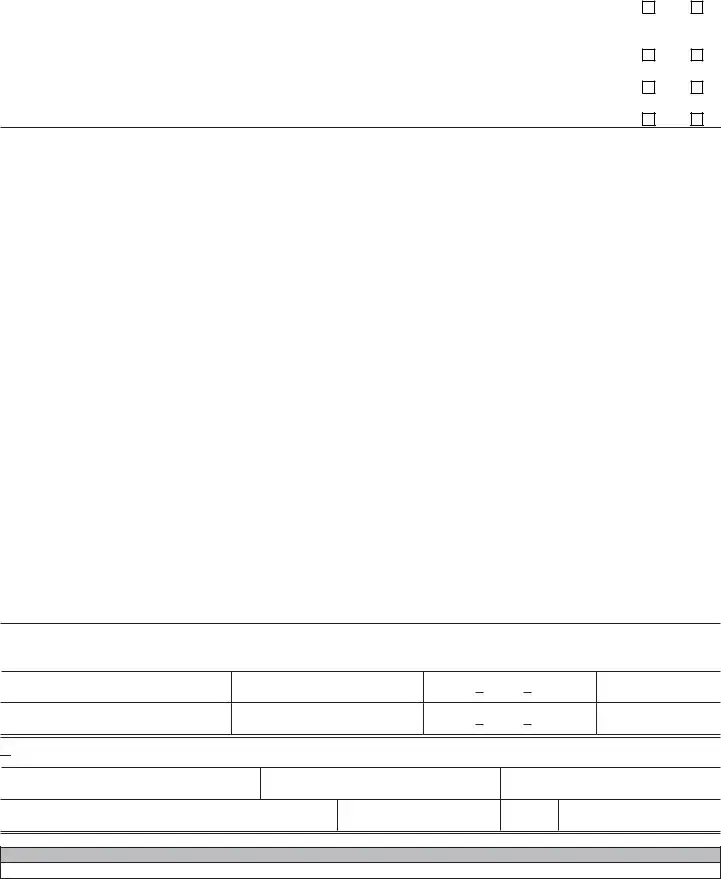

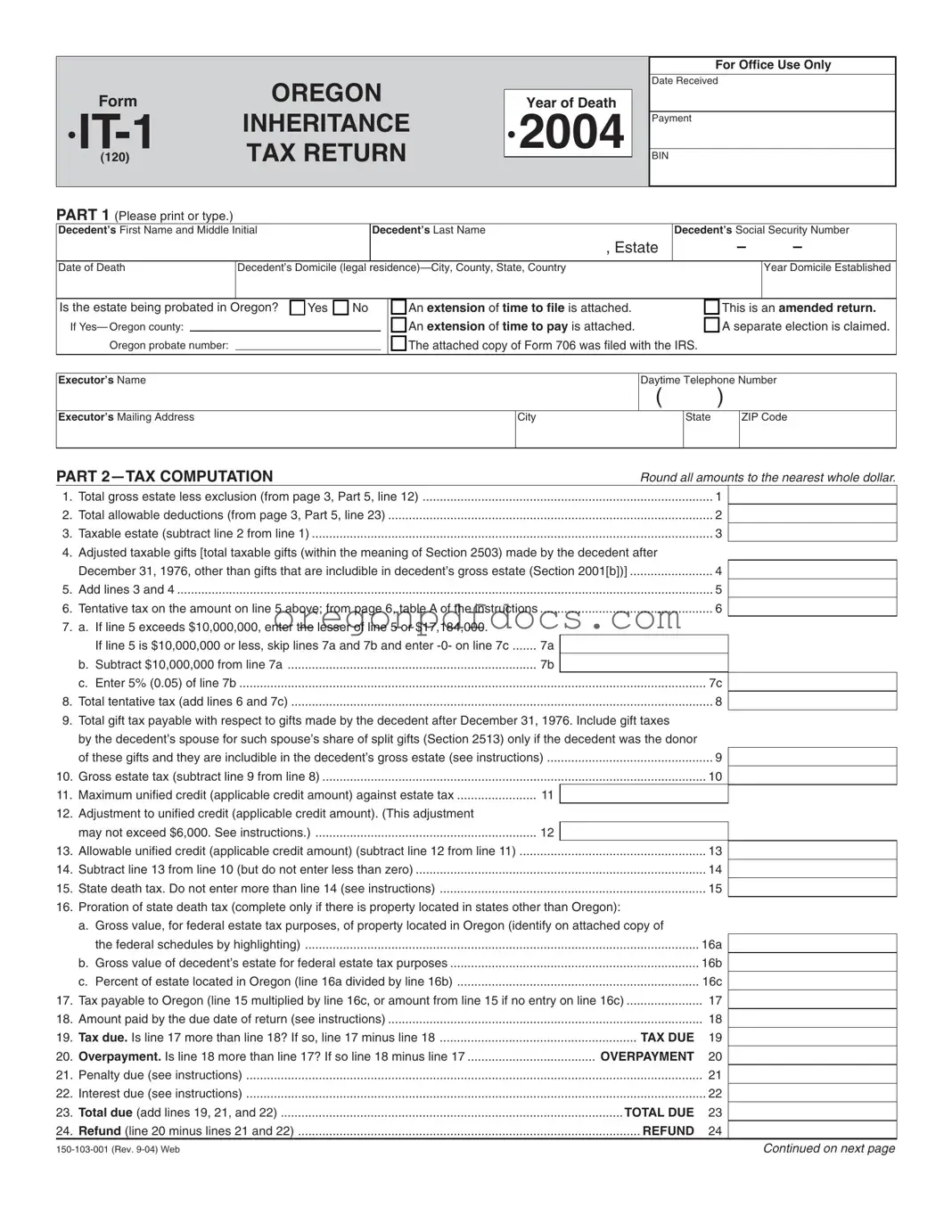

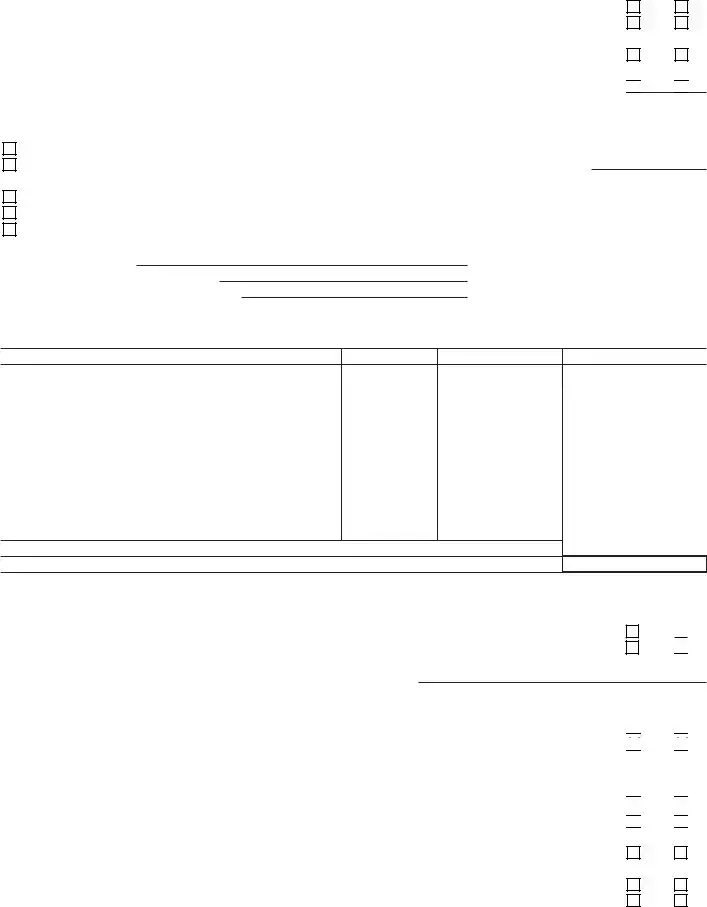

Free Oregon It 1 Form

The Oregon IT-1 form is a crucial document used for reporting inheritance tax for estates in Oregon. This form helps executors calculate the tax owed on the estate of a deceased individual, ensuring compliance with state regulations. If you need to complete this form, click the button below to get started!

Make My Document Online

Free Oregon It 1 Form

Make My Document Online

Make My Document Online

or

Get Oregon It 1 PDF Form

One more step to finish this form

Finalize your Oregon It 1 online in a few easy steps.

Yes

Yes

No

No

No

No

No

No Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes No

No

No

No

No

No

No

No