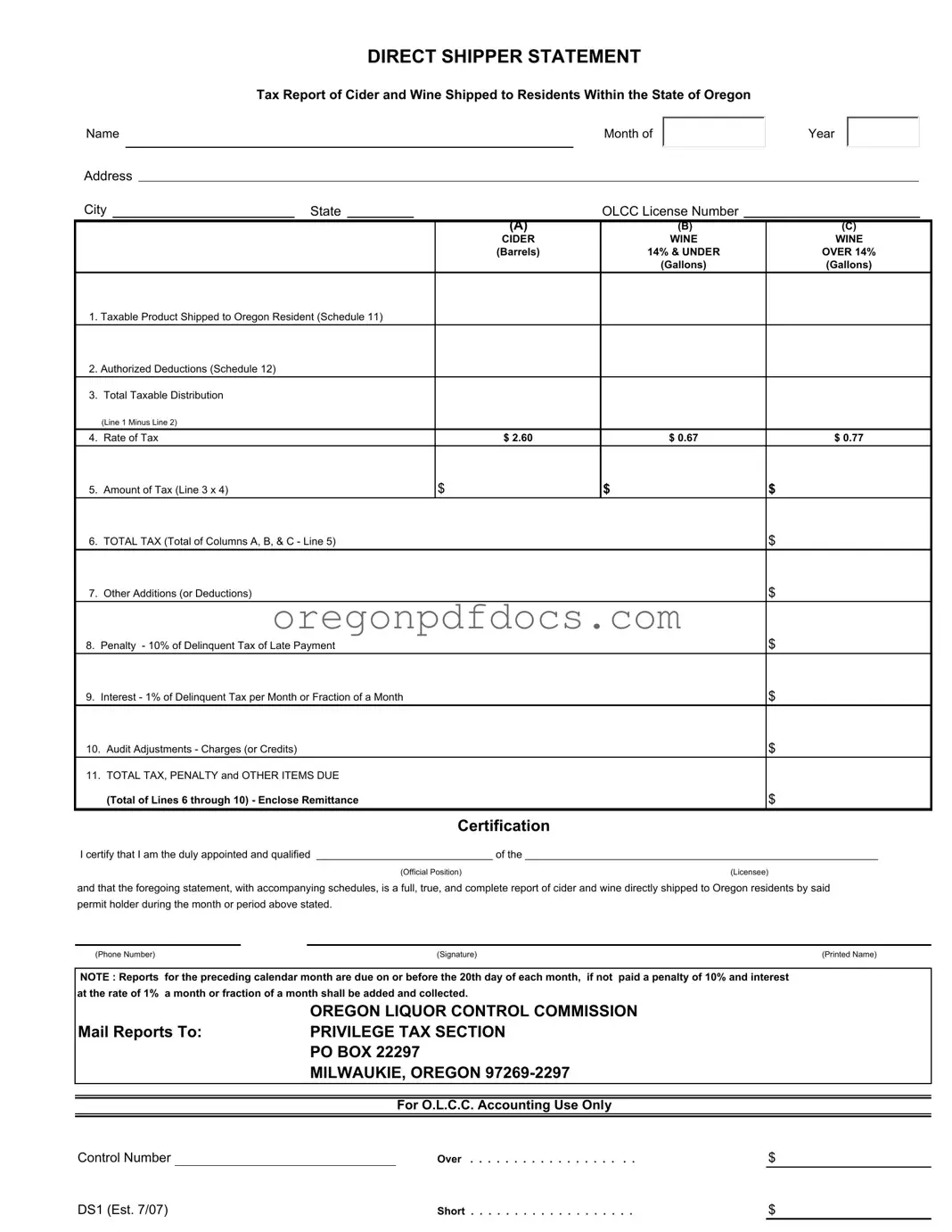

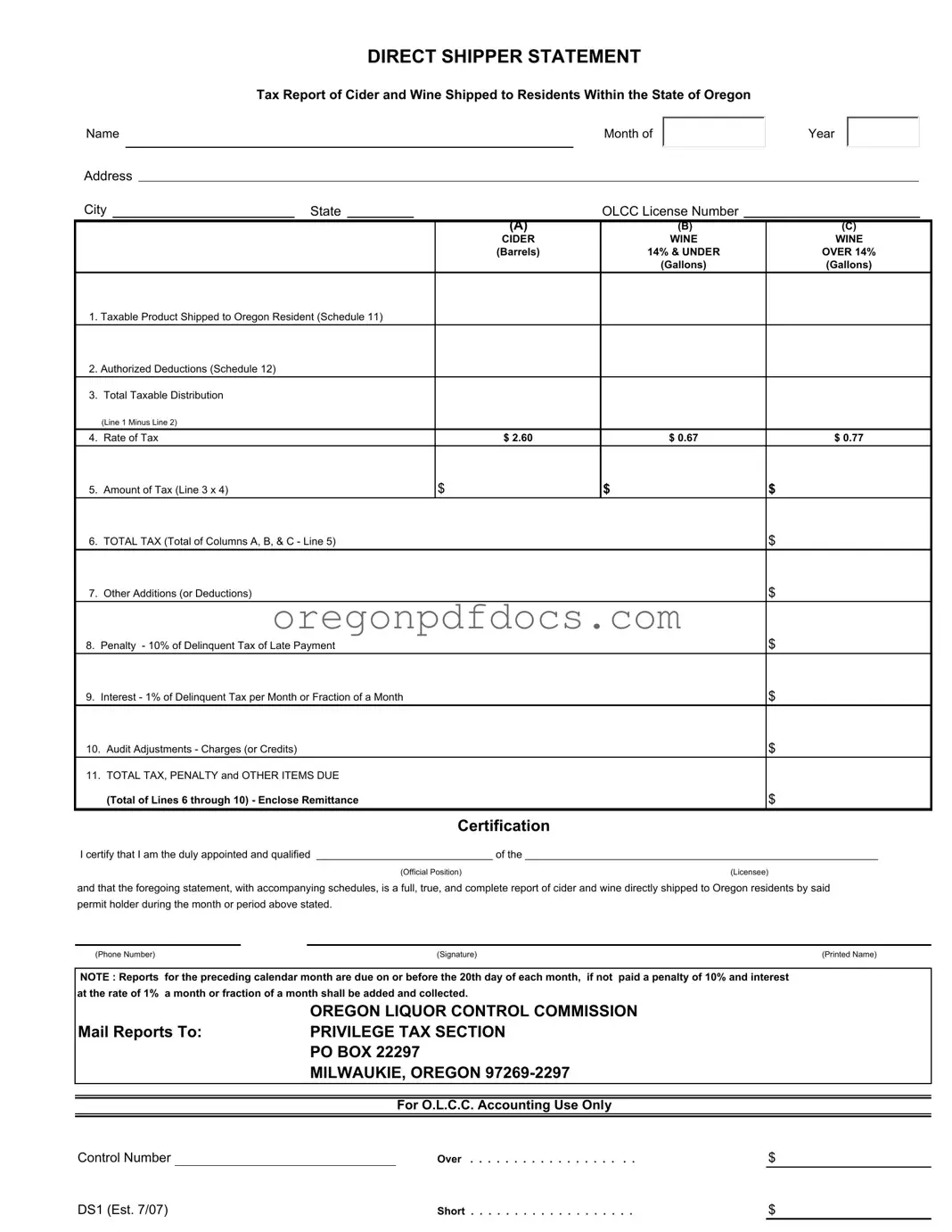

Free Oregon Ds1 Form

The Oregon DS1 form is a Direct Shipper Statement used to report the tax on cider and wine shipped to residents within the state of Oregon. This form must be completed monthly by all direct shippers and submitted by the 20th of the following month to avoid penalties. For assistance in filling out the form, click the button below.

Make My Document Online

Free Oregon Ds1 Form

Make My Document Online

Make My Document Online

or

Get Oregon Ds1 PDF Form

One more step to finish this form

Finalize your Oregon Ds1 online in a few easy steps.