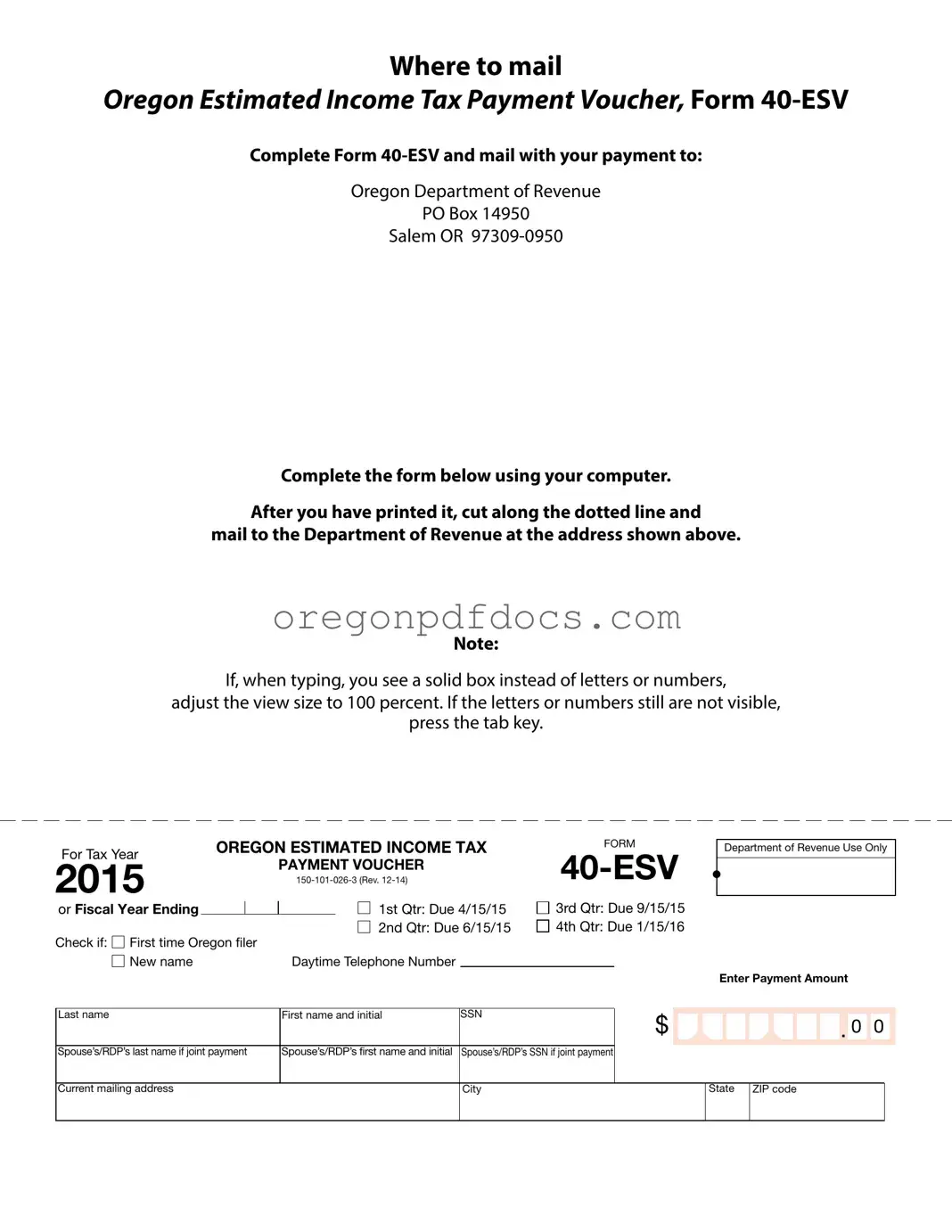

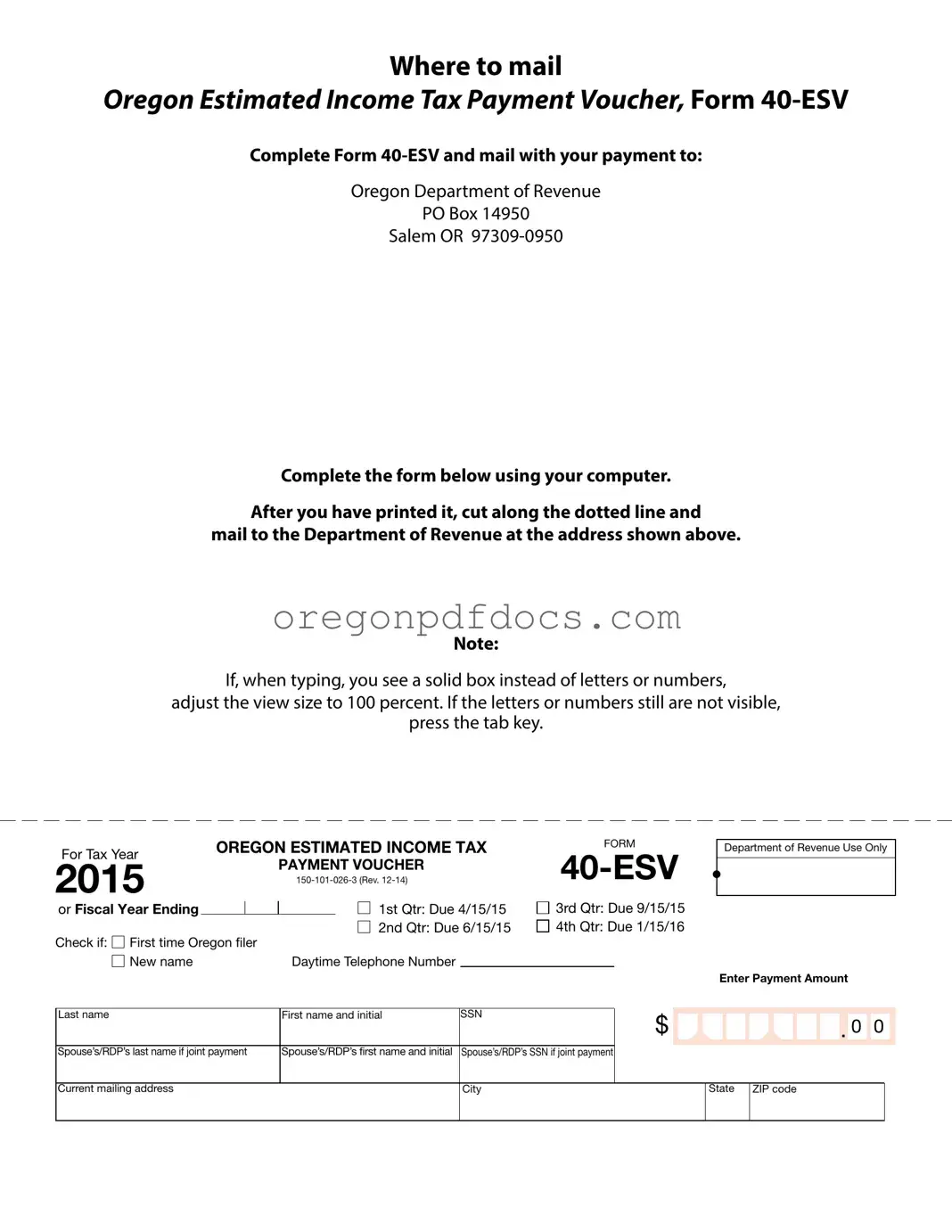

Free Oregon 40 Esv Form

The Oregon 40 ESV form is an Estimated Income Tax Payment Voucher used by residents of Oregon to submit their estimated tax payments. This form simplifies the process of making quarterly tax payments to the Oregon Department of Revenue. To ensure compliance and avoid penalties, it's important to fill out the form accurately and mail it to the appropriate address.

Ready to complete your Oregon 40 ESV form? Click the button below to get started!

Make My Document Online

Free Oregon 40 Esv Form

Make My Document Online

Make My Document Online

or

Get Oregon 40 Esv PDF Form

One more step to finish this form

Finalize your Oregon 40 Esv online in a few easy steps.

First time Oregon iler

First time Oregon iler

3rd Qtr: Due 9/15/15 4th Qtr: Due 1/15/16

3rd Qtr: Due 9/15/15 4th Qtr: Due 1/15/16