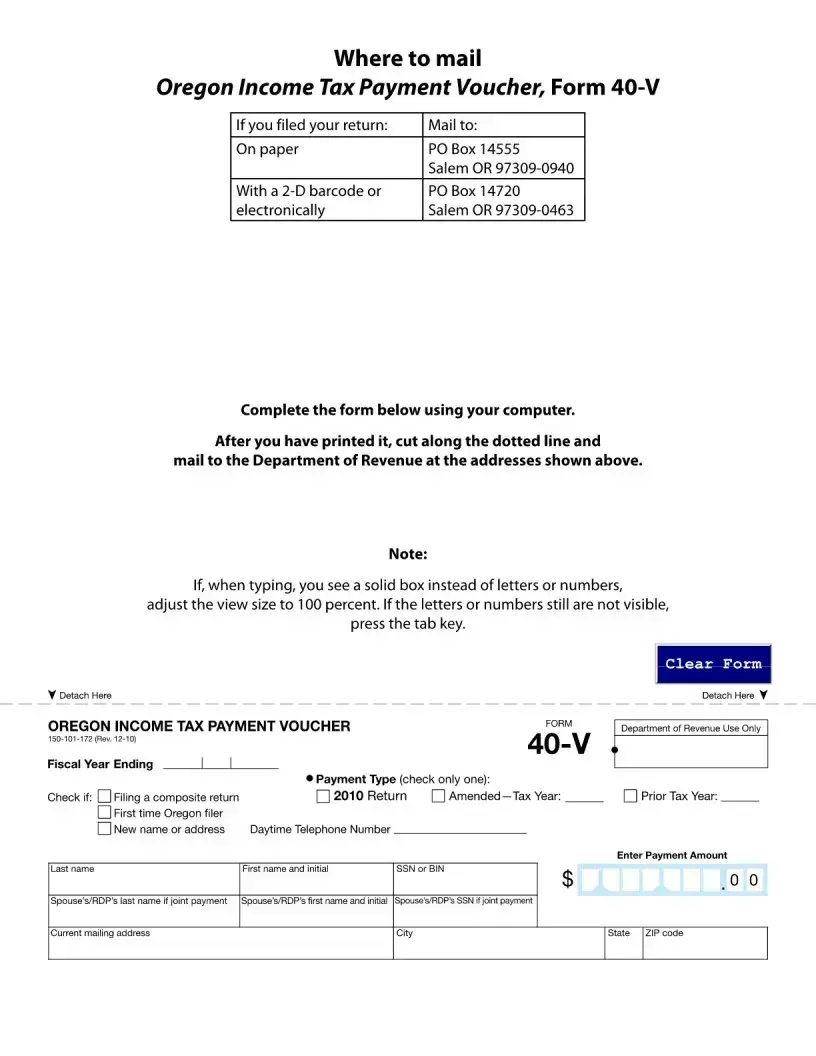

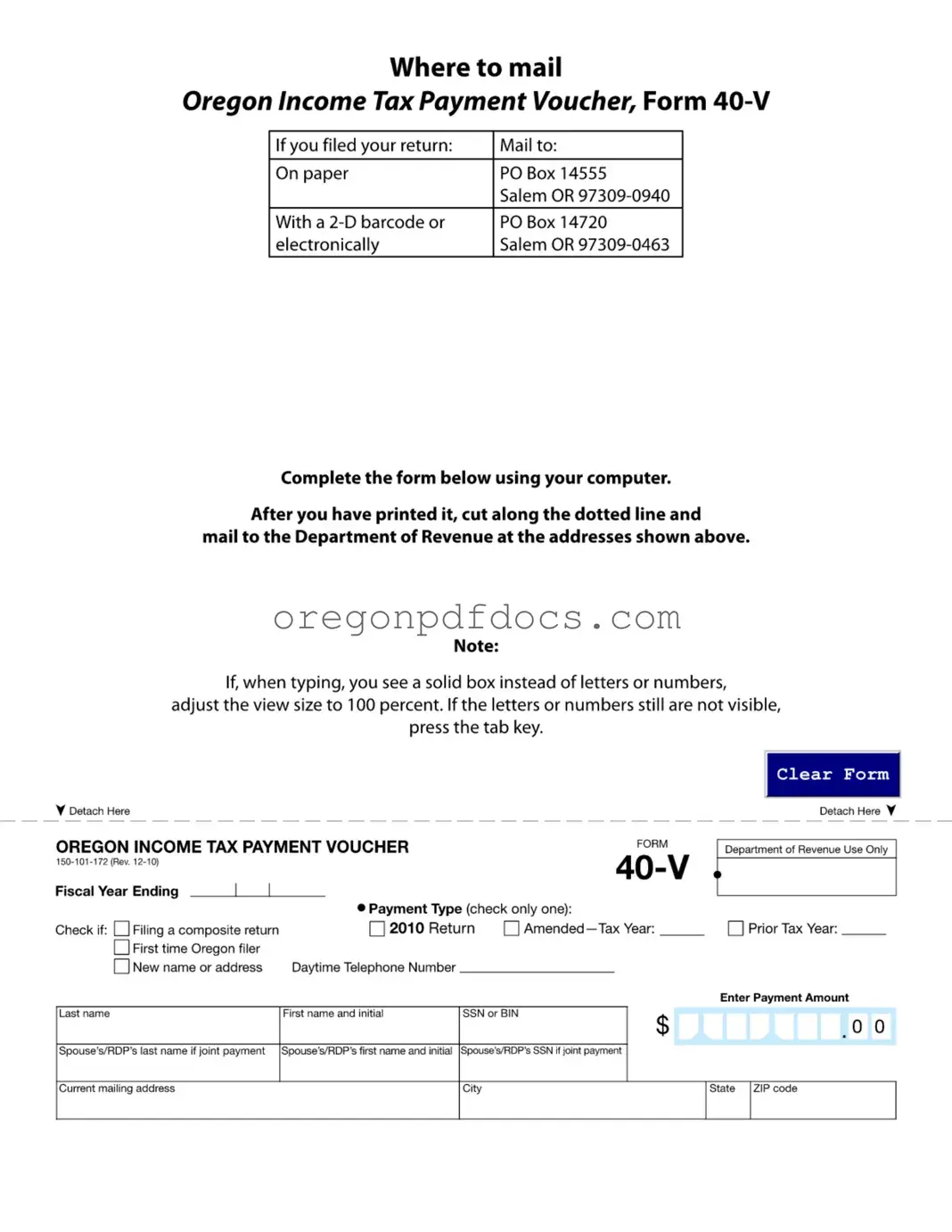

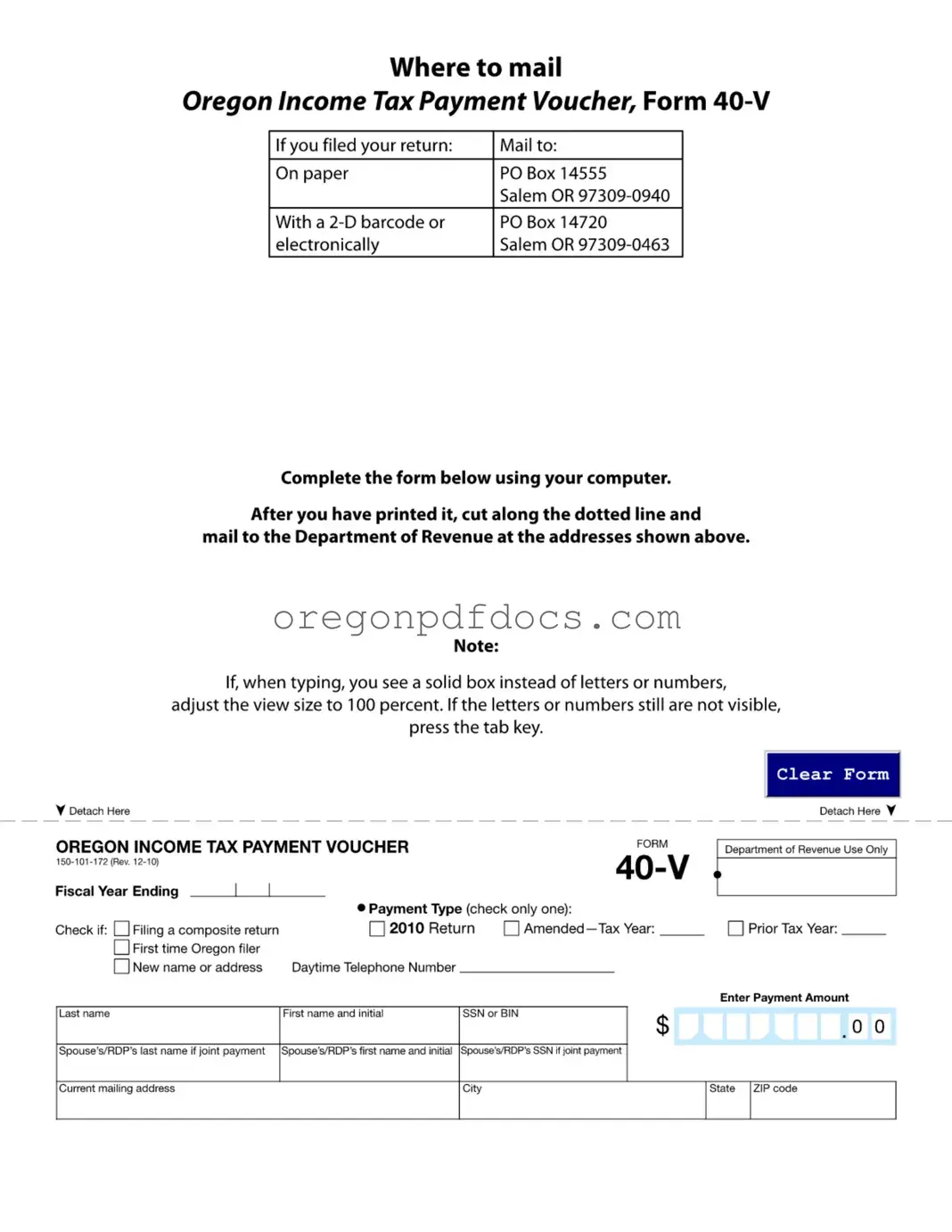

Free Oregon 40V Form

The Oregon 40V form is an essential document for individuals making income tax payments in Oregon. This form helps streamline the payment process, ensuring that your tax obligations are met efficiently. If you need to submit your payment, fill out the form below and take action by mailing it to the appropriate address.

Don't delay—complete the form by clicking the button below.

Make My Document Online

Free Oregon 40V Form

Make My Document Online

Make My Document Online

or

Get Oregon 40V PDF Form

One more step to finish this form

Finalize your Oregon 40V online in a few easy steps.