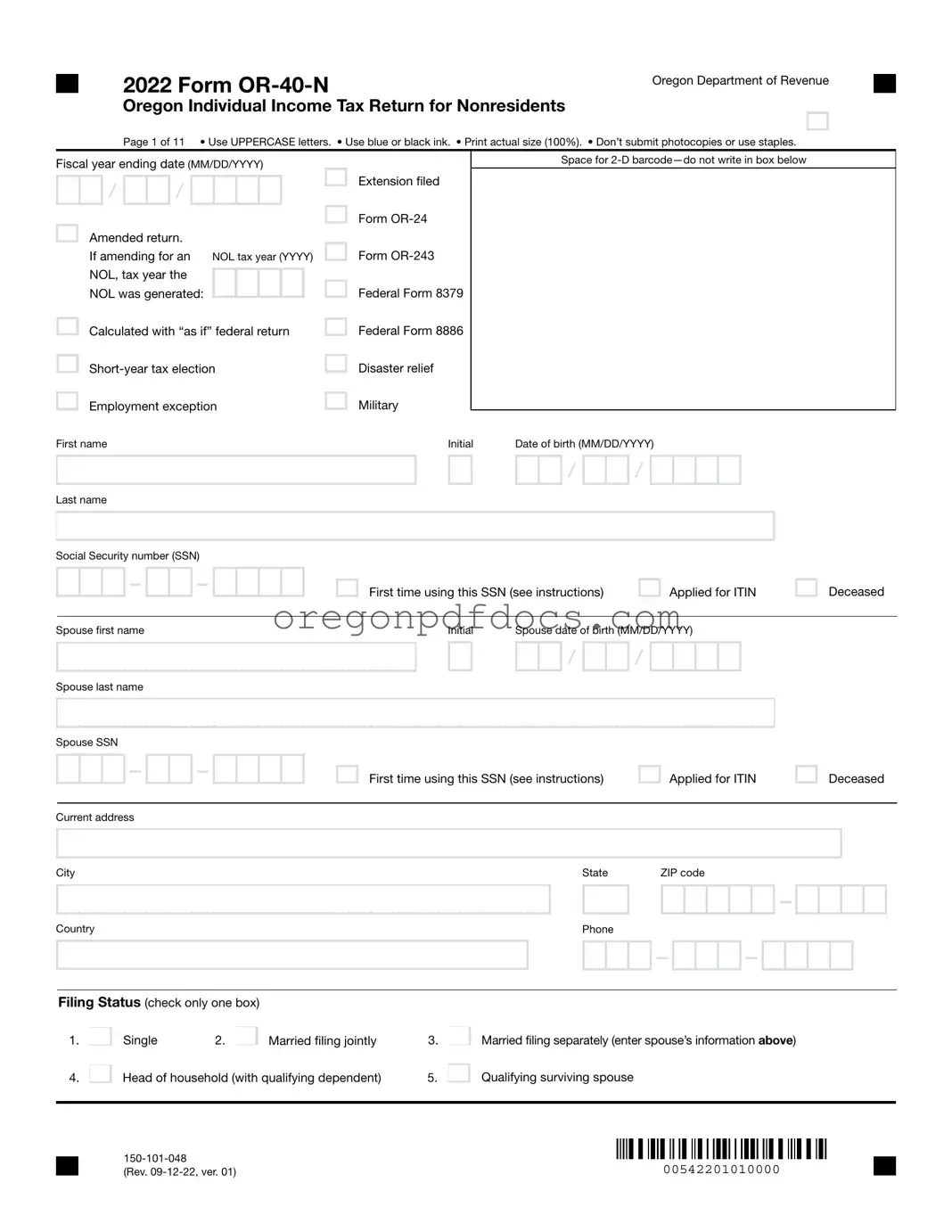

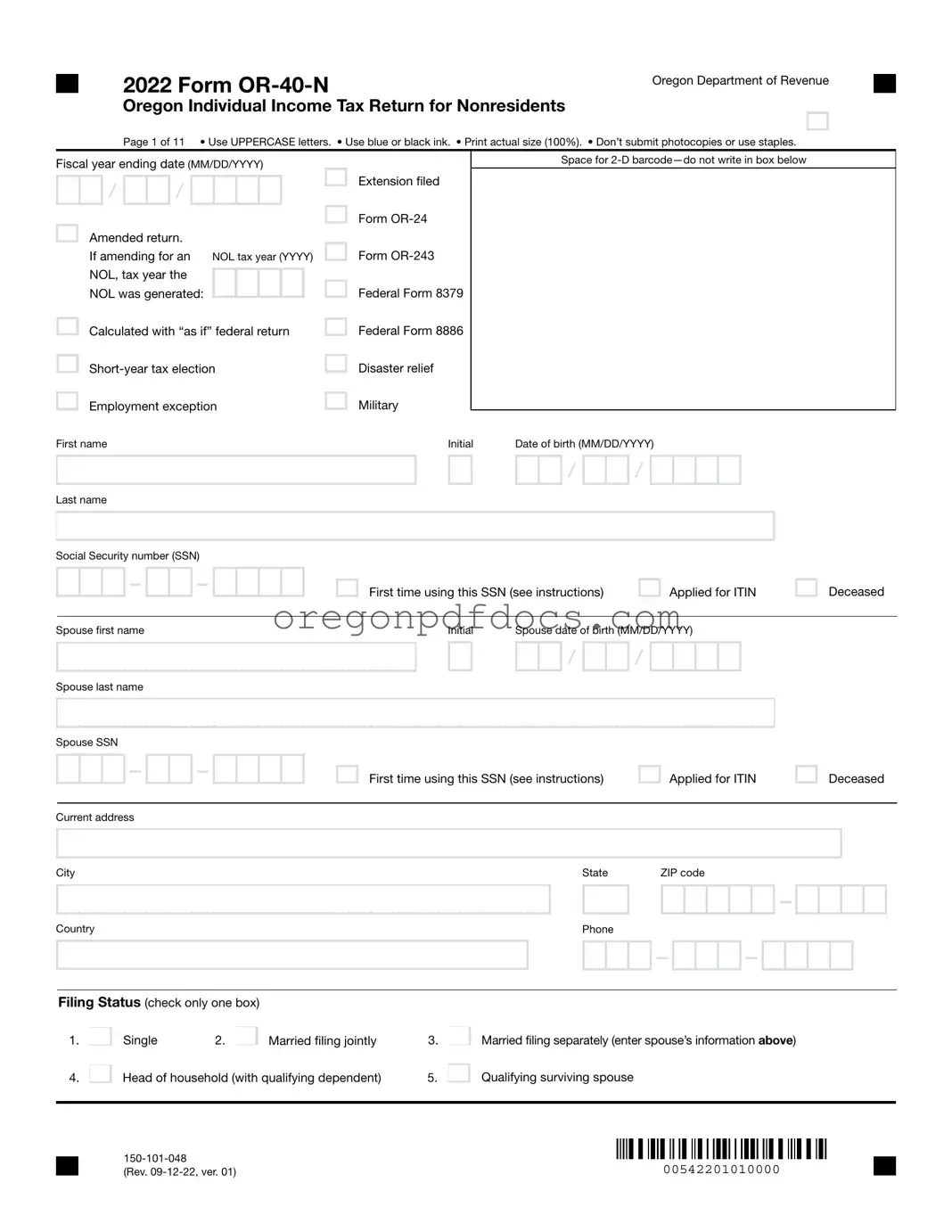

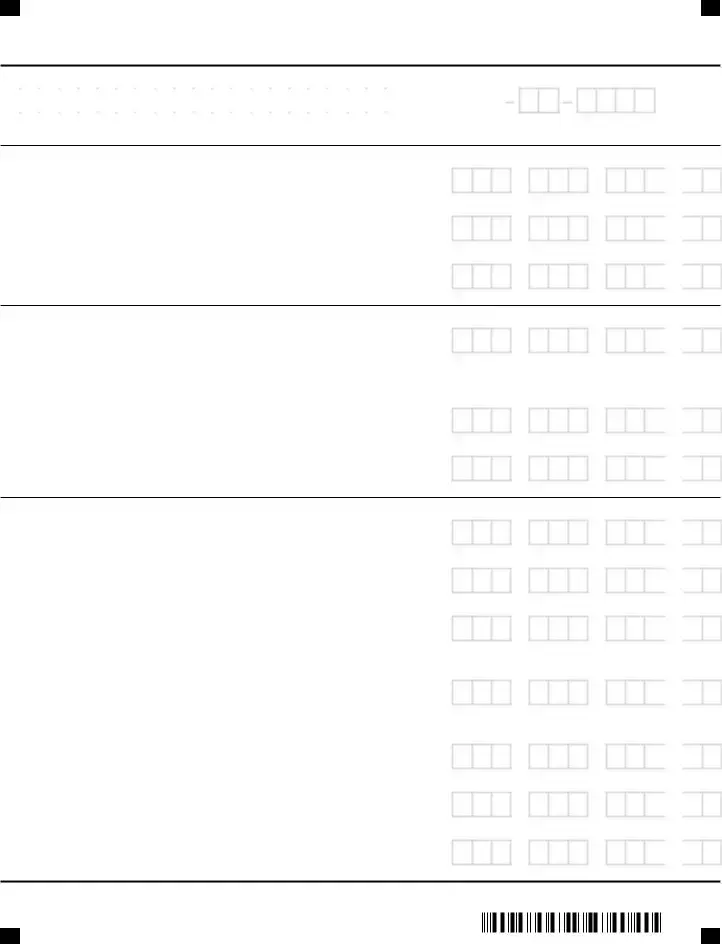

Fiscal year ending date (MM/DD/YYYY)

2022 Form OR-40-N

Oregon Individual Income Tax Return for Nonresidents

Oregon Department of Revenue

Page 1 of 11 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples.

Space for 2-D barcode—do not write in box below

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

Extension filed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form OR-24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amended return. |

|

|

|

|

|

If amending for an NOL tax year (YYYY) |

|

Form OR-243 |

|

NOL, tax year the |

|

|

|

|

|

|

Federal Form 8379 |

|

|

|

|

|

|

|

|

NOL was generated: |

|

|

|

|

|

|

Calculated with “as if” federal return

First name |

Initial |

Date of birth (MM/DD/YYYY) |

Last name

Social Security number (SSN)

First time using this SSN (see instructions)

Spouse first name |

Initial |

Spouse date of birth (MM/DD/YYYY) |

Spouse last name

Spouse SSN

First time using this SSN (see instructions)

Current address

City |

State |

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Country |

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filing Status (check only one box)

Married filing jointly |

3. |

Married filing separately (enter spouse’s information above)

