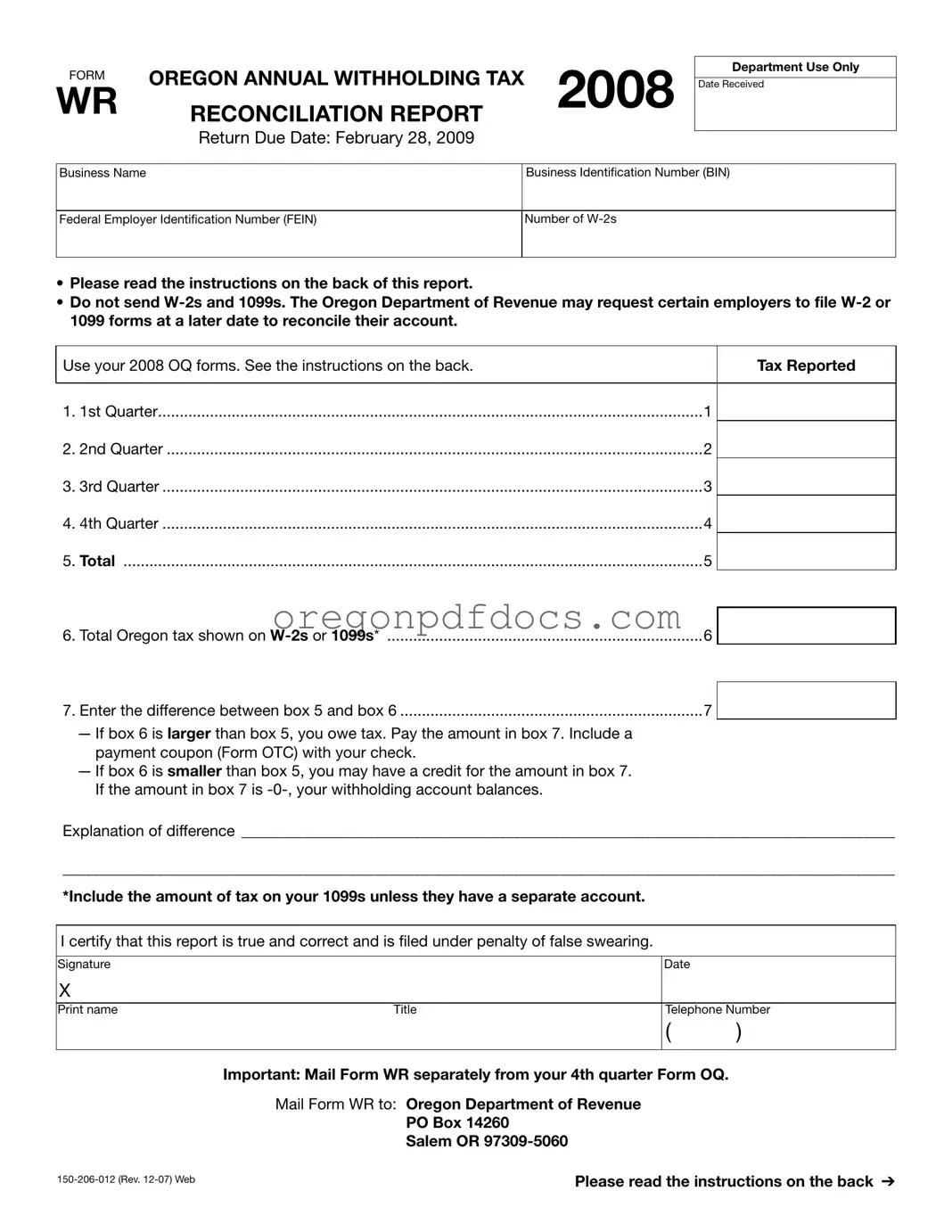

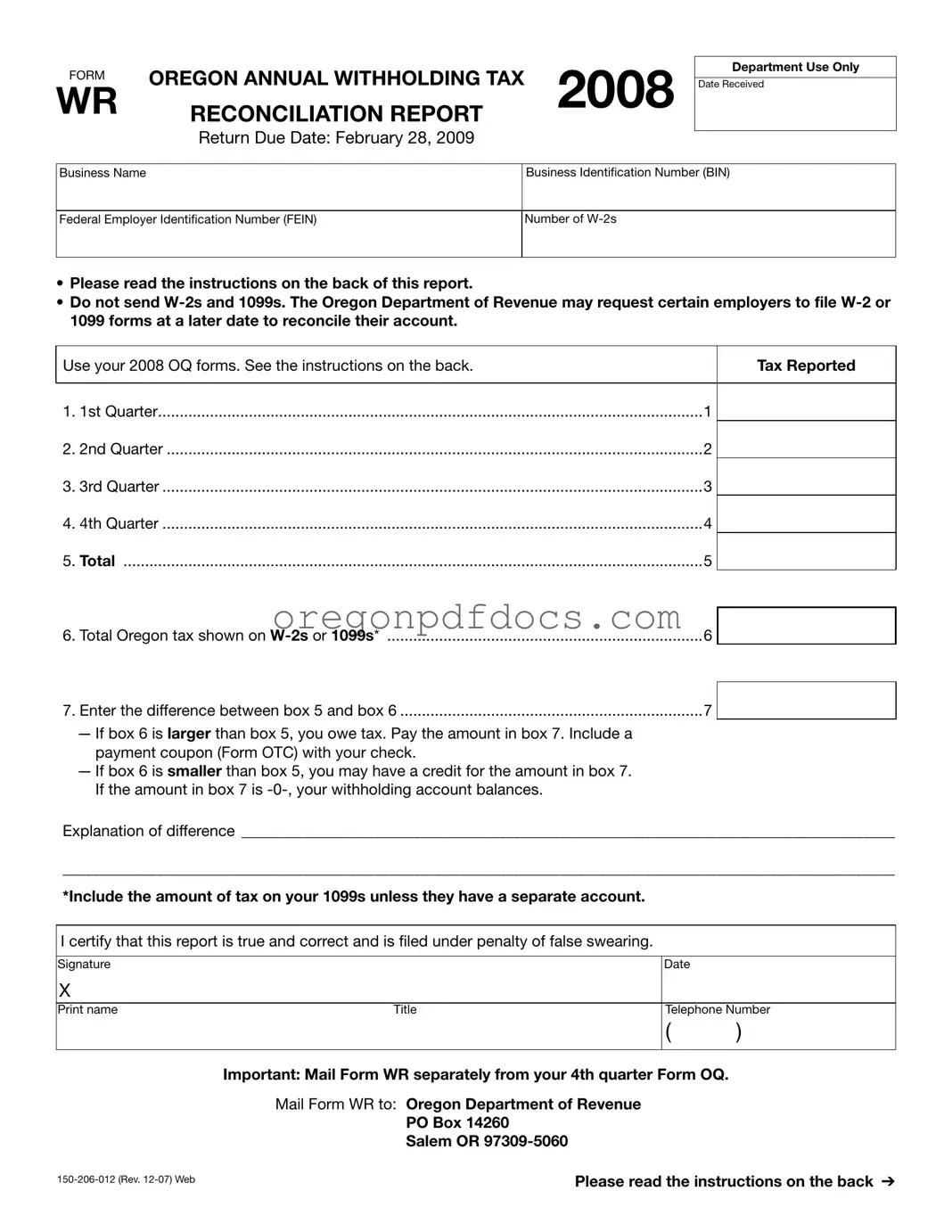

FORM |

OREGON ANNUAL WITHHOLDING TAX |

2008 |

WR |

|

RECONCILIATION REPORT |

|

Return Due Date: February 28, 2009

Department Use Only

Date Received

Business Identification Number (BIN)

Federal Employer Identification Number (FEIN)

•Please read the instructions on the back of this report.

•Do not send W-2s and 1099s. The Oregon Department of Revenue may request certain employers to file W-2 or

1099 forms at a later date to reconcile their account.

Use your 2008 OQ forms. See the instructions on the back.

1. |

1st Quarter |

1 |

2. |

2nd Quarter |

2 |

3. |

3rd Quarter |

3 |

4. |

4th Quarter |

4 |

5. |

Total |

5 |

6. Total Oregon tax shown on W-2s or 1099s* |

6 |

7. Enter the difference between box 5 and box 6 |

7 |

—If box 6 is larger than box 5, you owe tax. Pay the amount in box 7. Include a payment coupon (Form OTC) with your check.

—If box 6 is smaller than box 5, you may have a credit for the amount in box 7. If the amount in box 7 is -0-, your withholding account balances.

Explanation of difference ____________________________________________________________________________________

___________________________________________________________________________________________________________

*Include the amount of tax on your 1099s unless they have a separate account.

I certify that this report is true and correct and is iled under penalty of false swearing.

X |

|

|

Print name |

Title |

Telephone Number |

( )

Important: Mail Form WR separately from your 4th quarter Form OQ.

Mail Form WR to: Oregon Department of Revenue

PO Box 14260

Salem OR 97309-5060

150-206-012 (Rev. 12-07) Web

Please read the instructions on the back ➔

Filing requirements

All Oregon employers who pay state withholding tax must file Form WR, Oregon Annual Withholding Tax Reconciliation Report. The 2008 form is due February 28, 2009. If you stop doing business during 2008 or no longer have employees, Form WR is due 45 days after your final payroll.

