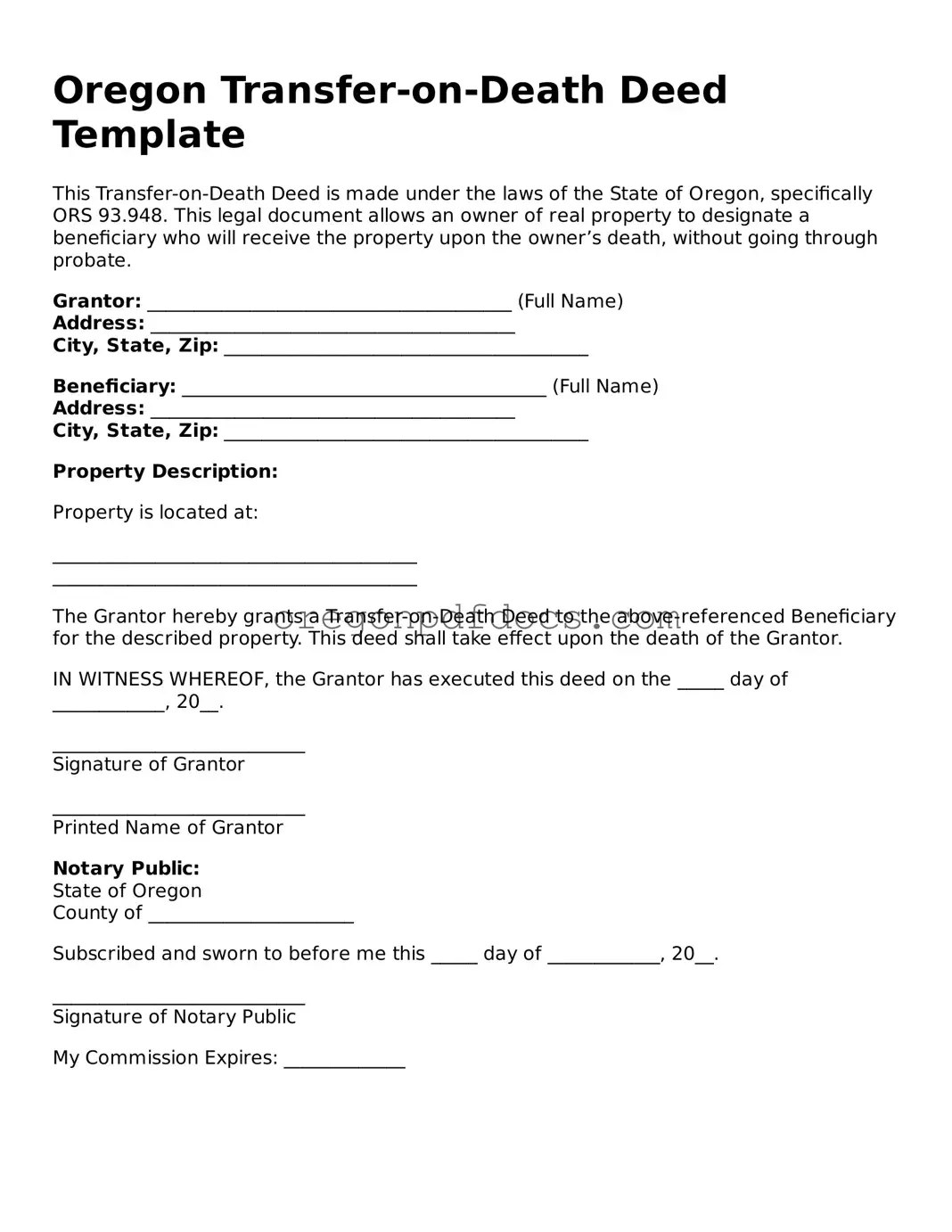

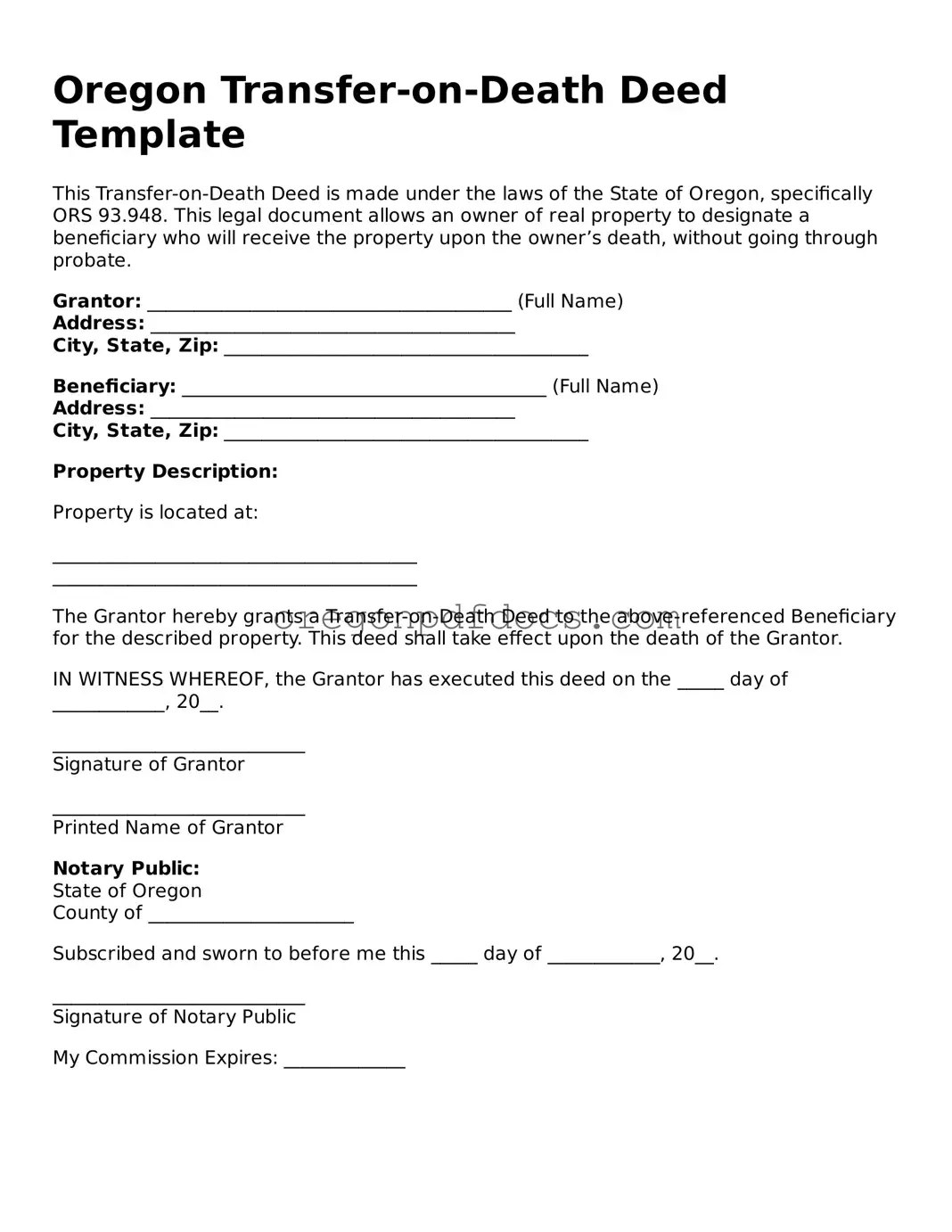

Printable Oregon Transfer-on-Death Deed Document

The Oregon Transfer-on-Death Deed form allows property owners to designate a beneficiary who will receive their real estate upon their death, bypassing the probate process. This legal tool can simplify the transfer of property and ensure that your wishes are honored. To get started with the form, click the button below.

Make My Document Online

Printable Oregon Transfer-on-Death Deed Document

Make My Document Online

Make My Document Online

or

Get Transfer-on-Death Deed PDF Form

One more step to finish this form

Finalize your Transfer-on-Death Deed online in a few easy steps.