|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

2 |

|

|

|

|

|

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

5 |

5 |

5 |

5 |

5 |

5 |

5 |

5 |

5 |

5 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

7 |

7 |

7 |

7 |

7 |

7 |

7 |

7 |

7 |

7 |

8 |

8 |

2 |

8 |

8 |

8 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

82 3 |

4 |

5 |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

4 |

|

|

FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

20-V |

|

|

|

|

|

|

|

|

|

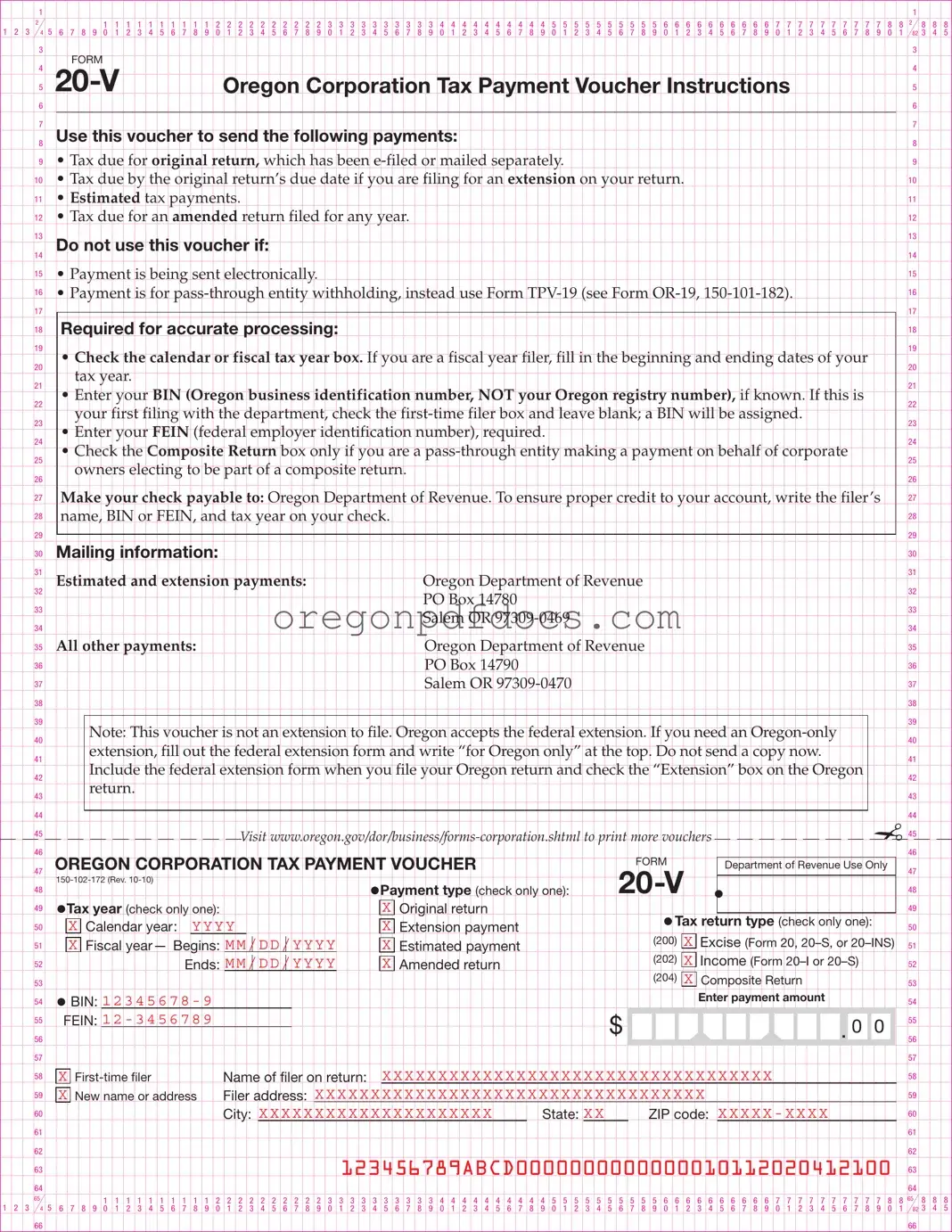

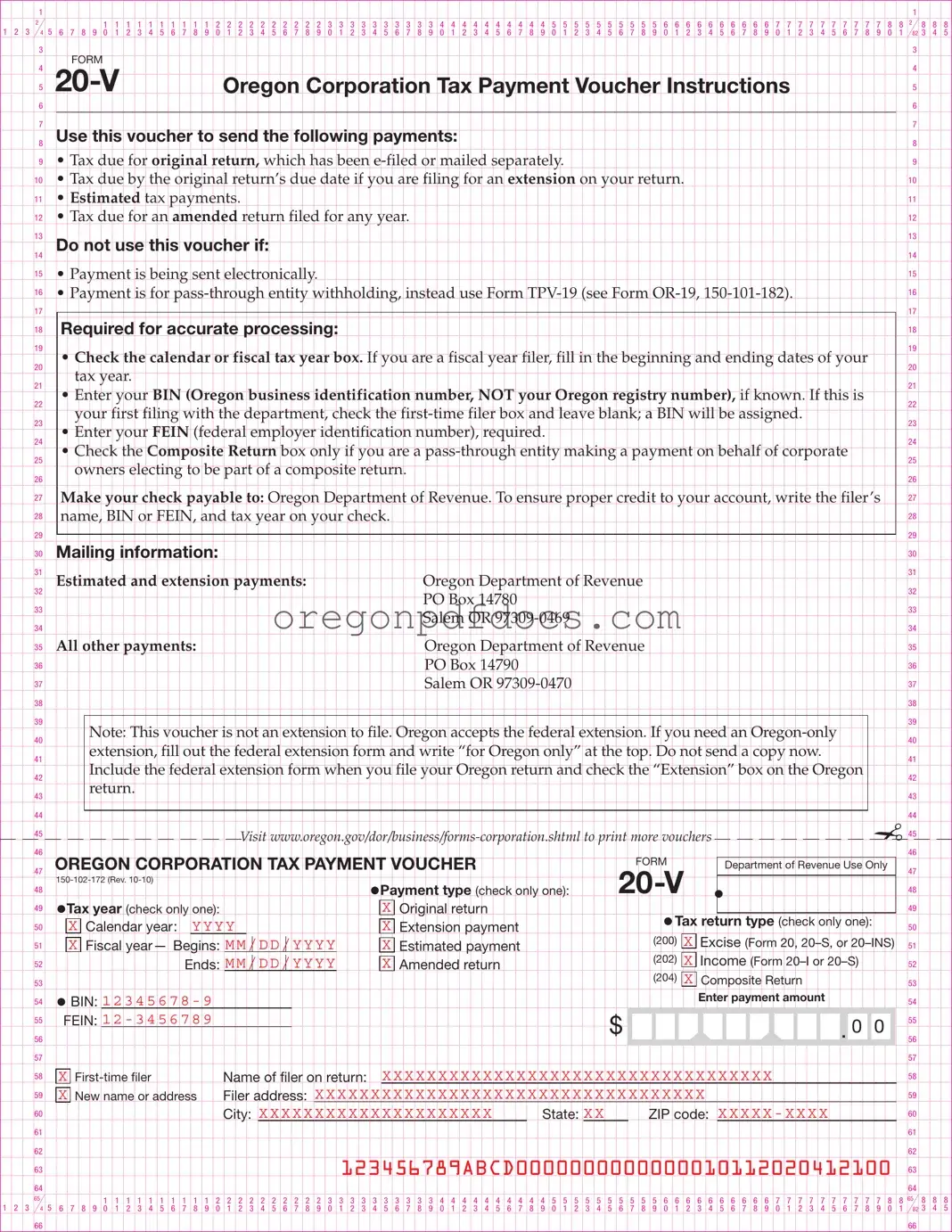

Oregon Corporation Tax Payment Voucher Instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

8 |

|

Use this voucher to send the following payments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

9 |

|

• Tax due for original return, which has been e-filed or mailed separately. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

10 |

|

• Tax due by the original return’s due date if you are filing for an extension on your return. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

11 |

|

• Estimated tax payments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

12 |

|

• Tax due for an amended return filed for any year. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

13 |

|

Do not use this voucher if: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

15 |

|

• Payment is being sent electronically. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

16 |

|

• Payment is for pass-through entity withholding, instead use Form TPV-19 (see Form OR-19, 150-101-182). |

|

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

18 |

|

Required for accurate processing: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

19 |

|

• Check the calendar or fiscal tax year box. If you are a fiscal year filer, fill in the beginning and ending dates of your |

|

|

|

19 |

|

|

|

|

|

|

20 |

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

tax year. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

• Enter your BIN (Oregon business identification number, NOT your Oregon registry number), if known. If this is |

|

|

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

22 |

|

|

|

|

|

|

|

|

|

your first filing with the department, check the first-time filer box and leave blank; a BIN will be assigned. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

|

• Enter your FEIN (federal employer identification number), required. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

|

• Check the Composite Return box only if you are a pass-through entity making a payment on behalf of corporate |

|

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

|

owners electing to be part of a composite return. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27 |

|

Make your check payable to: Oregon Department of Revenue. To ensure proper credit to your account, write the filer’s |

|

|

27 |

|

|

|

|

|

|

28 |

|

name, BIN or FEIN, and tax year on your check. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