Head of household (with qualifying dependent) |

5. |

Qualifying surviving spouse

150-101-048

(Rev. 09-12-22, ver. 01) |

00542201010000 |

|

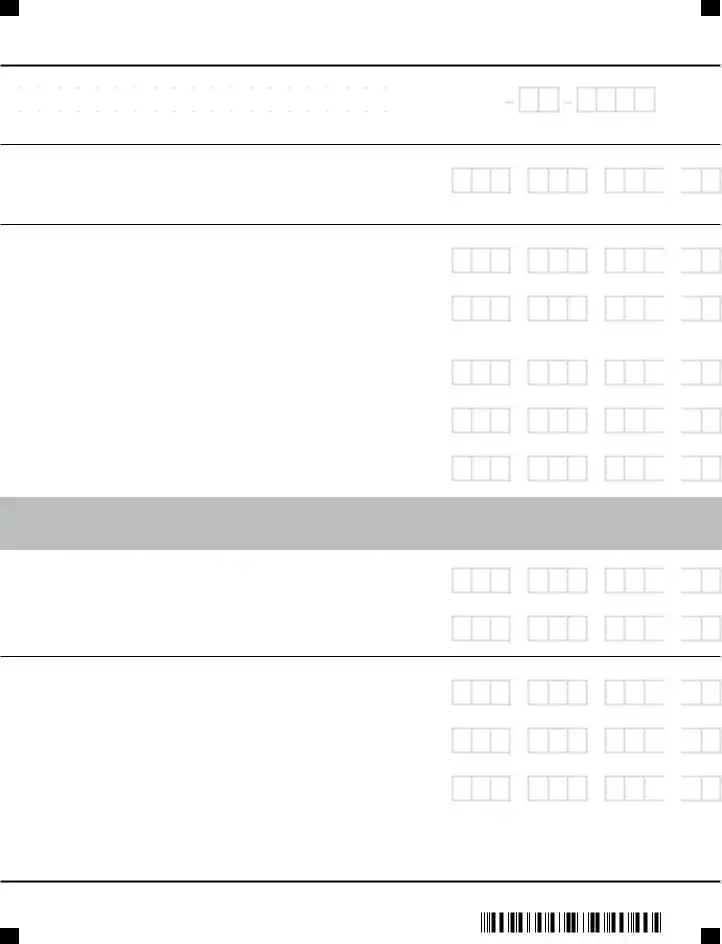

Oregon Department of Revenue

Page 2 of 11 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples.

Note: Reprint page 1 if you make changes to this page.

Exemptions

6a. Credits for yourself |

|

|

|

|

|

6a. |

Check boxes that apply: |

|

Regular |

|

Severely disabled |

|

Someone else can claim you as a dependent |

|

|

|

|

|

|

|

|

|

|

6b. Credits for your spouse |

|

|

|

|

|

6b. |

|

Check boxes that apply: |

|

Regular |

|

Severely disabled |

|

Someone else can claim you as a dependent |

|

|

|

|

|

|

|

|

|

|

|

Dependents. List your dependents in order from youngest to oldest.

Dependent 1: First name |

|

Initial |

Dependent 1: Last name |

|

|

|

|

|

|

|

|

|

|

Dependent 1: Date of birth (MM/DD/YYYY) |

Dependent 1: SSN |

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Code *

Dependent 1: Check if child has a qualifying disability

Dependent 2: First name |

|

Initial |

Dependent 2: Last name |

|

|

|

|

|

|

|

|

|

|

Dependent 2: Date of birth (MM/DD/YYYY) |

Dependent 2: SSN |

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Code *

Dependent 2: Check if child has a qualifying disability

Dependent 3: First name |

|

Initial |

Dependent 3: Last name |

|

|

|

|

|

|

|

|

|

|

Dependent 3: Date of birth (MM/DD/YYYY) |

Dependent 3: SSN |

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Code *

Dependent 3: Check if child has a qualifying disability

*Dependent relationship code (see instructions).

6c. Total number of dependents |

6c. |

|

|

|

|

|

|

6d. Total number of dependent children with a qualifying disability (see instructions) |

