W-2 File Specifications

The state of Oregon follows the Social Security Administration (SSA) guidelines for the filing of W-2 wage and tax statements, with Oregon-specific requirements for the RS and RV records (OAR 150-316-0359).

All employers and payroll service providers are required to file W-2 information electronically in a manner consistent with the electronic filing specifications outlined by the SSA. All W-2s must be filed by January 31 of the following year.

ORS 316.202 allows the department to assess penalties for failing to file an information return or filing an incorrect or incomplete information return and knowingly failing to file an information return or knowingly filing an incomplete, false or misleading information return.

Electronic records that do not conform to the specifications defined in these instructions will not be accepted.

Record format and record layout specifications

Transmitters are required to use the format listed beginning on page 2 of this document for RS and RV records. For all other record specifications, please follow the information in the SSA booklet, Specifications for Filing Forms W2 Electronically (EFW2). Additional information is available at www.ssa.gov/employer/pub.htm. Information regarding electronically filing W-2s with Oregon is available at our website, www.oregon.gov/dor/business.

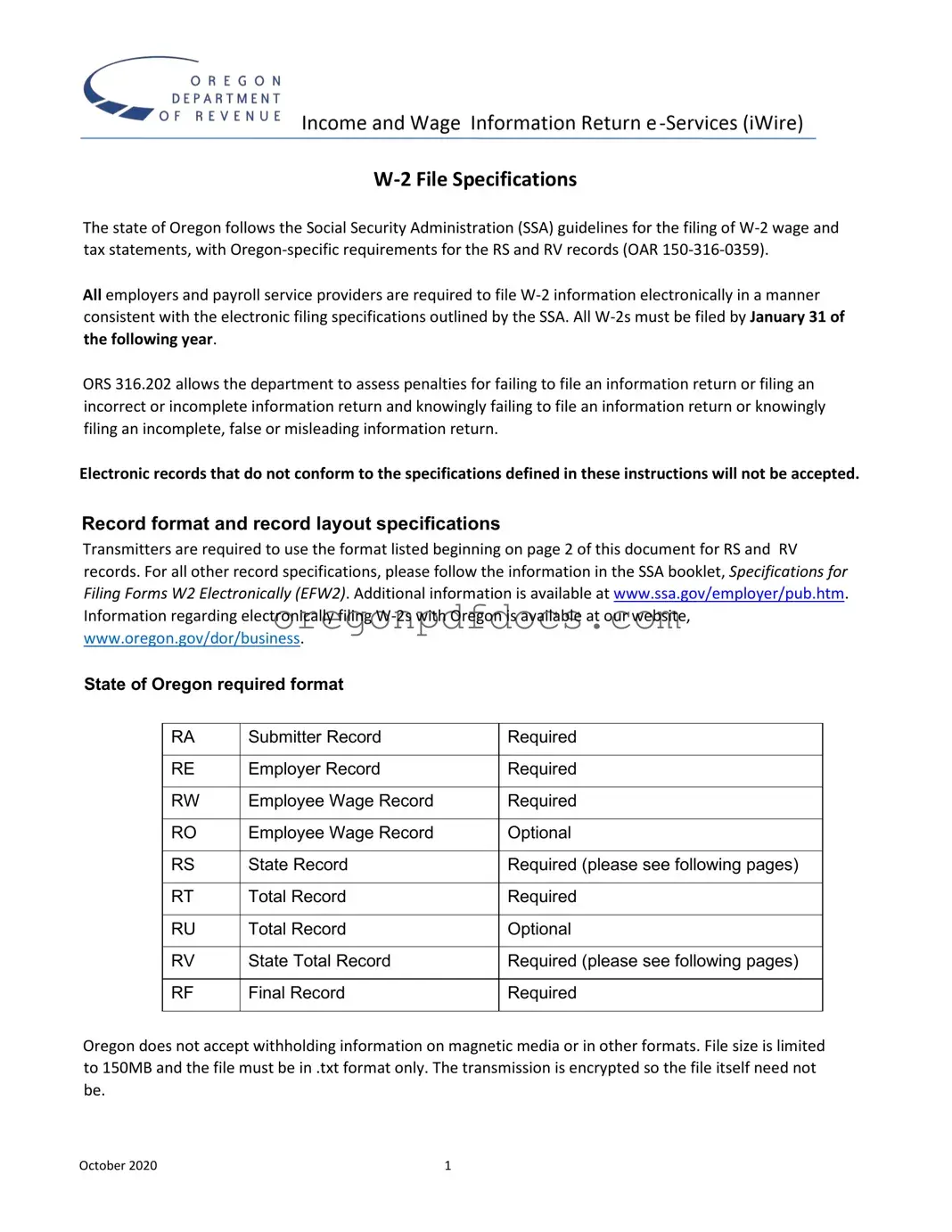

State of Oregon required format

RA |

Submitter Record |

Required |

|

|

|

RE |

Employer Record |

Required |

|

|

|

RW |

Employee Wage Record |

Required |

|

|

|

RO |

Employee Wage Record |

Optional |

|

|

|

RS |

State Record |

Required (please see following pages) |

|

|

|

RT |

Total Record |

Required |

|

|

|

RU |

Total Record |

Optional |

|

|

|

RV |

State Total Record |

Required (please see following pages) |

|

|

|

RF |

Final Record |

Required |

|

|

|

Oregon does not accept withholding information on magnetic media or in other formats. File size is limited to 150MB and the file must be in .txt format only. The transmission is encrypted so the file itself need not be.

For technical questions concerning electronic filing, email us at iwire.dor@oregon.gov. You can also reference the frequently asked questions and troubleshooting guide posted on our website at www.oregon.gov/dor/business.

Important information

All money fields follow SSA record specification rules:

•Must contain only numbers.

•No punctuation.

•No signed amounts (high order signed or low order signed).

Include both dollars and cents with the decimal point assumed (example: $59.60 = 00000005960). Do

not round to the nearest dollar (example: $5,500.99 = 00000550099).

•Right-justify and zero-fill to the left.

•Any money field that has no amount to be reported must be filled with zeros, not blanks.

Statewide Transit Tax (STT) Reporting Requirements

