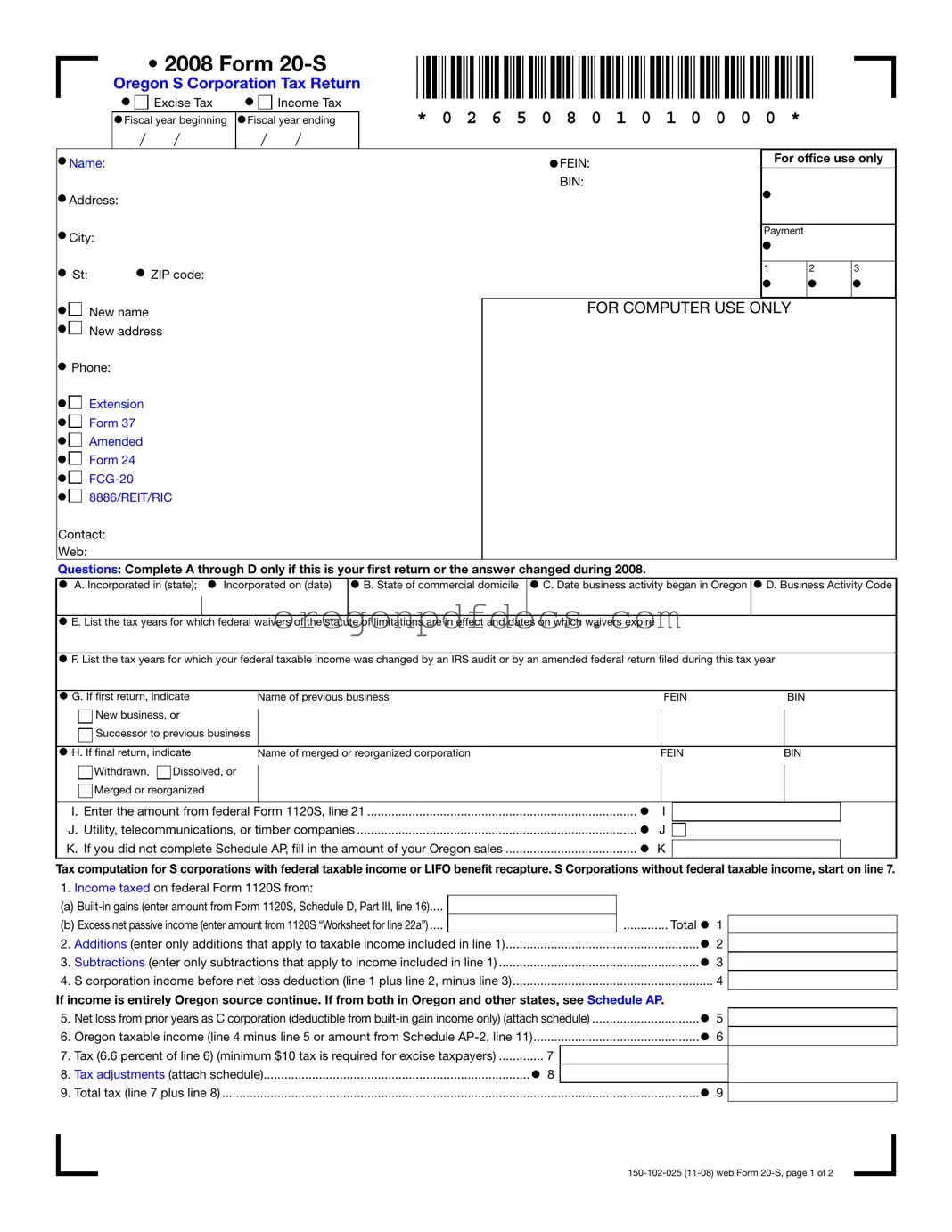

Free Oregon 20 S Form

The Oregon 20 S form is the official tax return for S corporations operating in Oregon. This form is used to report excise and income tax obligations for the fiscal year. Completing this form accurately is essential for compliance, so take the next step by filling it out using the button below.

Make My Document Online

Free Oregon 20 S Form

Make My Document Online

Make My Document Online

or

Get Oregon 20 S PDF Form

One more step to finish this form

Finalize your Oregon 20 S online in a few easy steps.

Extension

Extension

Form 37

Form 37

Amended

Amended

Form 24

Form 24

8886/REIT/RIC

8886/REIT/RIC