To amend data on Form WR, make a copy of the orig- inal Form WR and make the necessary changes on the copy. Write “Amended” at the top of the form. Attach any necessary amended OQ forms to the amended Form WR. Send your amended forms to the address shown below.

Oregon employers who fail to file Form WR may be charged a penalty of $100.

How to fill out Form WR

Write your business name and Oregon business iden- tification number (BIN) in the spaces shown. If you received a personalized booklet, your name and busi- ness identification number will be filled in. Follow the instructions below for each line number.

Line 1 through Line 4. Fill in the total Oregon tax re- ported for each quarter (use the amount from box 5B of your 2008 OQ forms).

Line 5. Total. Total amount from all quarters reported.

Line 6. Enter the total Oregon tax withheld from your employees’ W-2s or 1099R forms.

Line 7. Enter the difference between line 5 (total tax paid) and line 6 (total tax shown from W-2s or 1099Rs).

If line 6 is larger than line 5, you owe additional tax (shown on line 7). If line 6 is smaller than line 5, you have overpaid your tax and have a credit. If the amount on line 7 is zero, your state withholding account balances.

Please give an explanation of the difference on the lines provided.

If you have overpaid, the credit may be applied to a future quarter. The credit may not be used for another tax program. If you want the credit refunded, send a written request, or you may use the explanation lines to request your refund.

If you owe tax, please include a payment. Do not staple or tape your payment to Form WR. Be sure to remove and retain any check stubs.

Sign and date your completed Form WR. Print your name and telephone number. Mail Form WR to:

Oregon Department of Revenue

PO Box 14260

Salem OR 97309-5060

— IMPORTANT —

Mail your Form WR separately from your 2008 4th quarter Form OQ.

Make a copy for your records.

150-206-012 (Rev. 12-07) Web