If your business had employees who performed work in Oregon or had Oregon resident employees who performed work outside of Oregon during the year, you must report statewide transit tax information. That information should be reported on your RS record in character positions 348-369 and the RV record in character positions 40-69. These fields should be formatted like every other dollar-value field in the file.

RS record information

•Positions 348-358: Taxable wages for the Statewide Transit Tax .

•Positions 359-369: Amount withheld for the Statewide Transit Tax.

RV record information

•Positions 40-54: Total amount of taxable wages for the transit tax.

•Positions 55-69: Total amount of Statewide Transit Tax withheld.

NOTE: RECORD LENGTH FOR THE OREGON AND SSA RS RECORD IS 512 BYTES. ALL FIELDS ARE REQUIRED AND CAN BE BLANK OR ZERO-FILLED. The transmitter is required to send the federal records sent to the SSA for Oregon employees: RA, RE, RW, RO (optional), RS, RT, RU (optional), RV, and RF. The RS record must be for Oregon wages only.

RS Record Layout – State of Oregon, Department of Revenue

RV Record Layout – State of Oregon, Department of Revenue

|

Field |

|

Record |

|

Number |

|

State Taxable |

|

State Income |

|

State Taxable Wages |

|

|

|

of RS |

|

|

Tax Withheld |

|

for Statewide Transit |

|

Name |

|

Identifier |

|

|

Wages (Total) |

|

|

|

|

|

Records |

|

|

(Total) |

|

Tax (Total) |

|

Position |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1-2 |

3-9 |

10-24 |

25-39 |

40-54 |

|

Length |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

7 |

15 |

15 |

15 |

|

|

|

|

|

|

|

|

|

|

|

|

Statewide |

|

Transit Tax |

Blank |

Withheld (Total) |

|

55-69 |

70-512 |

15 |

443 |

RV Position |

|

Field Name |

Length |

Specifications |

|

|

|

|

|

1-2 |

|

Record Identifier |

2 |

Constant RV |

|

|

|

|

|

3-9 |

|

Number of RS Records |

7 |

Total number of RS records since the last |

|

|

|

|

RE record. |

|

|

|

|

|

10-24 |

|

State Taxable Wages |

15 |

Total amount of State Wages reported in |

|

|

|

|

|

all RS records since the last RE record. |

|

|

|

|

|

25-39 |

|

State Income Tax |

15 |

Total amount of State Withholding reported |

|

|

Withheld |

|

in all RS records since the last RE record. |

|

|

|

|

|

40-54 |

|

State Taxable Wages for |

15 |

Total amount of State Wages for Statewide |

|

|

Statewide Transit Tax |

|

Transit Tax reported in all RS records since |

|

|

|

|

the last RE record. |

|

|

|

|

|

55-69 |

|

Statewide Transit Tax |

15 |

Total amount of Statewide Transit Tax |

|

|

Withheld |

|

reported in all RS records since the last RE |

|

|

|

|

record. |

|

|

|

|

|

70-512 |

|

Blank |

443 |

Fill with blanks. |

|

|

|

|

|