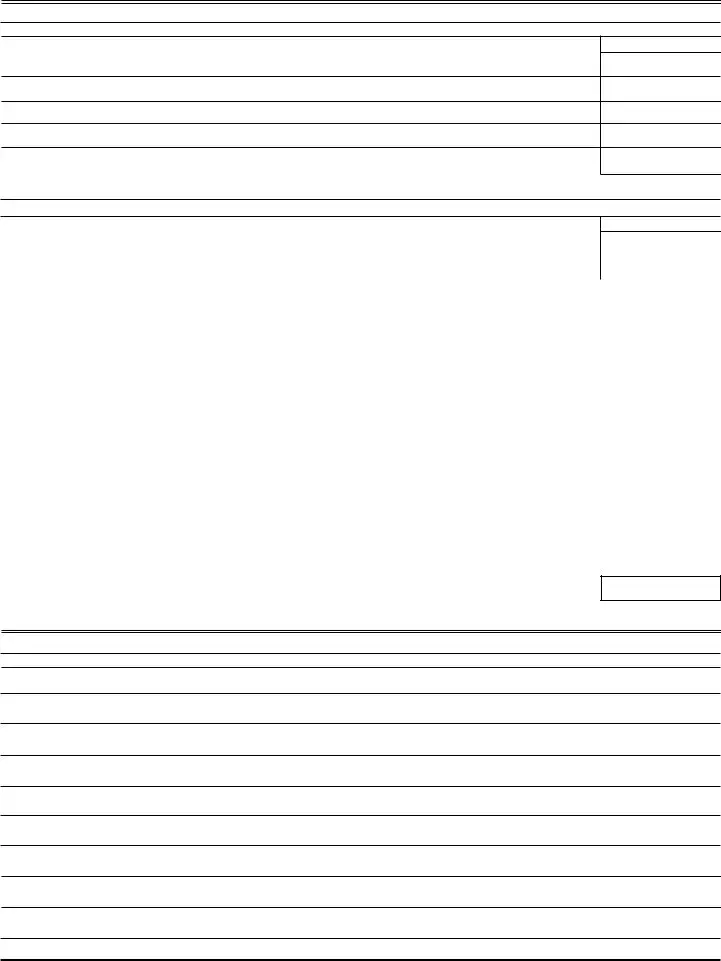

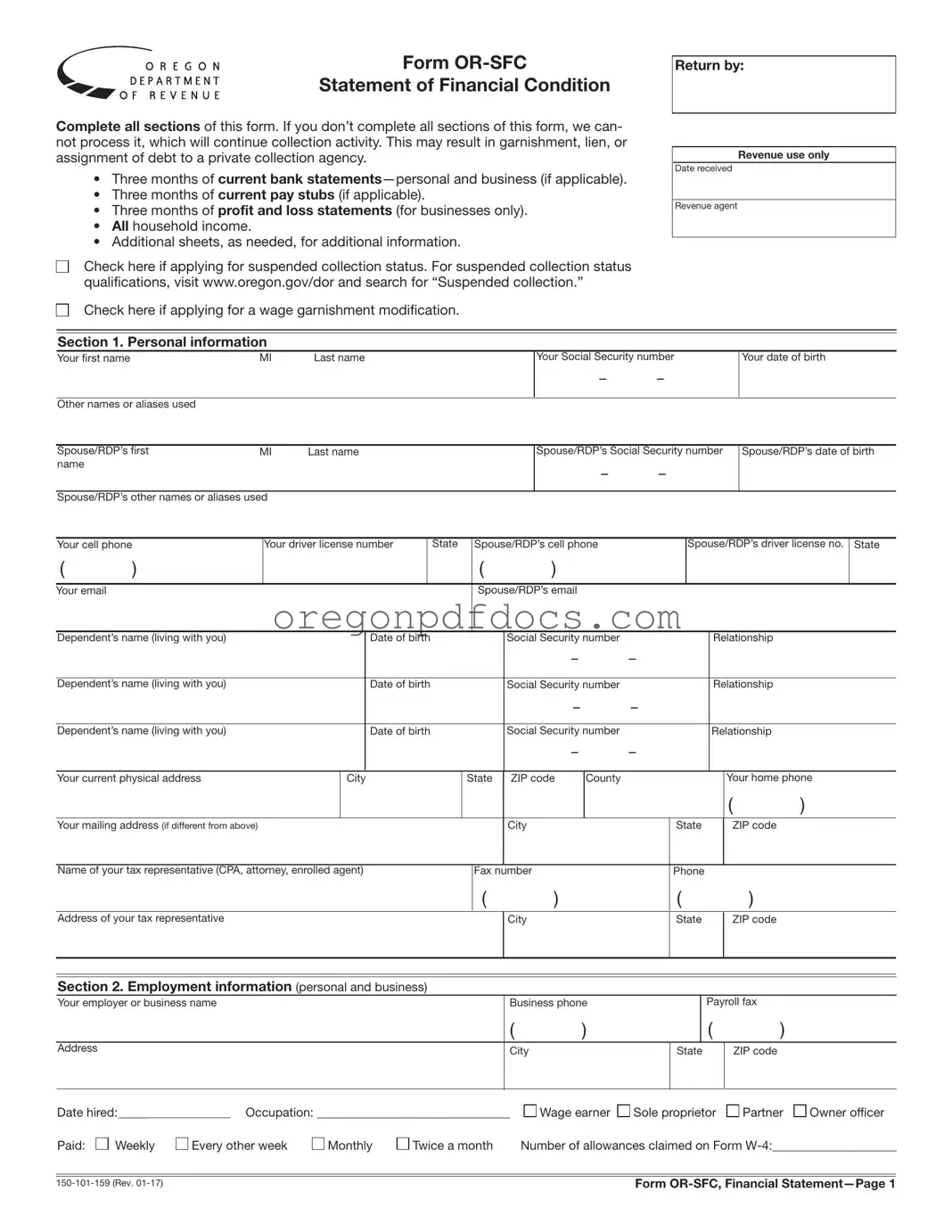

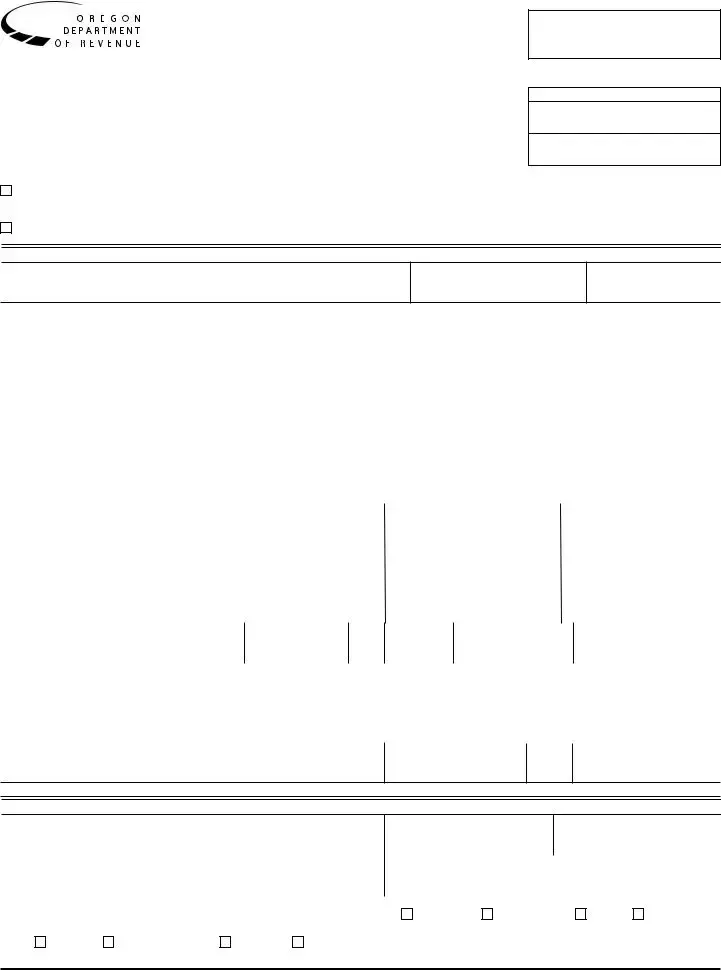

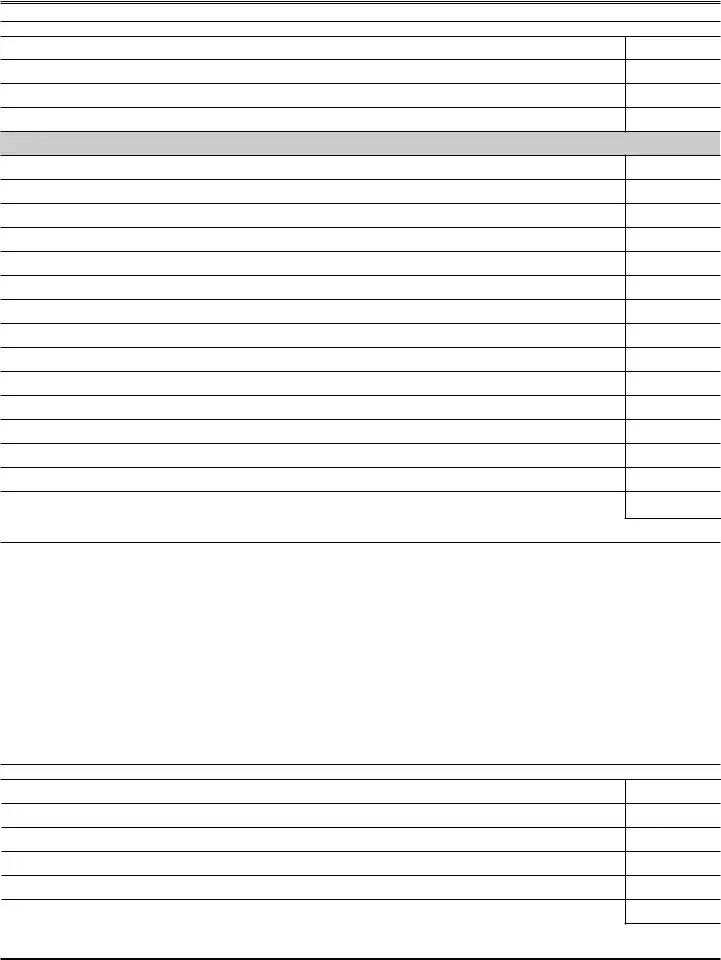

Free Oregon Statement Form

