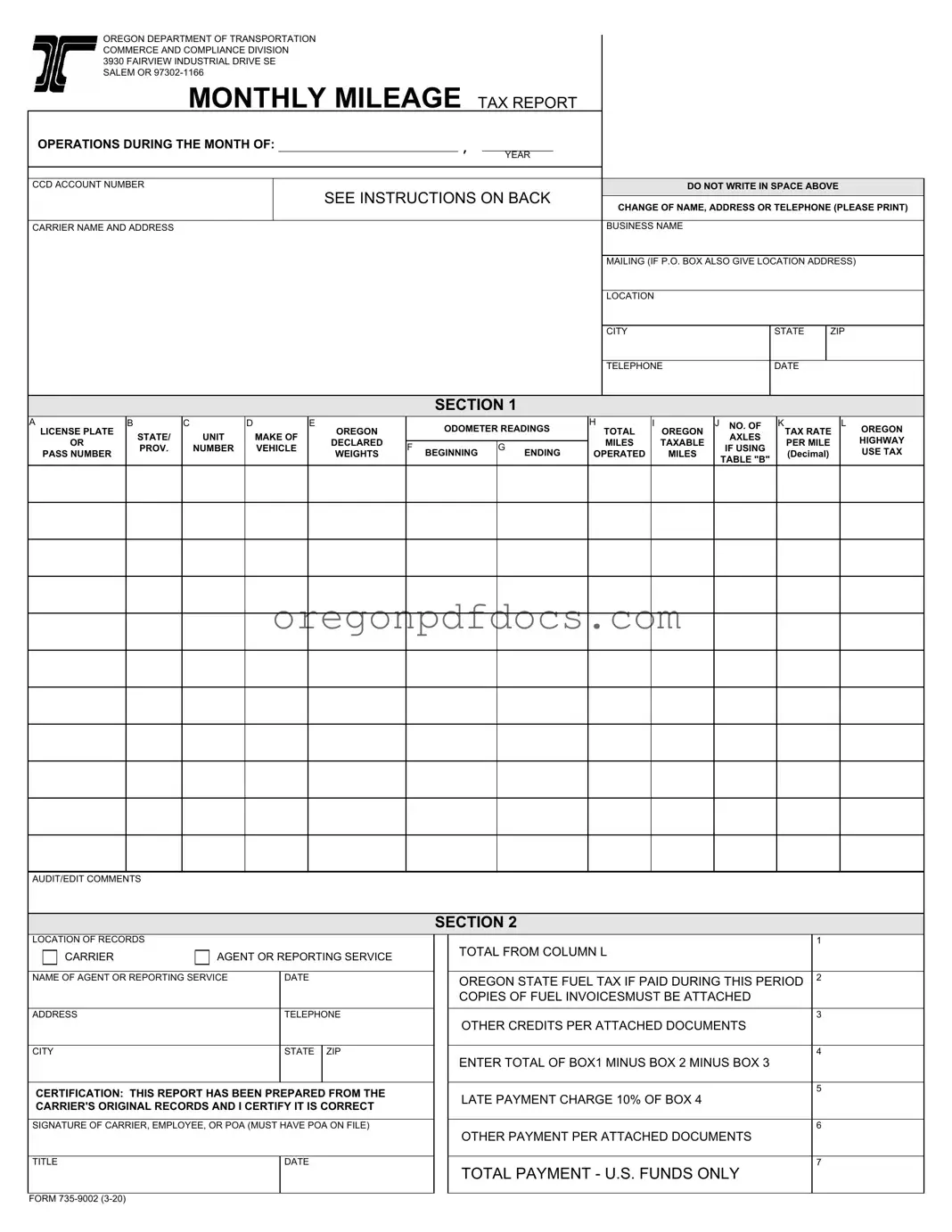

1

2

3

4

5

6

7

STATE ZIP

DATE

K L

TAX RATE OREGON

PER MILE HIGHWAY

(Decimal) USE TAX

OREGON DEPARTMENT OF TRANSPORTATION COMMERCE AND COMPLIANCE DIVISION 3930 FAIRVIEW INDUSTRIAL DRIVE SE SALEM OR 97302-1166