6d. |

|

|

|

|

|

|

|

6e. Total exemptions. Add lines 6a through 6d |

Total 6e. |

|

|

|

|

|

|

|

|

150-101-048 |

|

(Rev. 09-12-22, ver. 01) |

00542201020000 |

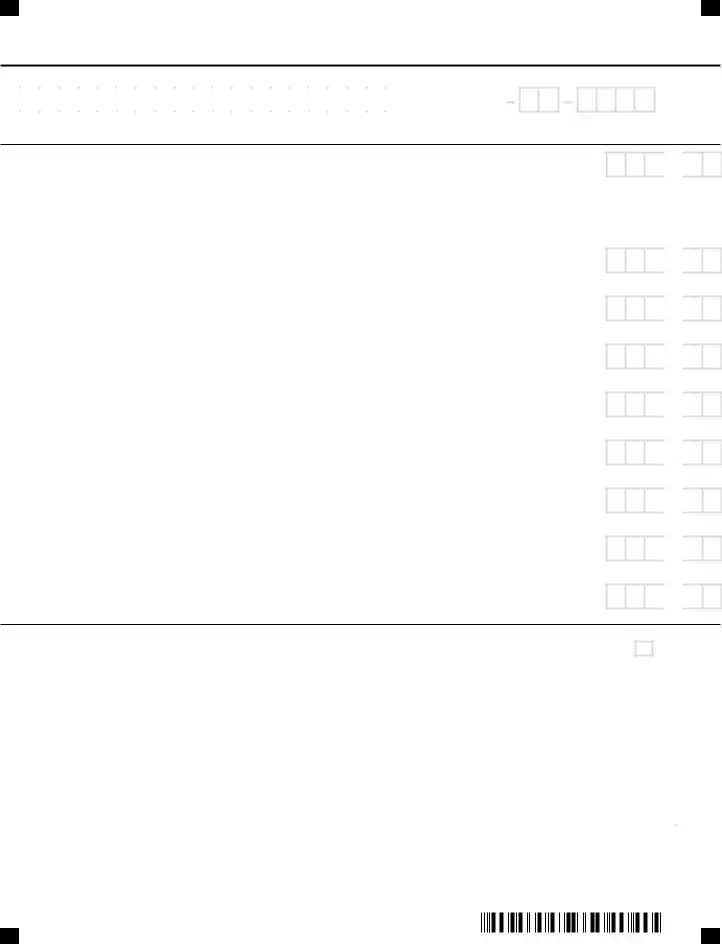

Oregon Department of Revenue

Page 3 of 11 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples.

Note: Reprint page 1 if you make changes to this page.

Income |

Federal column (F) |

Oregon column (S) |

7.Wages, salaries, and other pay for work from federal Form 1040 or 1040-SR, line 1z. Include all Forms W-2.

10.State and local income tax refunds from federal Schedule 1, line 1.

150-101-048 |

|

(Rev. 09-12-22, ver. 01) |

00542201030000 |

Oregon Department of Revenue

Page 4 of 11 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples.

Note: Reprint page 1 if you make changes to this page.

Federal column (F) |

Oregon column (S) |

16.Pensions and annuities from Form 1040 or 1040-SR, line 5b.

17.Schedule E income or loss from federal Schedule 1, line 5.

18F. |

|

|

|

, |

|

|

|

, |

|

|

|

|

0 |

0 |

18S. |

|

|

|

, |

|

|

|

, |

|

|

|

|

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19.Social Security benefits from Form 1040 or 1040-SR, line 6b; and unemployment and other income from federal Schedule 1, lines 7 and 9.

20.Total income. Add lines 7 through 19.

21.IRA or SEP and SIMPLE contributions, from federal Schedule 1, lines 16 and 20.

22.Education deductions from federal Schedule 1, lines 11 and 21.

23.Moving expenses from federal Schedule 1, line 14.

150-101-048 |

|

(Rev. 09-12-22, ver. 01) |

00542201040000 |

Oregon Department of Revenue

Page 5 of 11 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples.

Note: Reprint page 1 if you make changes to this page.

Federal column (F) |

Oregon column (S) |

24.Deduction for self-employment tax from federal Schedule 1, line 15.

25.Self-employed health insurance deduction from federal Schedule 1, line 17.

27.Total adjustments from Schedule OR-ASC-NP, line A7 for the federal column and line A8 for the Oregon column.

28.Total adjustments. Add lines 21 through 27.

Additions

30.Total additions from Schedule OR-ASC-NP, line B7 for the federal column and line B8 for the Oregon column.

150-101-048 |

00542201050000 |

|

(Rev. 09-12-22, ver. 01) |

|

Oregon Department of Revenue

Page 6 of 11 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples.

Note: Reprint page 1 if you make changes to this page.

Subtractions |

Federal column (F) |

Oregon column (S) |

32.Social Security and tier 1 Railroad Retirement Board benefits included on line 19F.

33.Total subtractions from Schedule OR-ASC-NP, line C7 for the federal column and line C8 for the Oregon column.

34.Income after subtractions. Line 31 minus lines 32 and 33.

