Free Oregon 40 Ext Form

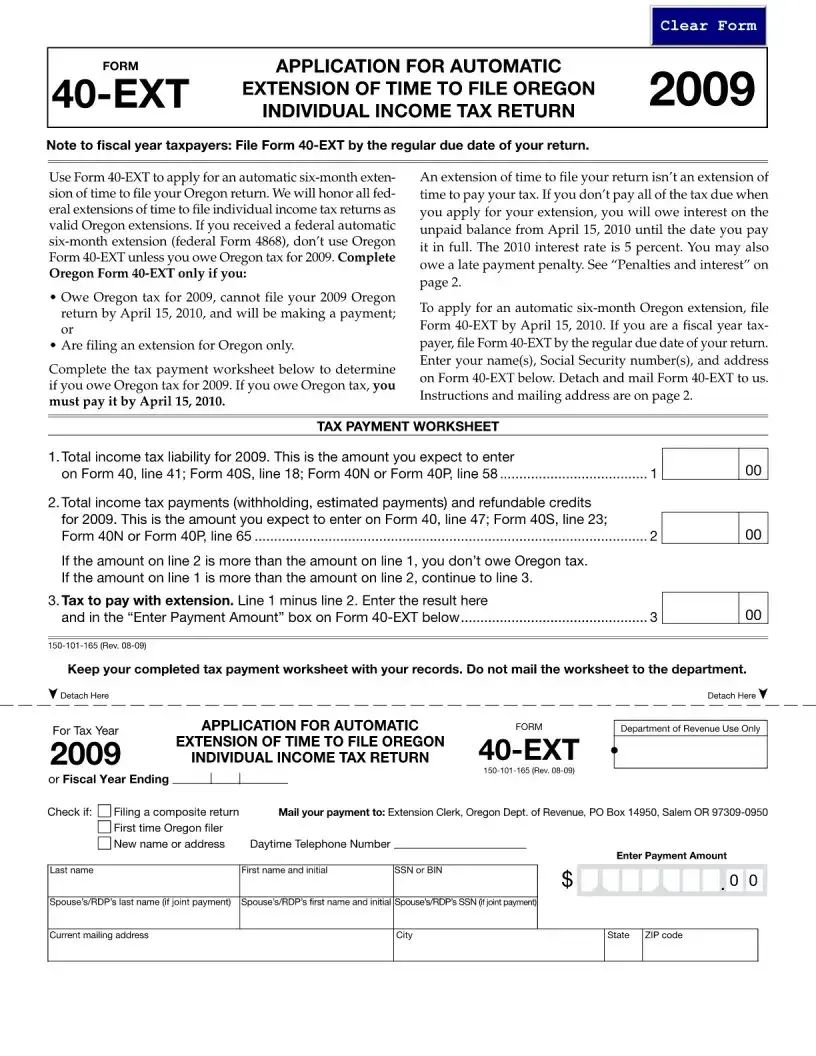

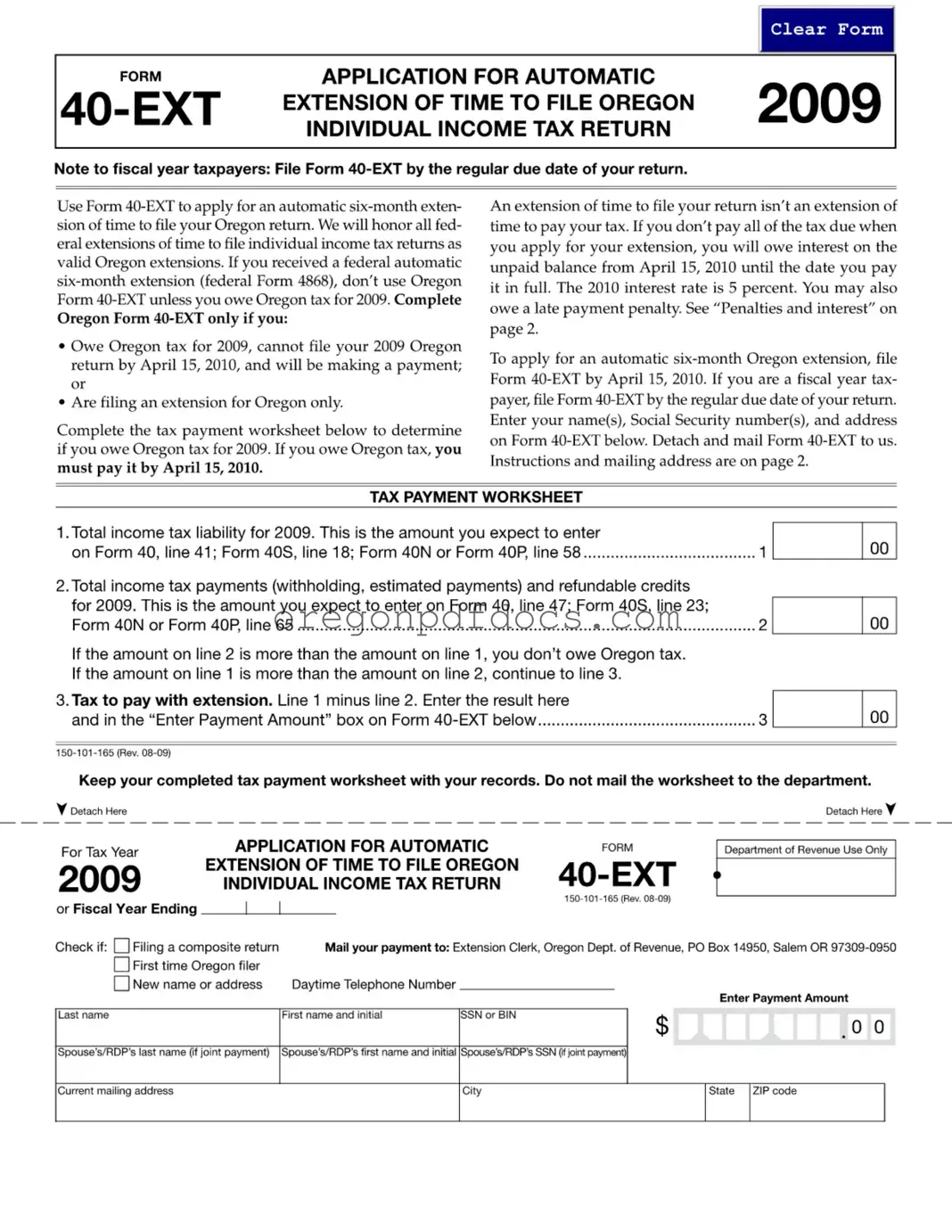

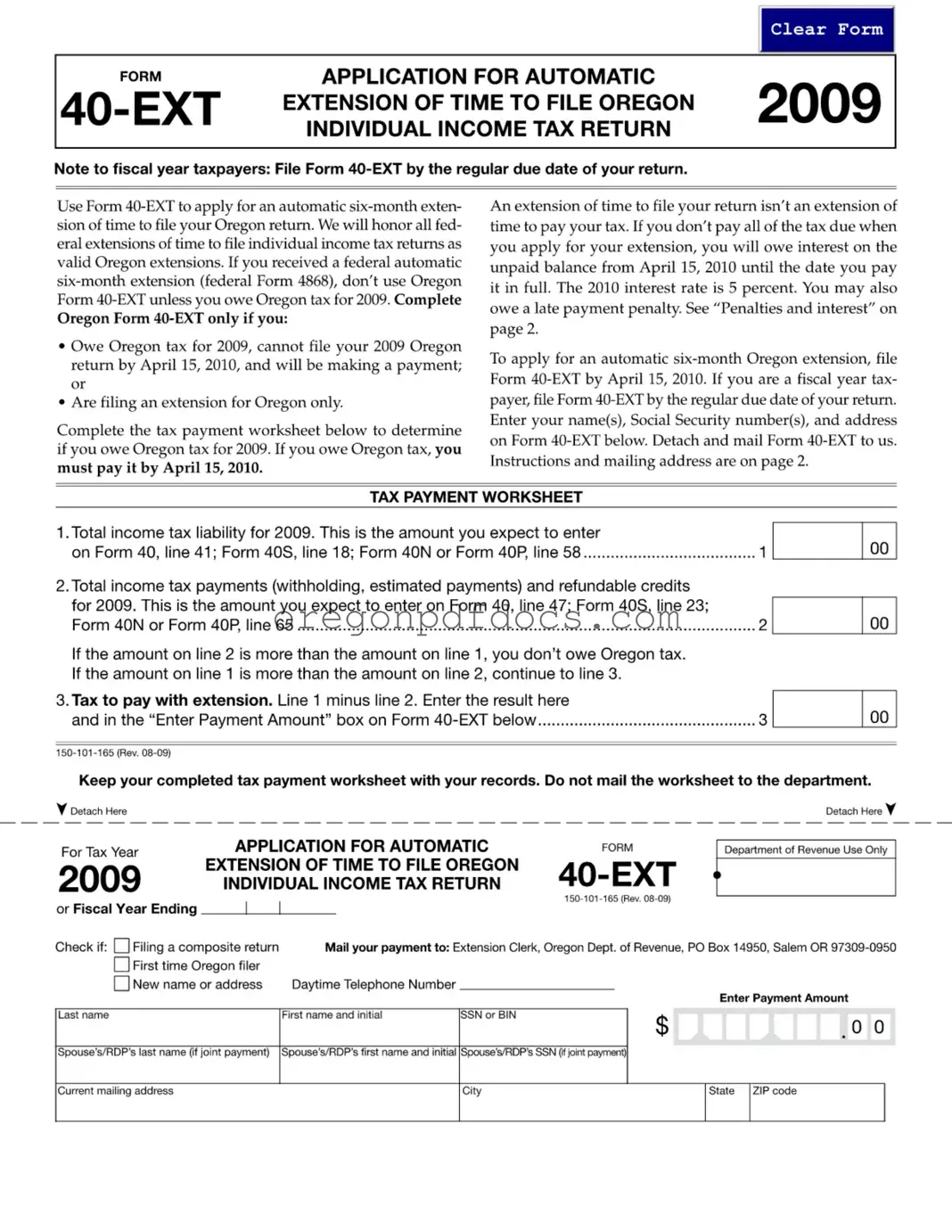

The Oregon Form 40-EXT is an application for an automatic six-month extension to file your Oregon individual income tax return. If you owe Oregon tax and cannot file by the due date, this form allows you to request additional time while ensuring you make any necessary payments. To get started on your extension, fill out the form by clicking the button below.

Make My Document Online

Free Oregon 40 Ext Form

Make My Document Online

Make My Document Online

or

Get Oregon 40 Ext PDF Form

One more step to finish this form

Finalize your Oregon 40 Ext online in a few easy steps.