MONTHLY MILEAGE TAX REPORT

OPERATIONS DURING THE MONTH OF: |

|

, |

|

|

|

|

|

|

|

|

|

|

YEAR |

|

|

|

|

|

|

|

|

|

|

|

|

CCD ACCOUNT NUMBER |

|

|

|

|

DO NOT WRITE IN SPACE ABOVE |

SEE INSTRUCTIONS ON BACK

CHANGE OF NAME, ADDRESS OR TELEPHONE (PLEASE PRINT)

CARRIER NAME AND ADDRESS |

BUSINESS NAME |

MAILING (IF P.O. BOX ALSO GIVE LOCATION ADDRESS)

LOCATION

CITY

TELEPHONE

SECTION 1

A

LICENSE PLATE

OR

PASS NUMBER

E

OREGON

DECLARED

WEIGHTS

ODOMETER READINGS

F BEGINNING G ENDING

HI

TOTAL OREGON

MILES TAXABLE OPERATED MILES

JNO. OF AXLES

IF USING

TABLE "B"

AUDIT/EDIT COMMENTS

SECTION 2

LOCATION OF RECORDS |

|

|

|

|

|

CARRIER |

AGENT OR REPORTING SERVICE |

|

|

|

|

|

|

|

|

|

|

NAME OF AGENT OR REPORTING SERVICE |

DATE |

|

|

|

|

ADDRESS |

|

TELEPHONE |

|

|

|

|

CITY |

|

STATE |

ZIP |

|

|

|

|

|

|

CERTIFICATION: THIS REPORT HAS BEEN PREPARED FROM THE CARRIER'S ORIGINAL RECORDS AND I CERTIFY IT IS CORRECT

SIGNATURE OF CARRIER, EMPLOYEE, OR POA (MUST HAVE POA ON FILE)

TOTAL FROM COLUMN L

OREGON STATE FUEL TAX IF PAID DURING THIS PERIOD COPIES OF FUEL INVOICESMUST BE ATTACHED

OTHER CREDITS PER ATTACHED DOCUMENTS

ENTER TOTAL OF BOX1 MINUS BOX 2 MINUS BOX 3

LATE PAYMENT CHARGE 10% OF BOX 4

OTHER PAYMENT PER ATTACHED DOCUMENTS

TOTAL PAYMENT - U.S. FUNDS ONLY

MONTHLY MILEAGE TAX REPORT

GENERAL REPORTING INFORMATION

DO NOT PAY ROAD USE ASSESSMENT FEES OR INVOICES FROM THE OVER-DIMENSIONAL PERMIT UNIT ON THIS REPORT. To report mileage on an Over-Dimensional Permit, contact OD Permits at 503-373-0000.

DUE DATE: Your report and payment must be postmarked by the Postal Service by the last day of the month following the end of the calendar month. An illegible or unreadable report will be returned and considered unfiled in accordance with OAR 740-055-0010. If you file your report late, add a 10 percent late payment charge in Box 5.

ODOT requires you to file reports and pay for all operations within the reporting period, as long as you have ODOT plates and/or vehicle(s) enrolled in the Oregon Weight-Mile Tax Program. If there is no tax due, you must still file a report. If you did not operate a vehicle, put a zero (0) in columns I and L. If you will not be using your vehicle(s), turn in the ODOT plate(s) or cancel by written notification.

Enter the ACCOUNT NUMBER. Enter the NAME AND ADDRESS OF THE BUSINESS as filed with Oregon Department of Transportation, Commerce and Compliance Division (CCD).