34F. |

|

|

|

, |

|

|

|

, |

|

|

|

|

0 |

0 |

34S. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35. Oregon percentage (see instructions; not more than 100.0%) |

|

|

|

|

|

|

|

|

|

35. |

|

Deductions and modifications

36. |

...............................................................................................Amount from line 34S |

|

|

|

|

36. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37. |

Oregon itemized deductions. Enter your Oregon itemized deductions from |

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule OR-A, line 23. If you are not itemizing your deductions, enter 0 |

37. |

|

|

|

|

|

|

|

|

|

|

|

38. |

Standard deduction. Enter your standard deduction |

|

38. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You were: |

38a. |

|

|

65 or older 38b. |

|

Blind Your spouse was: |

38c. |

|

|

|

|

|

|

|

|

|

Standard deductions

Single |

Married filing jointly |

Married filing separately |

Qualifying surviving spouse |

Head of Household |

|

|

|

|

|

$2,420 |

$4,840 |

$2,420 or $0 |

$4,840 |

$3,895 |

See instructions if you are age 65 or older, blind, or if someone can claim you as a dependent. See instructions if you are married filing separately.

39. |

Enter the larger of line 37 or 38 |

39. |

40. |

2022 federal tax liability (see instructions) |

40. |

41. |

Total modifications from Schedule OR-ASC-NP, line D7 |

41. |

42. |

Deductions and modifications multiplied by the Oregon percentage |

|

|

(see instructions) |

42. |

150-101-048 |

|

(Rev. 09-12-22, ver. 01) |

00542201060000 |

Oregon Department of Revenue

Page 7 of 11 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples.

Note: Reprint page 1 if you make changes to this page.

Deductions and modifications (continued)

43. |

Charitable art donation (see instructions) |

43. |

44. |

Total deductions and modifications. Add lines 42 and 43 |

44. |

45. |

Oregon taxable income. Line 36 minus line 44. If line 44 is more than |

|

|

line 36, enter 0 |

45. |

46. |

Tax. Check the appropriate box if you’re using an alternative method to |

|

|

|

calculate your tax (see instructions) |

|

|

46. |

|

46a. |

|

Schedule OR-FIA-40-N |

46b. |

|

Worksheet FCG |

46c. |

|

|

|

|

|

47. |

Interest on certain installment sales |

|

|

47. |

48. |

Total tax before credits. Add lines 46 and 47 |

|

|

48. |

Standard and carryforward credits

49. |

Exemption credit (see instructions) |

49. |

50. |

Total standard credits from Schedule OR-ASC-NP, line E16 |

50. |

51. |

Total standard credits. Add lines 49 and 50 |

51. |

52. |

Tax minus standard credits. Line 48 minus line 51. If line 51 is more than |

|

|

line 48, enter 0 |

52. |

53.Total carryforward credits used this year from Schedule OR-ASC-NP, line F9. Line 53 can’t be more than line 52 (see Schedule OR-ASC and

|

OR-ASC-NP Instructions) |

53. |

54. |

Tax after standard and carryforward credits. Line 52 minus line 53 |

54. |

55. |

Total tax recaptures reported this year from Schedule OR-ASC-NP, line G5 |

55. |

150-101-048 |

|

(Rev. 09-12-22, ver. 01) |

00542201070000 |

Oregon Department of Revenue

Page 8 of 11 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples.

Note: Reprint page 1 if you make changes to this page.

Standard and carryforward credits (continued)

56. Tax including tax recaptures. Line 54 plus line 55 |

56. |

Payments and refundable credits

57. |

Oregon income tax withheld. Include a copy of your Forms W-2 and 1099 |

57. |

58. |

Amount applied from your prior year’s tax refund |

58. |

59.Estimated tax payments for 2022. Include all payments you made prior to the filing date of this return, including real estate transactions. Do not include the

|

amount you already reported on line 58 |

59. |

60. |

Tax payments from a pass-through entity |

60. |

61. |

Earned income credit (see instructions) |

61. |

Reserved

62. Kicker (Oregon surplus credit). Enter your kicker credit amount (see instructions).

|

If you elect to donate your kicker to the State School Fund, enter 0 and |

|

|

see line 78 |

62. |

63. |

Total refundable credits from Schedule OR-ASC-NP, line H7 |

63. |

64. |

Total payments and refundable credits. Add lines 57 through 63 |

64. |

65. |

Overpayment of tax. If line 56 is less than line 64, you overpaid. |

|

|

Line 64 minus line 56 |

65. |

66. |

Net tax. If line 56 is more than line 64, you have tax to pay. |

|

|

Line 56 minus line 64 |

66. |

67. |

Penalty and interest for filing or paying late (see instructions) |

67. |

150-101-048 |

|

(Rev. 09-12-22, ver. 01) |

00542201080000 |

Oregon Department of Revenue

Page 9 of 11 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples.

