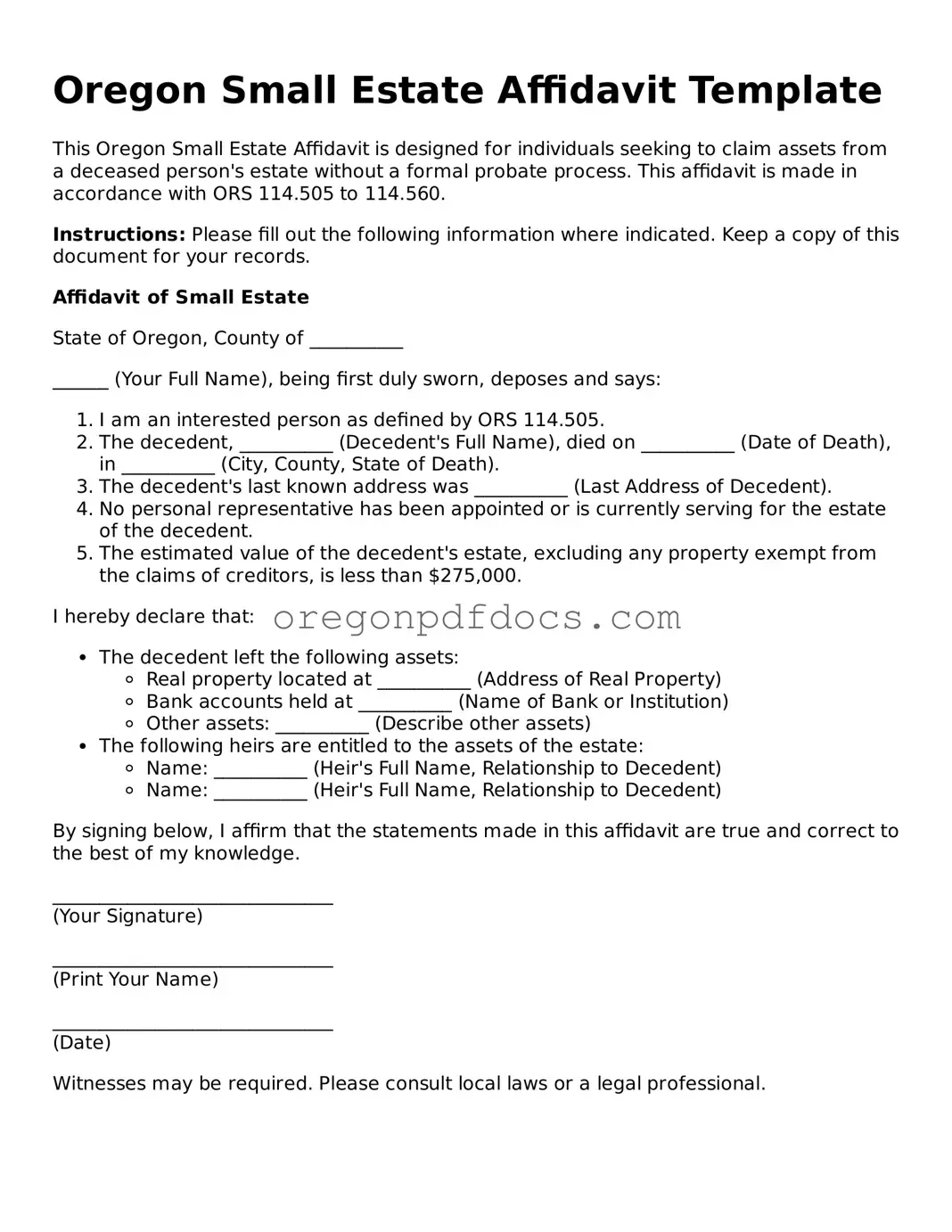

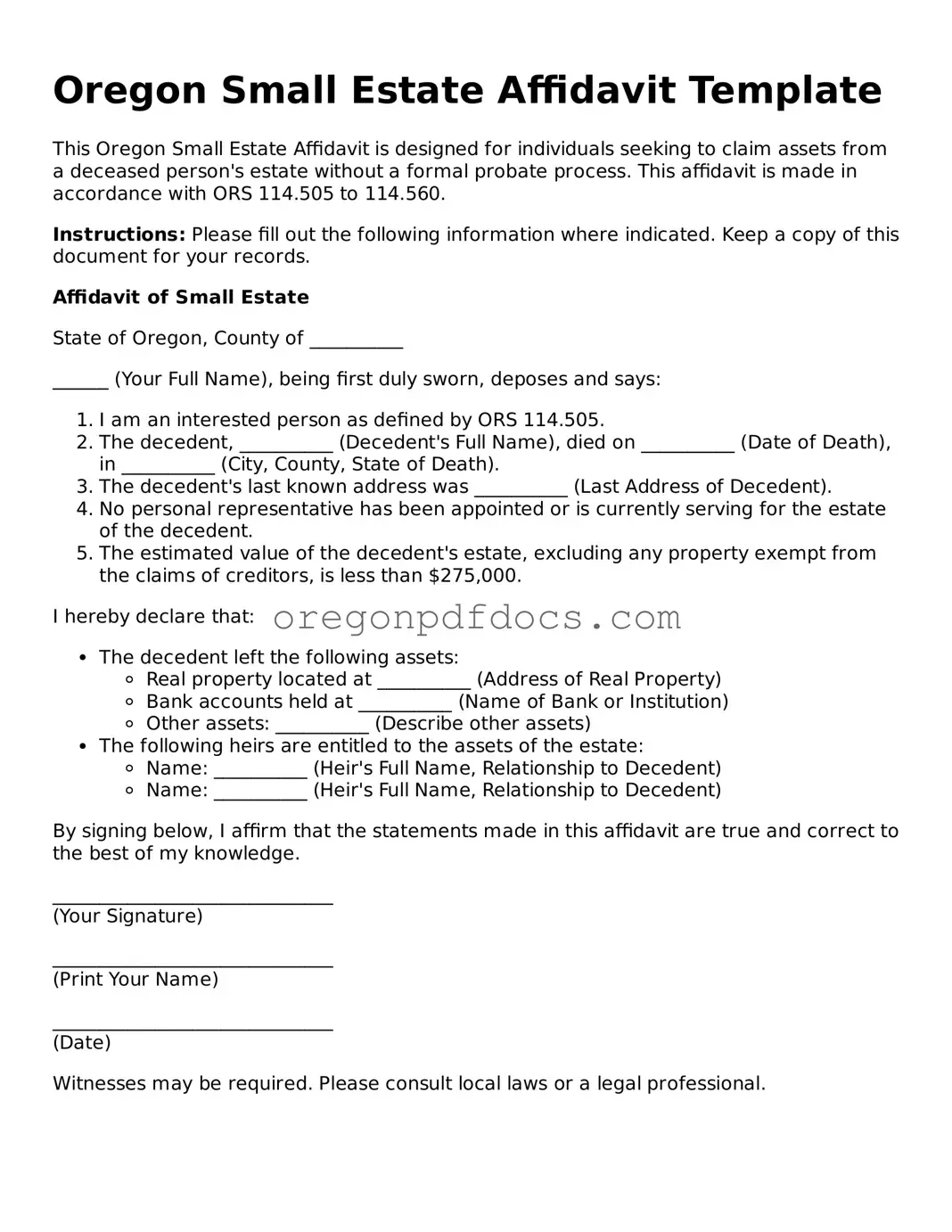

Printable Oregon Small Estate Affidavit Document

The Oregon Small Estate Affidavit is a legal document that allows heirs to claim assets from a deceased person's estate without going through a lengthy probate process. This form simplifies the transfer of property and helps families access their loved ones' assets more quickly. If you need to fill out the form, click the button below to get started.

Make My Document Online

Printable Oregon Small Estate Affidavit Document

Make My Document Online

Make My Document Online

or

Get Small Estate Affidavit PDF Form

One more step to finish this form

Finalize your Small Estate Affidavit online in a few easy steps.