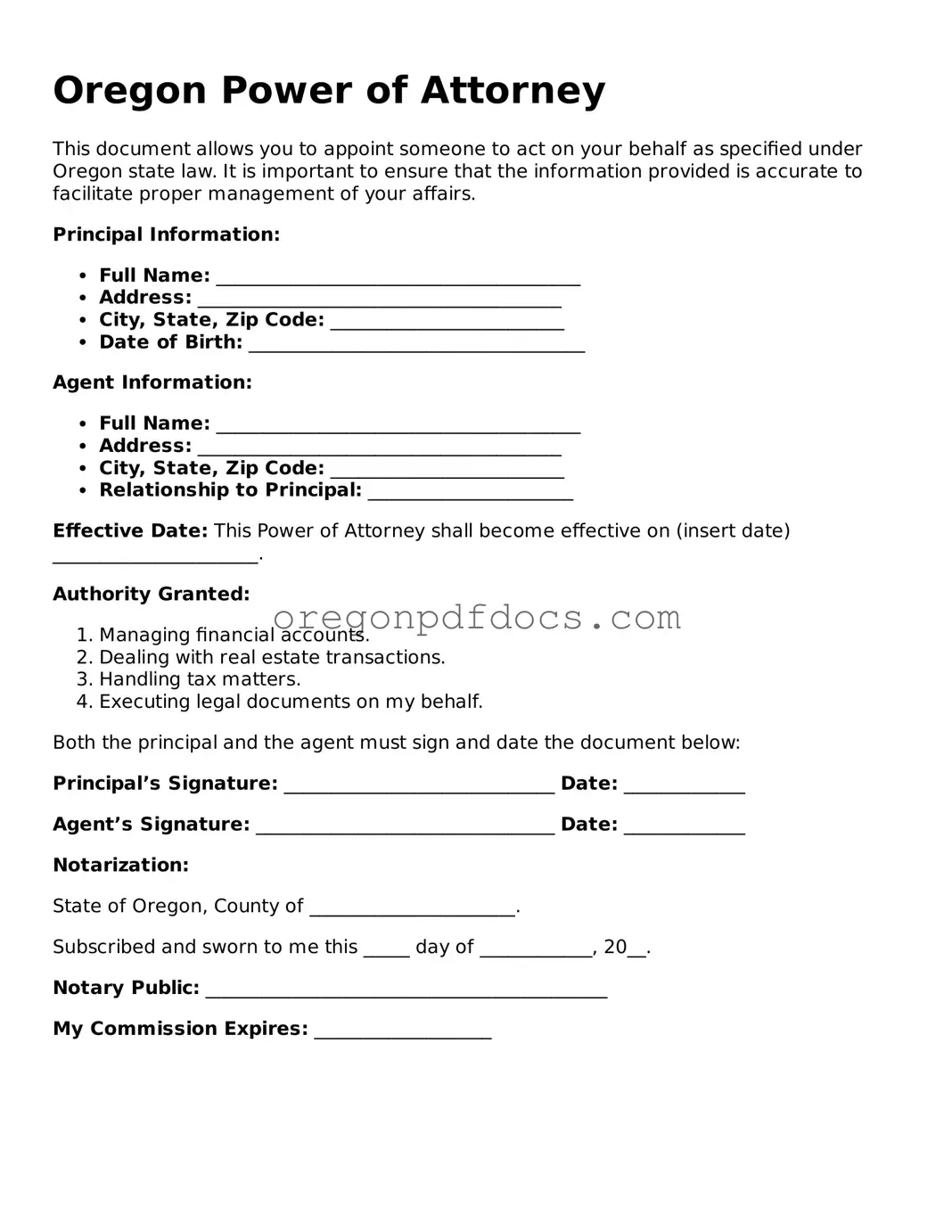

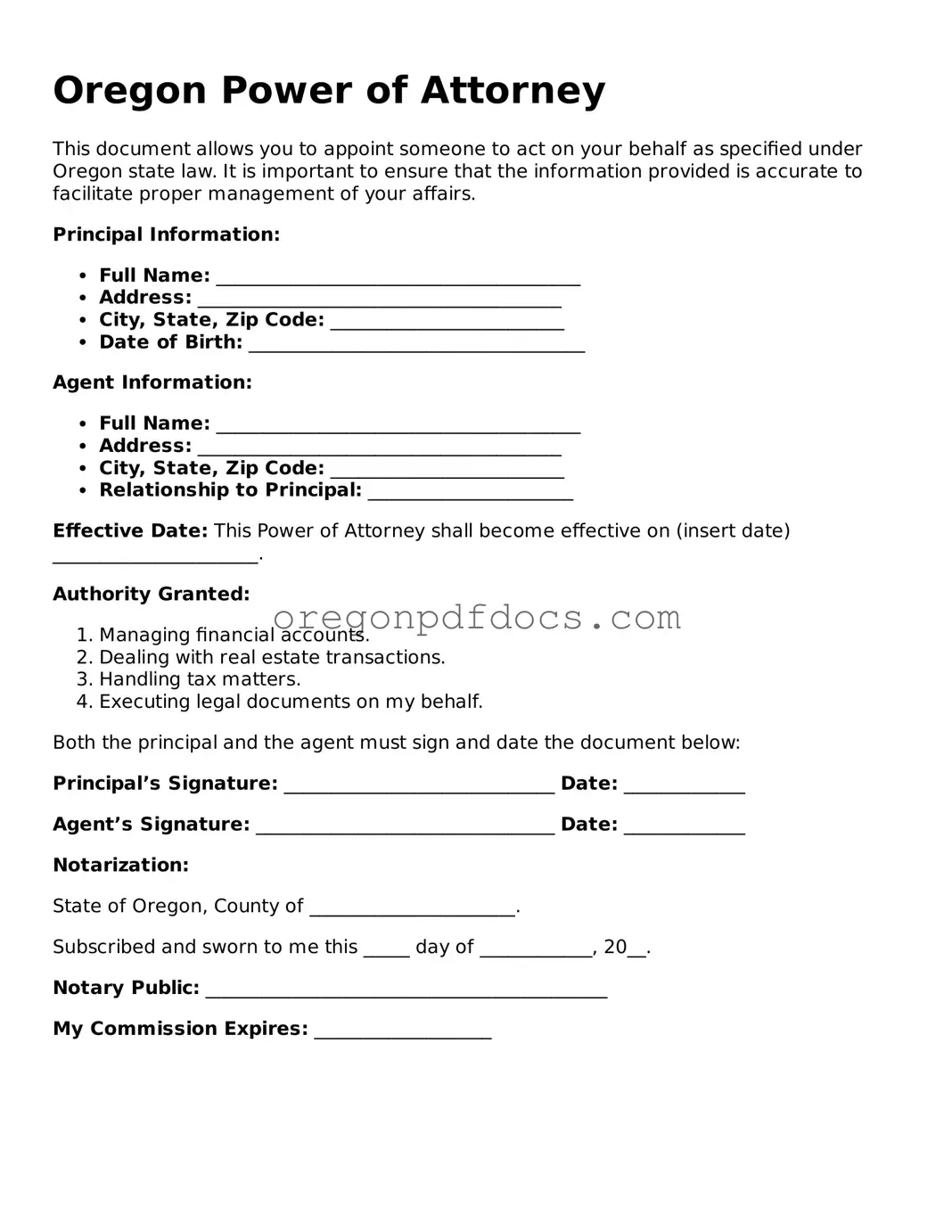

Printable Oregon Power of Attorney Document

The Oregon Power of Attorney form is a legal document that allows one person to grant another the authority to make decisions on their behalf. This form can cover a range of decisions, from financial matters to healthcare choices, ensuring that your preferences are respected even if you cannot communicate them yourself. To get started on securing your rights, consider filling out the form by clicking the button below.

Make My Document Online

Printable Oregon Power of Attorney Document

Make My Document Online

Make My Document Online

or

Get Power of Attorney PDF Form

One more step to finish this form

Finalize your Power of Attorney online in a few easy steps.