Note: Reprint page 1 if you make changes to this page.

68. |

Interest on underpayment of estimated tax. Include Form OR-10 |

68. |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

Exception number from Form OR-10, line 1: 68a. |

|

|

Check box if you annualized: 68b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

69. |

Total penalty and interest due. Add lines 67 and 68 |

|

|

69. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

70. |

Net tax including penalty and interest. |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Line 66 plus line 69 |

This is the amount you owe. 70. |

|

|

|

|

|

|

|

71. |

|

|

|

|

|

|

|

|

Overpayment less penalty and interest. |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Line 65 minus line 69 |

|

This is your refund. 71. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

72. |

Estimated tax. Fill in the portion of line 71 you want applied to your open |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

estimated tax account |

|

|

72. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

73. |

Charitable checkoff donations from Schedule OR-DONATE, line 30 |

73. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

74. |

Oregon 529 college savings plan deposits from Schedule OR-529, line 5 |

74. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

75. |

Total. Add lines 72 through 74. The total can’t be more than your refund |

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

on line 71 |

|

|

75. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

76. |

Net refund. Line 71 minus line 75 |

|

This is your net refund. 76. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct deposit

77. For direct deposit of your refund, see instructions. Check the box if the final deposit destination is outside the United States:

Type of account:

Account information:

|

|

Checking or |

Routing number |

Account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reserved |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kicker donation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

78. If you elect to donate your kicker to the State School Fund, check this box |

|

78a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete the kicker worksheet, located in the instructions, and enter the |

|

|

|

|

, |

, |

0 0 |

amount here |

|

|

|

|

This election is irrevocable. 78b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

150-101-048 |

|

(Rev. 09-12-22, ver. 01) |

00542201090000 |

Oregon Department of Revenue

Page 10 of 11 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples.

Note: Reprint page 1 if you make changes to this page.

Sign here. Under penalty of false swearing, I declare that the information in this return and any attachments is true, correct, and complete.

Your signature

X

Date (MM/DD/YYYY)

Spouse signature

X

Date (MM/DD/YYYY)

Signature of preparer other than taxpayer

X

Date (MM/DD/YYYY) |

Preparer phone |

Preparer license number |

Preparer first name |

|

Initial |

Preparer last name |

|

|

|

|

|

|

|

|

|

|

Preparer address

Signing this return does not grant your preparer the right to represent you or make decisions on your behalf. For more information, see the instructions for the Tax Information Authorization and Power of Attorney for Representation form on our website.

Important: Include a copy of your federal Form 1040, 1040-SR, 1040-X, or 1040-NR. We may adjust your return without it.

Pay the amount due (shown on line 70)

•Online: www.oregon.gov/dor.

•By mail: Payable to the Oregon Department of Revenue. Write “2022 Oregon Form OR-40-N” and the last four digits of your SSN or ITIN on your check or money order. If you include payment with your return, don’t include Form OR-40-V payment voucher.

Mail your return

•Non-2-D barcode. If the large 2-D barcode box on the first page of this form is blank:

—Mail tax-due returns to: Oregon Department of Revenue, PO Box 14555, Salem OR 97309-0940.

—Mail refund and no-tax-due returns to: Oregon Department of Revenue, PO Box 14700, Salem OR 97309-0930.

•2-D barcode. If the large 2-D barcode box on the first page of this form is filled in:

—Mail tax-due returns to: Oregon Department of Revenue, PO Box 14720, Salem OR 97309-0463.

—Mail refund and no-tax-due returns to: Oregon Department of Revenue, PO Box 14710, Salem OR 97309-0460.

150-101-048 |

|

(Rev. 09-12-22, ver. 01) |

00542201100000 |

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

,

,

,

,

,

,

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0 0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0