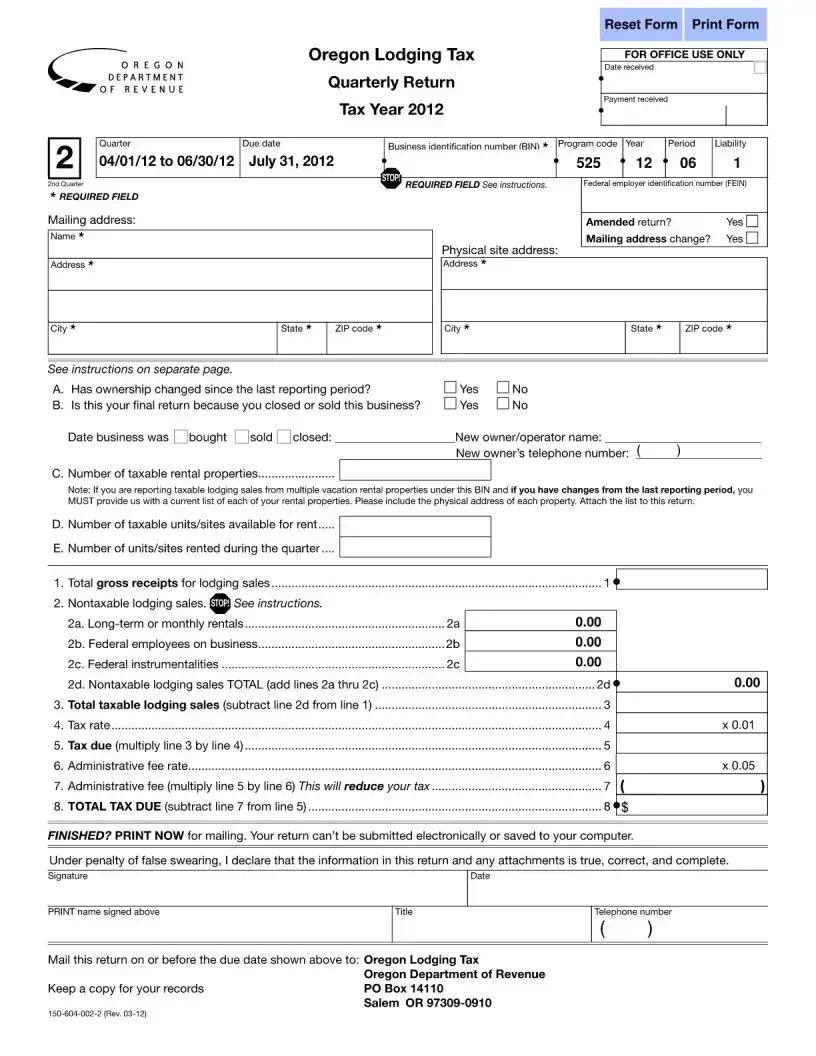

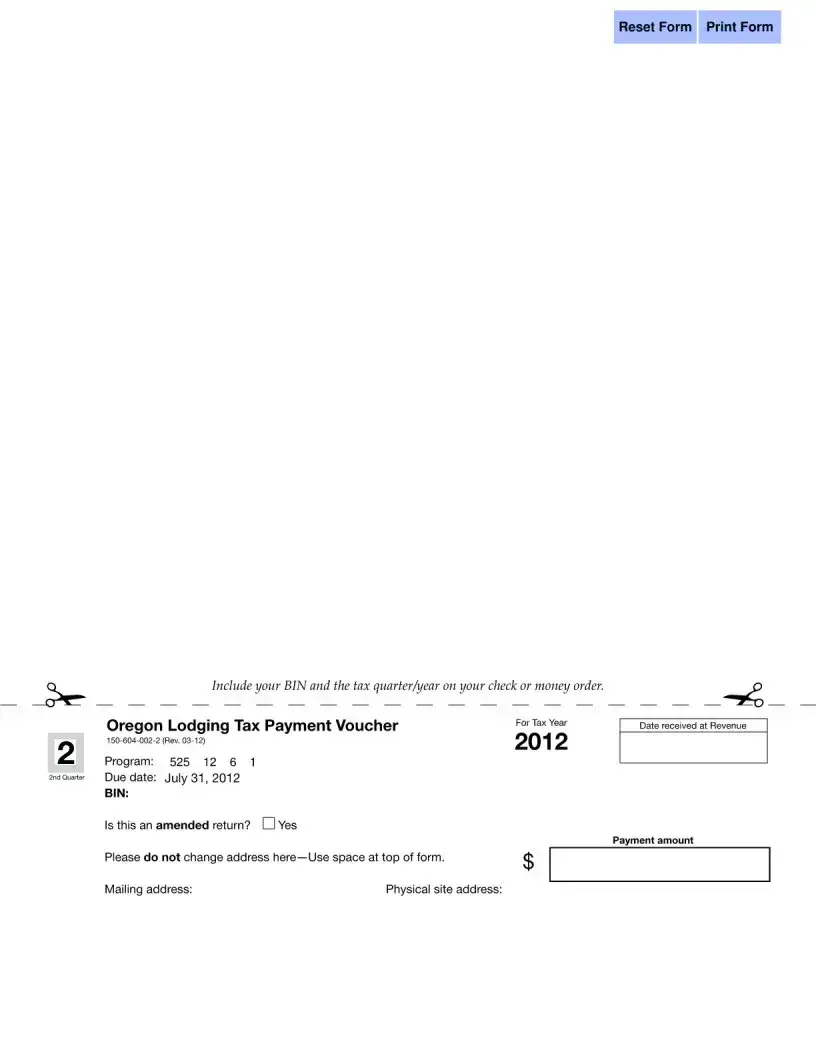

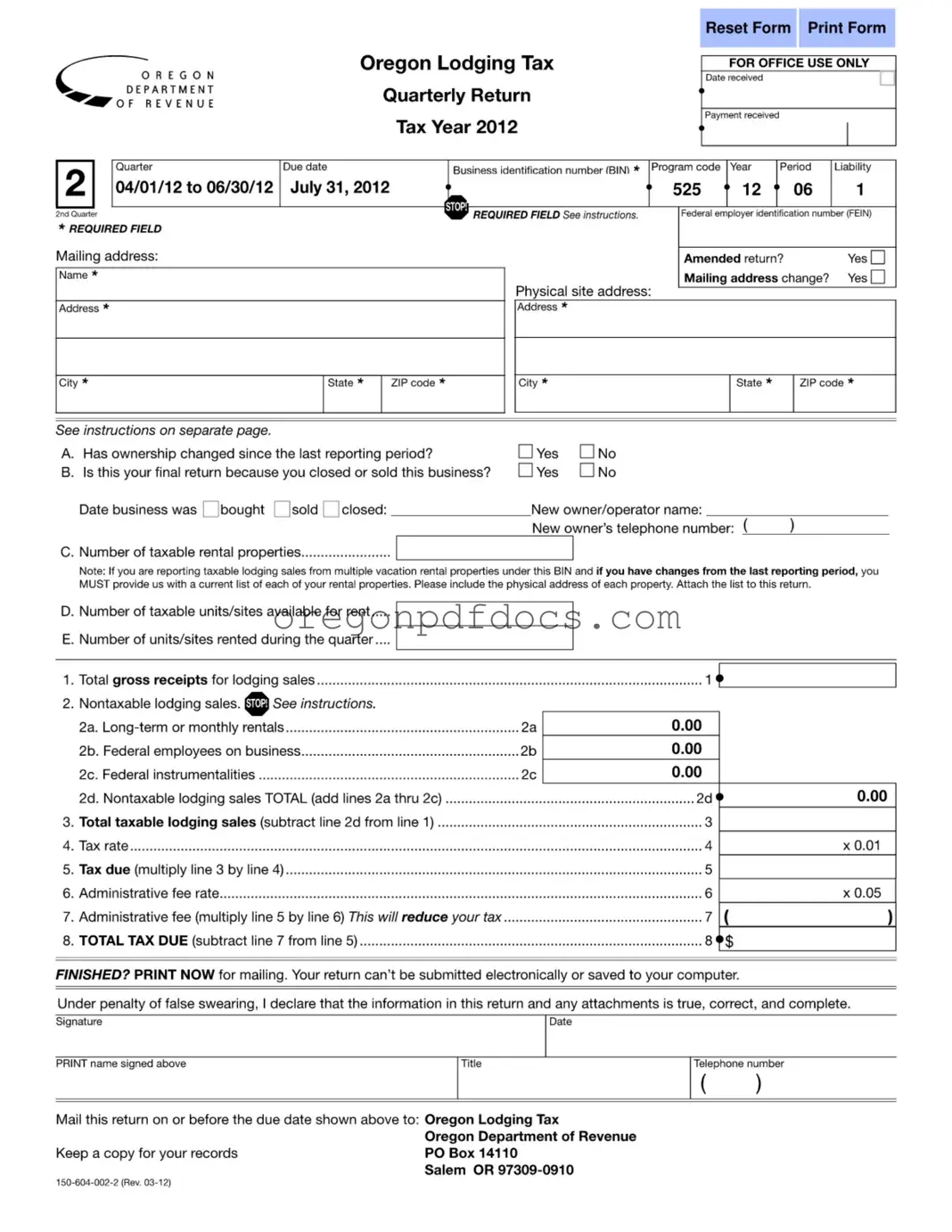

Free State Of Oregon Lodging Tax Form

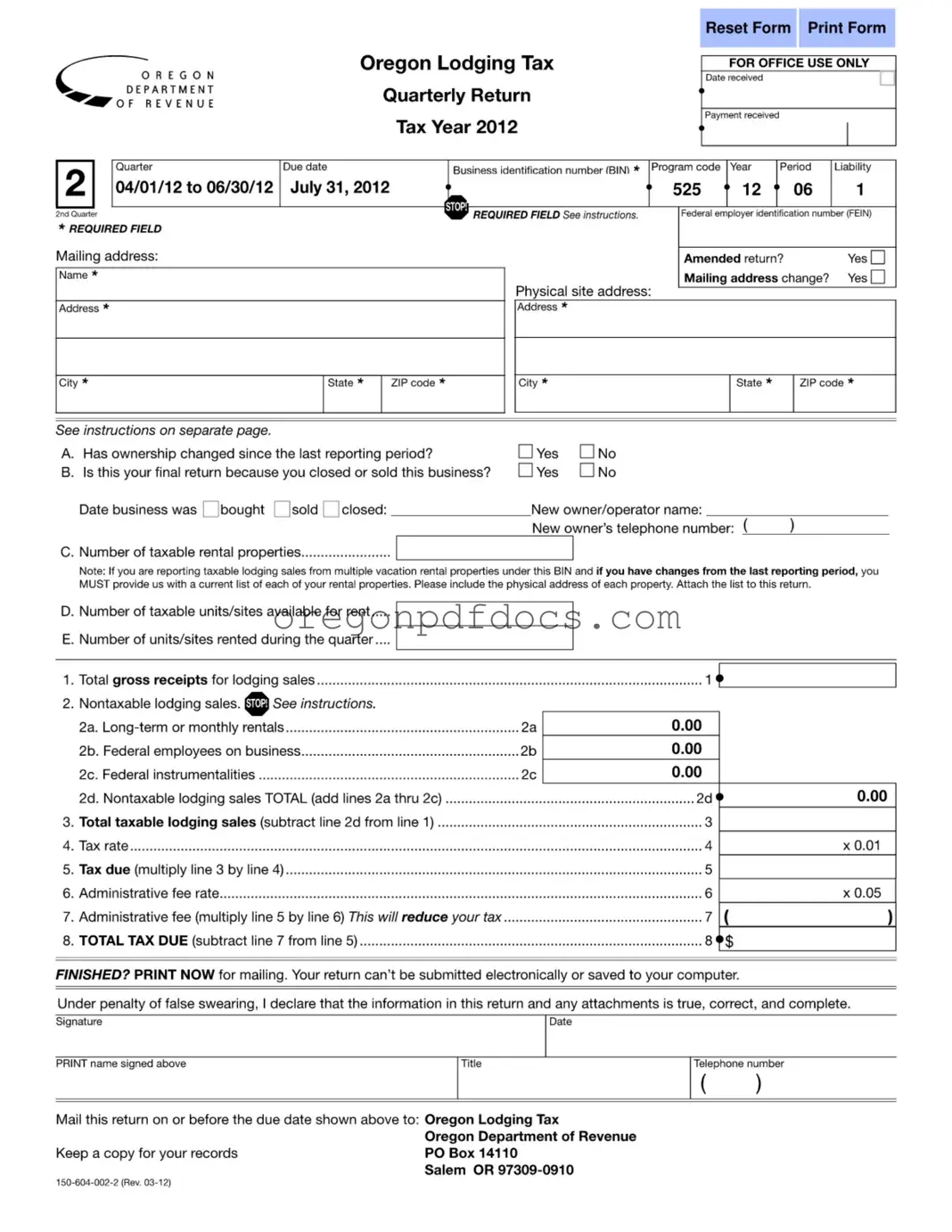

The State of Oregon Lodging Tax form is a quarterly return that lodging providers must complete to report their taxable lodging sales and pay the associated tax. This form ensures compliance with state regulations regarding lodging taxes and helps maintain transparency in the hospitality industry. It is essential for businesses to fill out this form accurately and submit it on time to avoid penalties.

To fill out the form, please click the button below.

Make My Document Online

Free State Of Oregon Lodging Tax Form

Make My Document Online

Make My Document Online

or

Get State Of Oregon Lodging Tax PDF Form

One more step to finish this form

Finalize your State Of Oregon Lodging Tax online in a few easy steps.