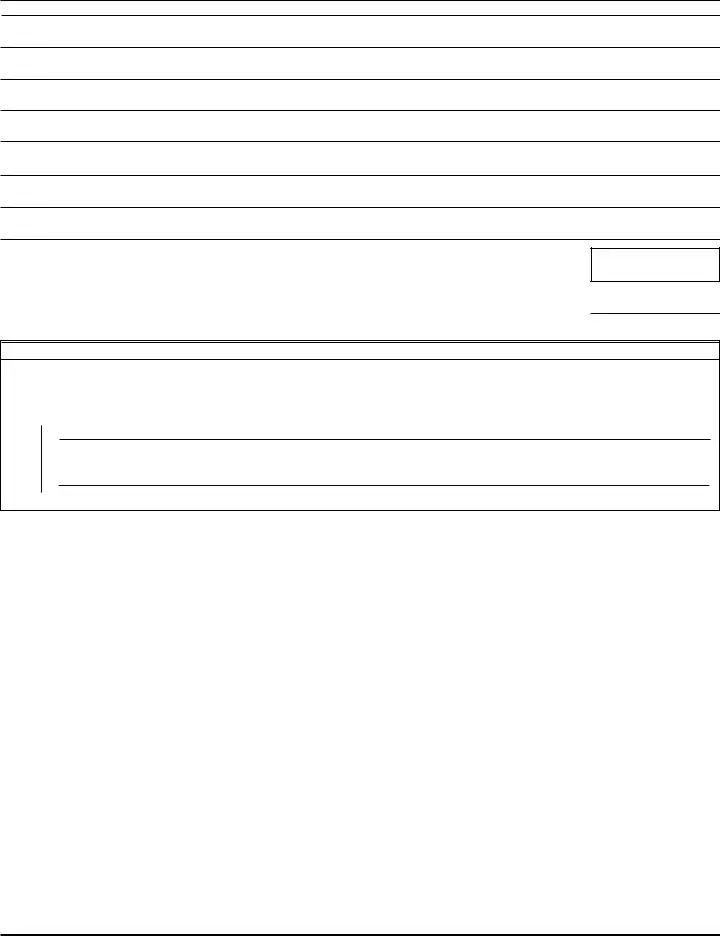

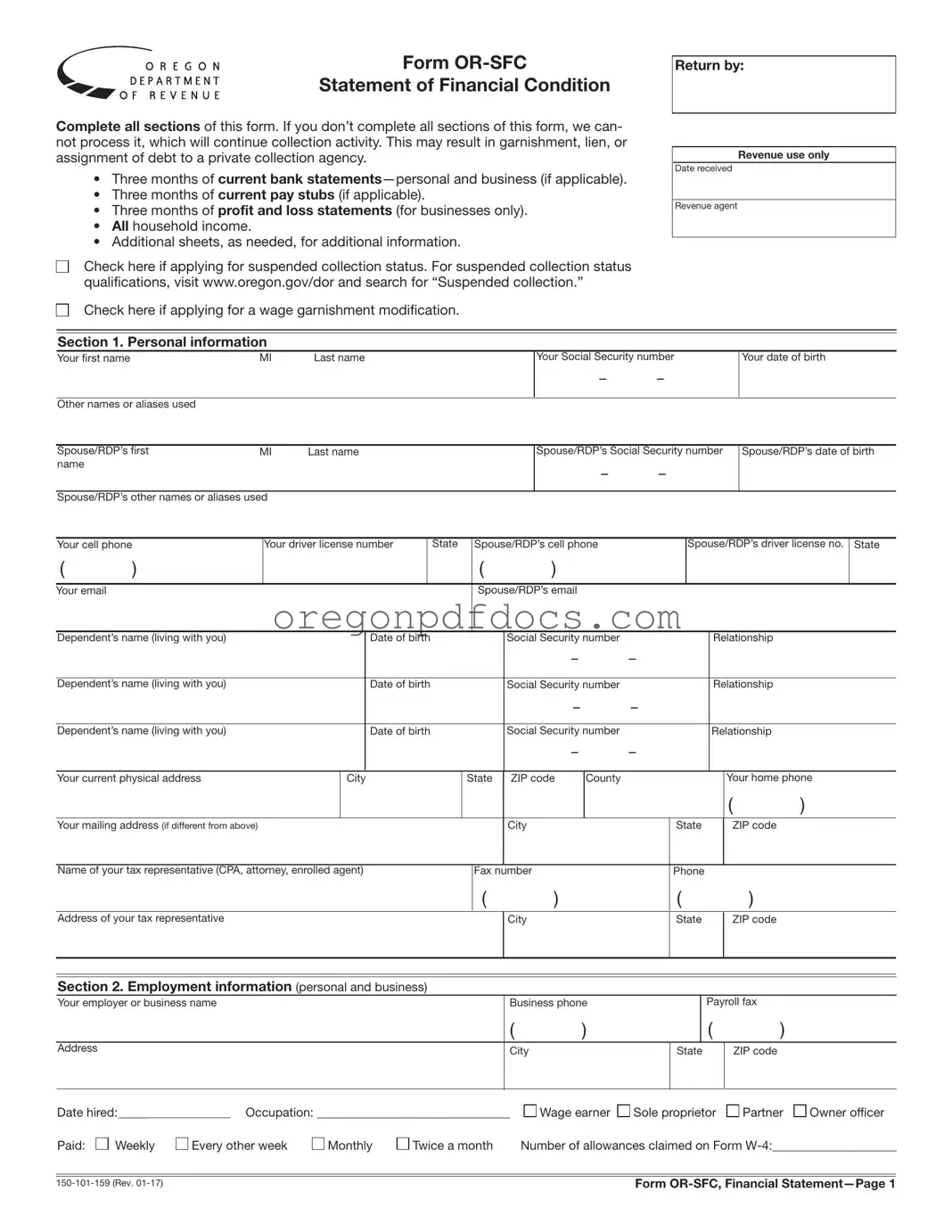

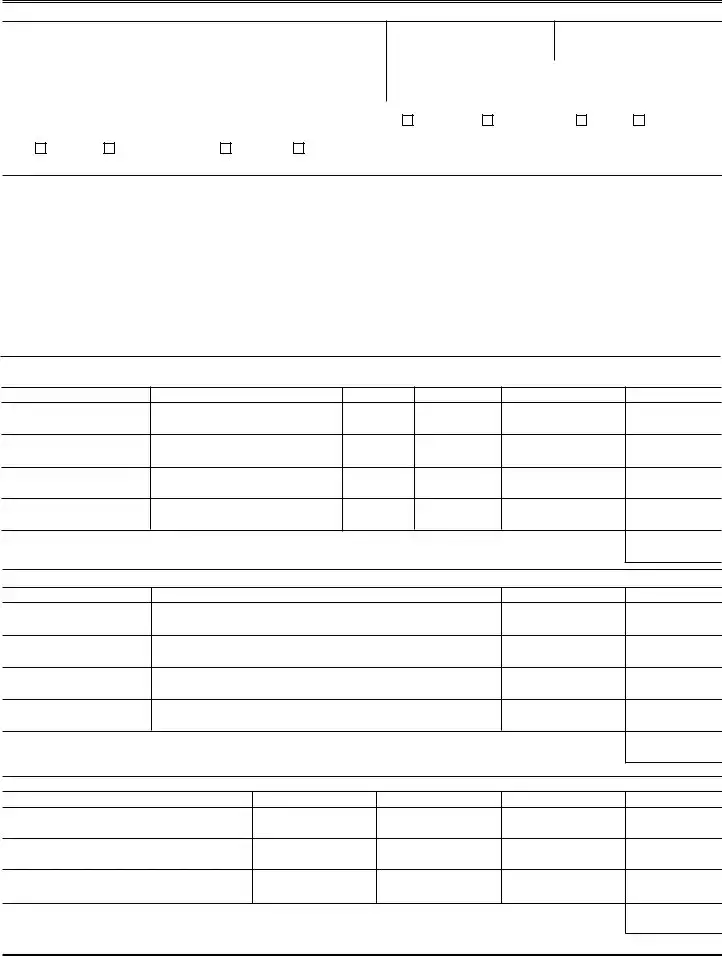

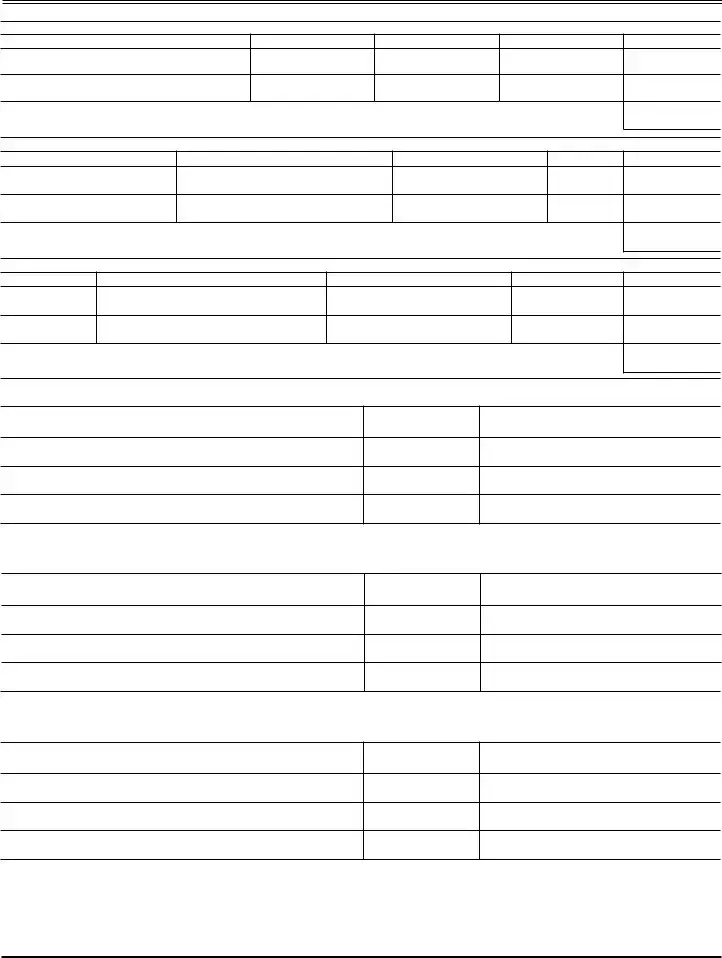

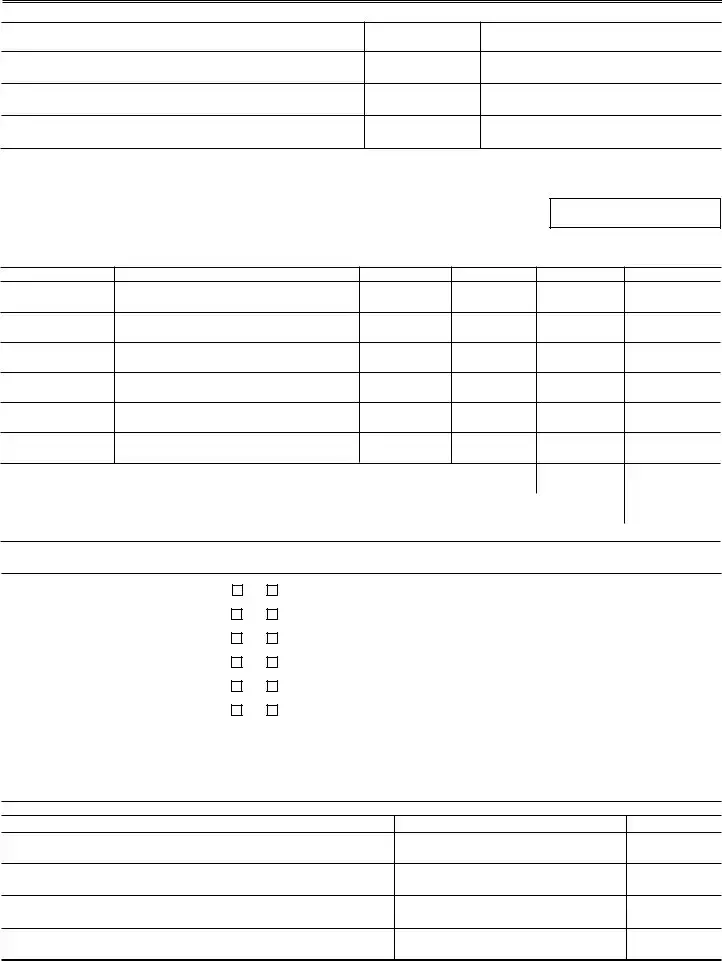