STEP-BY-STEP INSTRUCTIONS (SECTION 1) |

COLUMN A |

= Enter the plate or pass number of the power unit for which you are reporting. |

COLUMN B |

= Enter the state or province that issued the license plate. |

COLUMN C |

= Enter the company's unit number for the power unit for which you are reporting. |

COLUMN D |

= Enter the make of the vehicle. |

COLUMN E |

= You must declare and report operations at the heaviest weight operated per configuration. This should be one of the weights you declared with |

|

|

ODOT. If returning empty, use the same declared weight and tax rate as when loaded. |

COLUMN F |

= Enter the beginning odometer reading from the first day of the month for which you are reporting. This should be the same as the ending |

|

|

odometer reading from the preceding month. |

COLUMN G |

= Enter the ending odometer reading from the last day of the month for which you are reporting. |

COLUMN H |

= Enter the total miles operated for each vehicle (Column G minus Column F). |

COLUMN I |

= Enter the Oregon taxable miles (miles operated on Oregon public roads). |

COLUMN J |

= Enter the number of axles for any declared weight greater than 80,000 pounds. |

COLUMN K |

= Enter the appropriate rate as indicated on Form 735-9928, " Mileage Tax Rates". If you are operating between 26,001 and 80,000 pounds, use |

|

|

Table A rates. If returning empty, use the same declared weight and tax rate as when loaded. Empty operations associated with Special |

|

|

Transportation Permits (STP) are to be reported at 80,000 pounds. If you are operating between 80,001 and 105,000 pounds under an extended |

|

|

weight permit complete all columns. Use Table B Tax Rates. Raising a lift axle is not a change in configuration and does not constitute a change |

|

|

in rate. Do not use Table B rates for heavy haul operations conducted under STP when in excess of 98,000 pounds. |

COLUMN L |

= Compute and enter the Oregon Highway Use Tax (Column I times Column K). |

PAYMENT INSTRUCTIONS (SECTION 2) |

BOX 1 |

= |

Enter the total fees from Column L. |

BOX 2 |

= |

Enter Oregon state fuel tax paid during this month. You may claim a credit if you pay Oregon state fuel tax on fuel purchases. Fuel must have been |

purchased in the same report month credit is claimed. Attach copies of fuel invoices to the report. The invoice must contain:

Date of purchase |

Type of fuel |

ODOT plate or Pass No |

Name & Location of supplier |

Number of gallons |

Amount of Oregon state fuel tax paid |

BOX 3

BOX 4

BOX 5

BOX 6

BOX 7

If you buy fuel in bulk, you can only claim credit for fuel pumped into a qualified vehicle during the reporting period. In addition to the invoice, you must attach records to show the amount of fuel pumped into each qualified vehicle.

=Enter the amount of other credits as indicated on monthly Statement of Account and attach a copy. Do not use credits that have not yet appeared on the monthly Statement of Account.

=Enter the total of the amounts in Box 1 minus Box 2 minus Box 3.

=If you file your report late, enter 10% of Box 4.

=Add other payments and attach the supporting documents. Payments received without supporting documentation may not be correctly applied to your account.

=Enter the total of the amounts in Box 4 plus Box 5 plus Box 6.

An authorized company representative or agent must sign the Report. An agent must have Power of Attorney on file with CCD before they are an authorized representative.

Be sure to enclose the payment. Make a copy for your records and mail the original to: ODOT Commerce and Compliance Division, 3930 Fairview Industrial Drive SE, Salem, Oregon 97302-1166. Reports are not considered filed until we receive your complete report and payment. You are required to maintain records for three years to support the information contained in this report and forms are available for this purpose.

Trucking Online is available for your convenience in filing and paying reports online. You may also amend your vehicle information using Trucking Online. Visit our Website at www.oregontruckingonline.com. For additional record keeping requirements and tax reporting information, please see Instructions for Filing Highway- Use Tax Reports available on our website at https://www.oregon.gov/ODOT/MCT/Pages/FormsandTables.aspx or call 503-378-6699 for help.