29 |

|

Mailing information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

31 |

|

Estimated and extension payments: |

|

|

|

|

|

|

|

|

|

|

Oregon Department of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

|

|

|

|

|

|

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PO Box 14780 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32 |

|

|

|

|

|

|

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salem OR 97309-0469 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35 |

|

All other payments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oregon Department of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PO Box 14790 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

|

|

|

|

|

|

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salem OR 97309-0470 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

|

|

|

|

|

|

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38 |

|

|

|

|

|

|

39 |

|

|

|

|

Note: This voucher is not an extension to file. Oregon accepts the federal extension. If you need an Oregon-only |

|

|

|

|

|

|

39 |

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

41 |

|

|

|

|

extension, fill out the federal extension form and write “for Oregon only” at the top. Do not send a copy now. |

|

|

|

|

|

|

|

41 |

|

|

|

|

|

|

42 |

|

|

|

|

Include the federal extension form when you file your Oregon return and check the “Extension” box on the Oregon |

|

|

|

|

42 |

|

|

|

|

|

|

43 |

|

|

|

|

return. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43 |

|

|

|

|

|

|

44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

44 |

|

|

|

|

|

|

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Visit www.oregon.gov/dor/business/forms-corporation.shtml to print more vouchers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

✁ |

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

46 |

|

|

|

|

|

|

|

|

OREGON CORPORATION TAX PAYMENT VOUCHER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM |

|

|

|

|

|

Department of Revenue Use Only |

|

|

|

|

|

|

|

|

|

47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

20-V |

|

|

|

|

|

47 |

|

|

|

|

|

|

|

|

150-102-172 (Rev. 10-10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•Payment type (check only one): |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

48 |

|

|

|

|

|

|

49 |

|

•Tax year (check only one): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X Original return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•Tax return type (check only one): |

|

|

|

49 |

|

|

|

|

|

|

50 |

|

|

X Calendar year: |

|

YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

X Extension payment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

51 |

|

|

X Fiscal year— Begins: MM /DD/Y YYY |

|

|

|

|

X Estimated payment |

|

|

|

|

|

|

|

|

|

|

|

(200) |

X Excise (Form 20, 20–S, or 20–INS) |

|

51 |

|

|

|

|

|

|

52 |

|

|

|

|

|

|

|

|

|

|

|

|

Ends: MM/D D/YYY Y |

|

|

|

|

X Amended return |

|

|

|

|

|

|

|

|

|

|

|

|

|

(202) |

X Income (Form 20–I or 20–S) |

|

|

|

|

52 |

|

|

|

|

|

|

53 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(204) |

X Composite Return |

|

|

|

|

|

|

|

|

|

53 |

|

|

|

|

|

|

54 |

|

• BIN: 1 23 456 78 -9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter payment amount |

|

|

|

|

|

|

|

54 |

|

|

|

|

|

|

55 |

|

|

FEIN: 1 2- 345 67 89 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. 0 |

|

0 |

|

|

55 |

|

|

|

|

|

|

56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

56 |

|

|

|

|

|

|

57 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

57 |

|

|

|

|

|

|

58 |

|

X First-time filer |

|

|

|

|

|

|

Name of filer on return: |

|

XX X XX XX X XX XX X XX XX X XX XX X XX XX X XX XX X XX |

|

|

|

|

|

|

|

|

|

|

|

|

58 |

|

|

|

|

|

|

59 |

|

X New name or address |

|

|

Filer address: XXXXX XXX XX XX X XX XX X XX XX X XX XX X XX XX X XX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

59 |

|

|

|

|

|

|

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City: XXXXX XXXXX XXX XX XX X XX X |

|

|

|

|

State: X X |

|

|

|

|

ZIP code: X X XX X- X X XX |

|

|

|

|

|

|

|

60 |

|

|

|

|

|

|

61 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

61 |

|

|

|

|

|

|

62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

62 |

|

|

|

|

|

|

63 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

123456789ABCD0000000000000010112020412100 |

|

63 |

|

|

|

|

|

|

64 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

64 |

|

|

|

|

|

|

65 |

|

|

|

|

|

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

3 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

4 |

5 |

5 |

5 |

5 |

5 |

5 |

5 |

5 |

5 |

5 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

6 |

7 |

7 |

7 |

7 |

7 |

7 |

7 |

7 |

7 |

7 |

8 |

8 65 |

8 |

8 |

8 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

82 3 |

4 |

5 |

|

|

|

66 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

66 |

|

|

|