The Oregon Statement form, also known as Form OR-SFC, is a financial statement that individuals must complete to provide a comprehensive overview of their financial condition. This form is essential for those facing collection actions, as it helps assess their financial situation and may lead to suspended collection status or modifications in wage garnishment. To ensure your form is processed without delay, make sure to fill out all sections accurately and completely.

Ready to take the next step? Fill out the form by clicking the button below.

Make My Document Online

Free Oregon Statement Form

Make My Document Online

Make My Document Online

or

Get Oregon Statement PDF Form

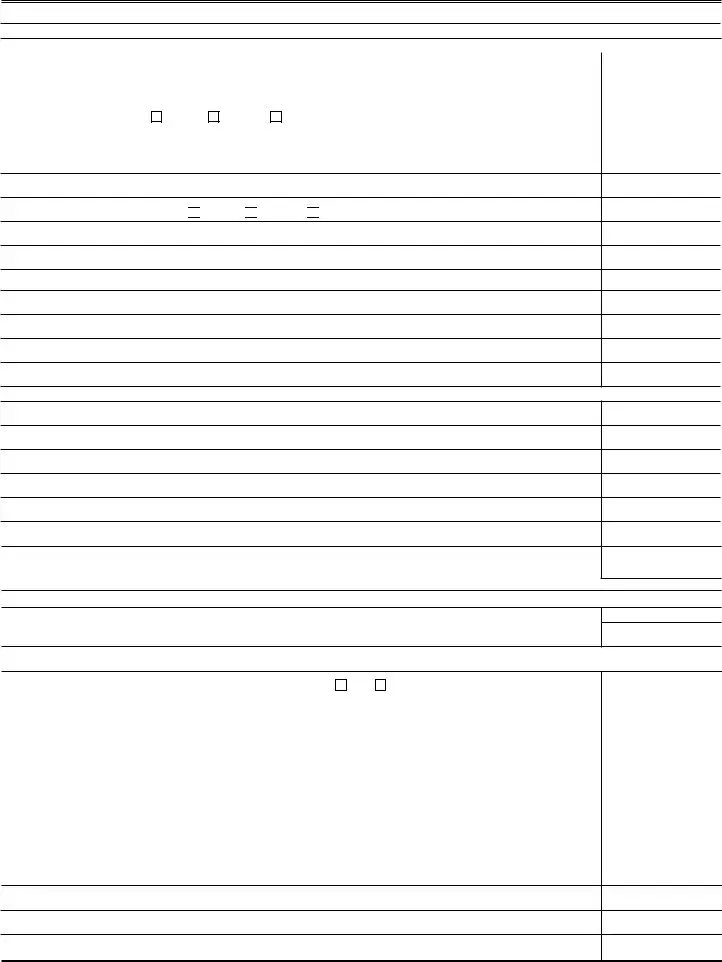

One more step to finish this form

Finalize your Oregon Statement online in a few easy steps.

pension

pension

annuities

annuities

both

both