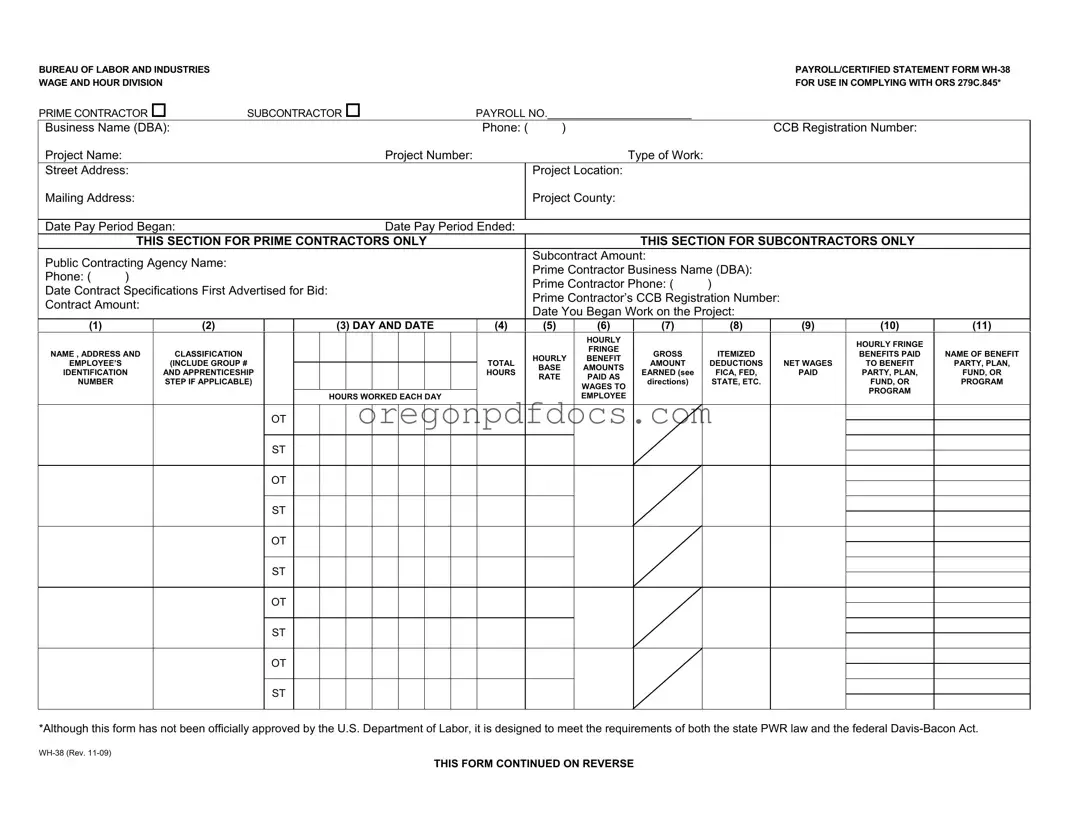

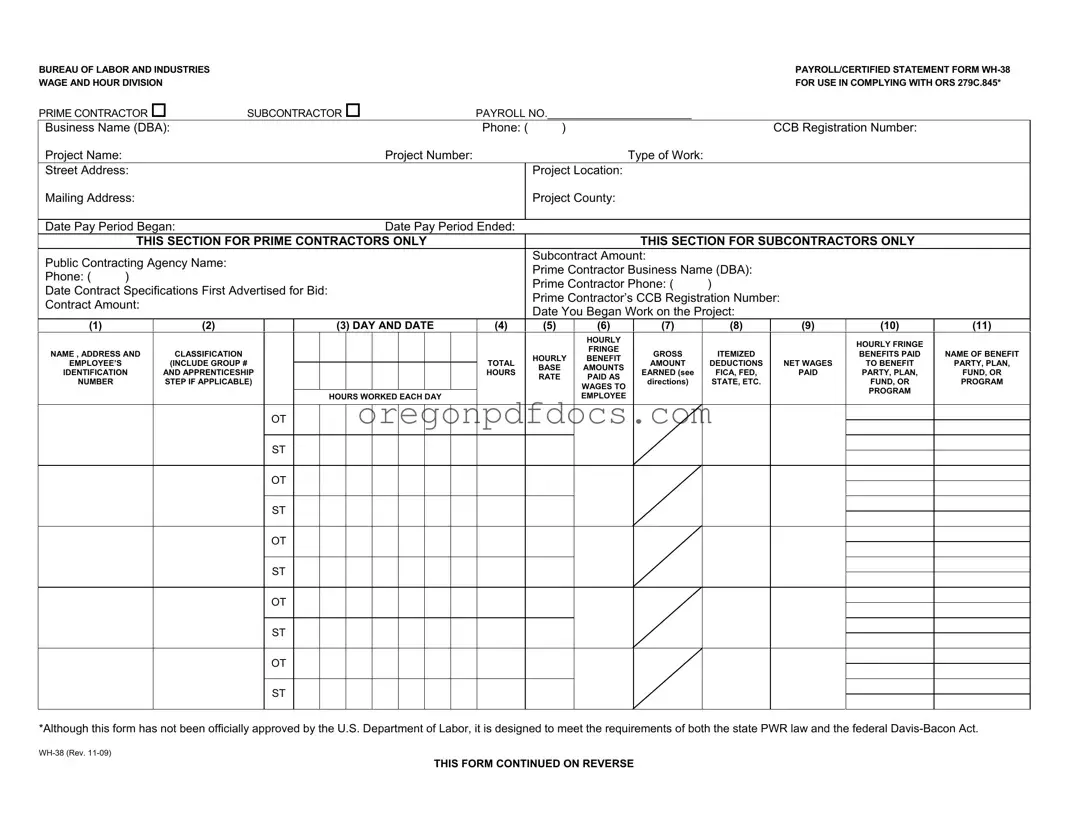

Free Oregon Payroll Wh 38 Form

The Oregon Payroll WH-38 form is a certified statement used by contractors and subcontractors to comply with state and federal wage laws. This form ensures that all employees are paid fairly and that payroll records are accurately maintained. To fill out the form, click the button below.

Make My Document Online

Free Oregon Payroll Wh 38 Form

Make My Document Online

Make My Document Online

or

Get Oregon Payroll Wh 38 PDF Form

One more step to finish this form

Finalize your Oregon Payroll Wh 38 online in a few easy steps.